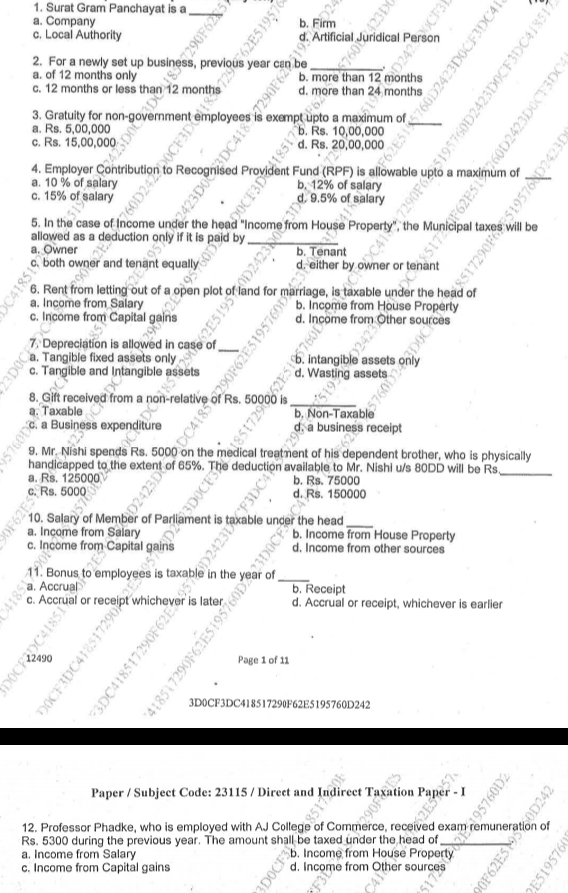

Surat Gram Panchayat is a ____. For a newly set up business, previous year can be ___. Gratuity for non-government employees is exempt up to a maximum of ____. The Employer Contrib... Surat Gram Panchayat is a ____. For a newly set up business, previous year can be ___. Gratuity for non-government employees is exempt up to a maximum of ____. The Employer Contribution to Recognised Provident Fund (RPF) is allowable up to a maximum of ____. What is the case of Income under the head 'Income from House Property' regarding municipal taxes? Rent for letting out an open plot of land for marriage is taxable under the head of ____. Depreciation is allowable in case of ____. Gift received from a non-relative is ___. Mr. Nishi spends Rs. 5000 on medical treatment and the deduction available will be ____. Salary of Member of Parliament is taxable under the head ____. Bonus to employees is taxable in the year of ____. Professor Phadke received remuneration of Rs. 5300 for the previous year and will be taxed under the head of ____.

Understand the Problem

The question is about various aspects of taxation, such as types of income, deductions, and allowances under taxation laws. It seems to be focused on evaluating knowledge in the area of direct and indirect taxation.

Answer

1. Local Authority 2. More than 12 months 3. Rs. 20,00,000 4. 12% of salary 5. Either by owner or tenant 6. Income from Other Sources 7. Tangible fixed assets only 8. Taxable 9. Rs. 75,000 10. Income from Other Sources 11. Accrual or receipt 12. Income from Other Sources

- Local Authority 2. More than 12 months 3. Rs. 20,00,000 4. 12% of salary 5. Either by owner or tenant 6. Income from Other Sources 7. Tangible fixed assets only 8. Taxable 9. Rs. 75,000 10. Income from Other Sources 11. Accrual or receipt, whichever is earlier 12. Income from Other Sources

Answer for screen readers

- Local Authority 2. More than 12 months 3. Rs. 20,00,000 4. 12% of salary 5. Either by owner or tenant 6. Income from Other Sources 7. Tangible fixed assets only 8. Taxable 9. Rs. 75,000 10. Income from Other Sources 11. Accrual or receipt, whichever is earlier 12. Income from Other Sources

More Information

Gratuity for non-government employees is exempted up to Rs. 20,00,000. Salary of a Member of Parliament is considered 'Income from Other Sources'. Gift from a non-relative exceeding Rs. 50,000 is taxable.

Tips

Ensure correct identification of what constitutes 'Other Sources' for income classification.

Sources

- Gratuity Exemption Rules Under Income Tax - Tax2win - tax2win.in

- All about Recognized Provident Fund, Approved Superannuation ... - sbsandco.com

AI-generated content may contain errors. Please verify critical information