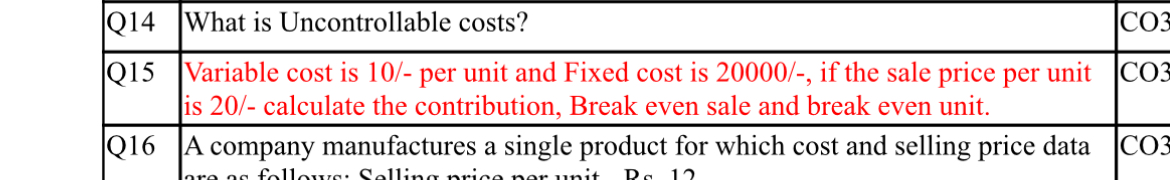

Variable cost is 10/- per unit and Fixed cost is 20000/-, if the sale price per unit is 20/-, calculate the contribution, break even sale and break even unit.

Understand the Problem

The question is asking to calculate the contribution, break-even sale, and break-even unit based on provided variable cost, fixed cost, and sale price per unit.

Answer

Contribution: $10$, Break-even units: $2000$, Break-even sales: $40000$

Answer for screen readers

- Contribution per unit: $10$

- Break-even units: $2000$

- Break-even sales: $40000$

Steps to Solve

- Calculate Contribution per Unit

Contribution per unit is calculated using the formula:

$ \text{Contribution} = \text{Selling Price} - \text{Variable Cost} $

Substituting the values:

$ \text{Contribution} = 20 - 10 = 10 $

- Calculate Break-even Point in Units

Break-even point (BEP) in units is given by the formula:

$ \text{Break-even Units} = \frac{\text{Fixed Costs}}{\text{Contribution per Unit}} $

Using the values:

$ \text{Break-even Units} = \frac{20000}{10} = 2000 $

- Calculate Break-even Sales

Break-even sales can be found by multiplying the Break-even units by the Selling Price:

$ \text{Break-even Sales} = \text{Break-even Units} \times \text{Selling Price} $

Thus:

$ \text{Break-even Sales} = 2000 \times 20 = 40000 $

- Contribution per unit: $10$

- Break-even units: $2000$

- Break-even sales: $40000$

More Information

The contribution margin is critical in determining how much revenue from each unit sold contributes to covering fixed costs and ultimately generating profit. The break-even analysis helps businesses understand the minimum sales needed to avoid losses.

Tips

- Not deducting variable costs from the selling price correctly.

- Forgetting to use the fixed cost in the break-even unit calculation.

- Confusing break-even units with break-even sales.

AI-generated content may contain errors. Please verify critical information