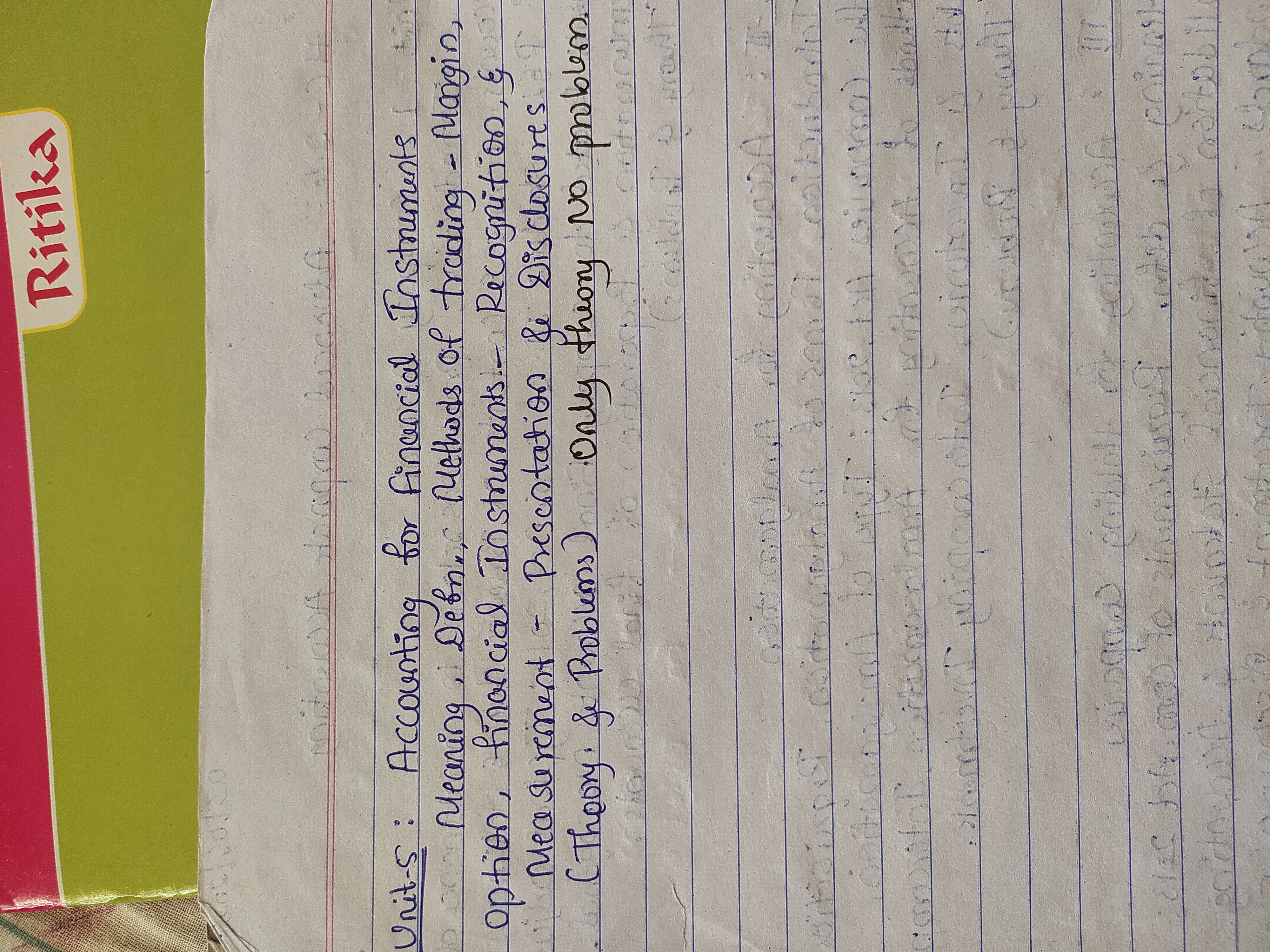

Units: Accounting for financial instruments - Meaning, Debt, Methods of Trading, Margin, Option, Financial Instruments, Recognition, Measurement, Presentation & Disclosures (Theory... Units: Accounting for financial instruments - Meaning, Debt, Methods of Trading, Margin, Option, Financial Instruments, Recognition, Measurement, Presentation & Disclosures (Theory & Problems) - Only theory, no problem.

Understand the Problem

The question seems to be focusing on the accounting principles related to financial instruments, including definitions, trading methods, recognition, measurement, presentation, and disclosures. It specifically notes that only theoretical concepts are to be covered, with no problems included.

Answer

Accounting principles for financial instruments focusing on meaning, debt, trading methods, recognition, and disclosures.

The final answer is related to the general accounting principles for financial instruments covering meaning, debt, methods of trading, recognition, and disclosures.

Answer for screen readers

The final answer is related to the general accounting principles for financial instruments covering meaning, debt, methods of trading, recognition, and disclosures.

More Information

Financial instruments encompass contracts that lead to financial assets for one party and financial liabilities or equity instruments for another. Accounting principles focus on recognizing and measuring these instruments under standards like IAS 39 and IFRS 9, ensuring accurate financial reporting.

Tips

Common mistakes include misunderstanding the classification of instruments, incorrect measurement methods, and insufficient disclosure of financial risk management policies.

Sources

- Financial Instruments Explained: Types and Asset Classes - investopedia.com

- IAS 39 — Financial Instruments: Recognition and Measurement - iasplus.com

- Apply IFRS 9 - Impairment of financial instruments under IFRS 9 - assets.ey.com

AI-generated content may contain errors. Please verify critical information