How does a tax on buyers affect the supply and demand for ice-cream cones?

Understand the Problem

The question is likely asking about the representation of a tax on buyers in a supply and demand graph for ice-cream cones, examining how it affects prices and quantities in the market.

Answer

The demand curve shifts left, reducing equilibrium quantity and increasing buyer prices.

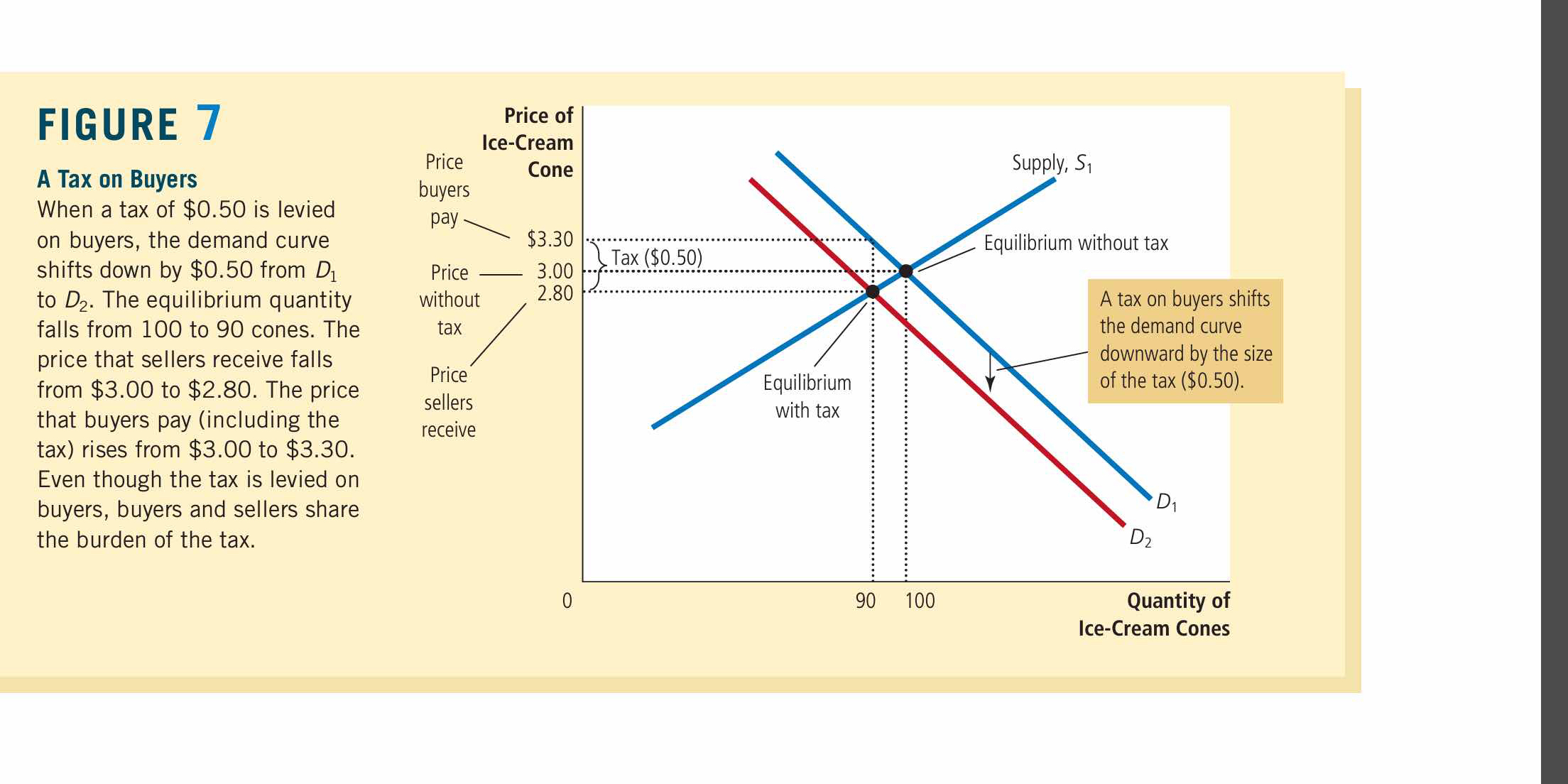

A tax on buyers reduces demand, shifting the demand curve leftward. Equilibrium quantity decreases, the price buyers pay increases, and the price sellers receive decreases. The tax burden is shared by both buyers and sellers.

Answer for screen readers

A tax on buyers reduces demand, shifting the demand curve leftward. Equilibrium quantity decreases, the price buyers pay increases, and the price sellers receive decreases. The tax burden is shared by both buyers and sellers.

More Information

In economics, taxes on buyers typically decrease the quantity demanded as higher costs deter purchases, and both consumers and producers share the load.

Tips

Common mistakes include assuming the tax only affects buyers' price and not accounting for shared burden between buyers and sellers.

Sources

- A subsidy is the opposite of a tax - homework.study.com

- Supply, Demand and Government Policies - hhadah.github.io

- Solved 12. Short Answer A subsidy is the opposite of a tax. - chegg.com

AI-generated content may contain errors. Please verify critical information