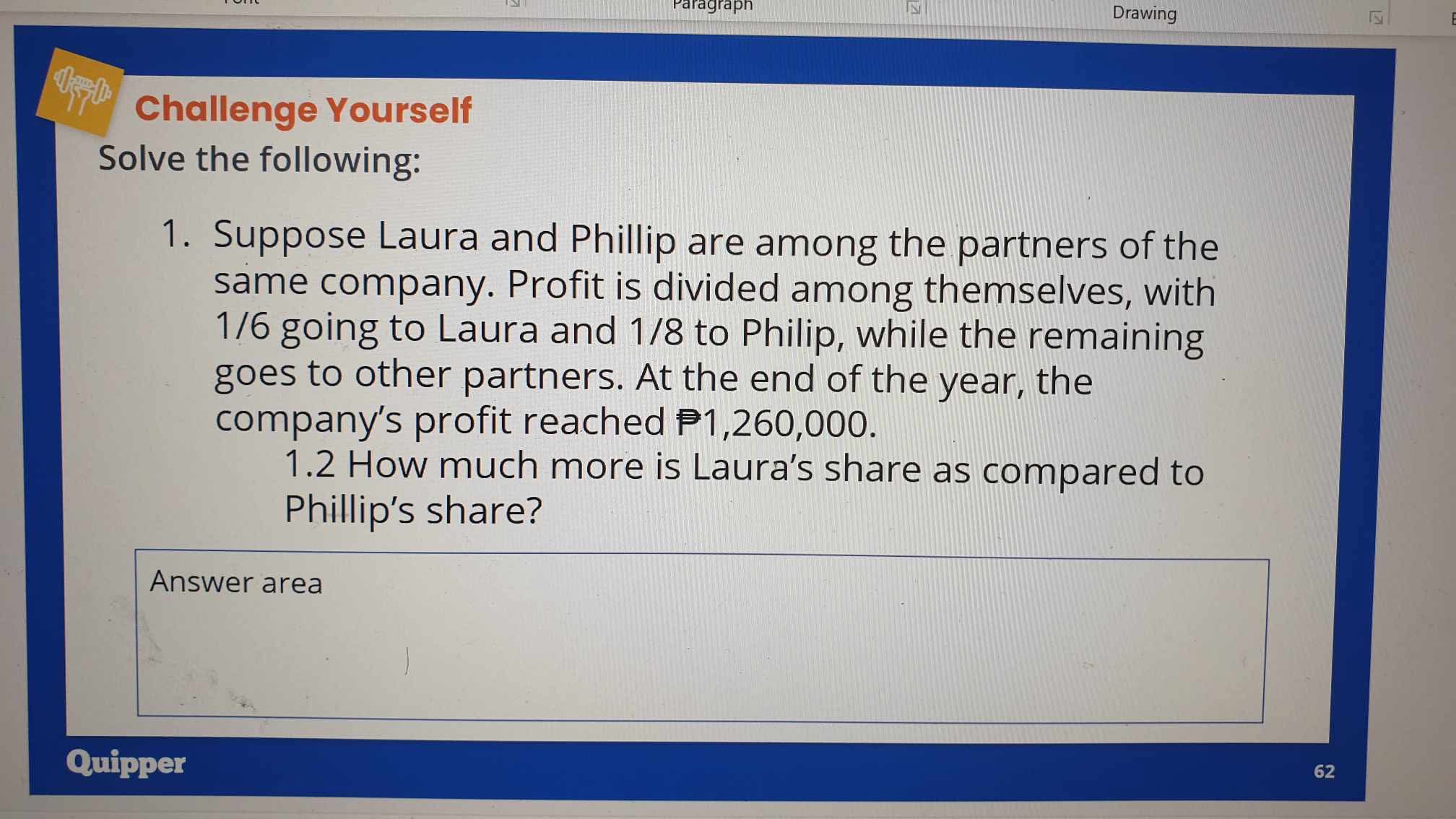

Suppose Laura and Phillip are among the partners of the same company. Profit is divided among themselves, with 1/6 going to Laura and 1/8 to Phillip, while the remaining goes to ot... Suppose Laura and Phillip are among the partners of the same company. Profit is divided among themselves, with 1/6 going to Laura and 1/8 to Phillip, while the remaining goes to other partners. At the end of the year, the company's profit reached ₱1,260,000. How much more is Laura's share compared to Phillip's share?

Understand the Problem

The question is asking how much Laura's share of the profit is compared to Phillip's share, based on the total profit and their respective fractions. We'll determine the total shares given to Laura and Phillip, calculate their individual shares from the total profit, and then find the difference.

Answer

The difference is ₱52,500.

Answer for screen readers

The difference between Laura's share and Phillip's share is ₱52,500.

Steps to Solve

- Determine Laura's Share of Profit

First, we calculate Laura's share of the profit, which is given as 1/6 of the total profit of ₱1,260,000.

$$ \text{Laura's Share} = \frac{1}{6} \times 1,260,000 $$

- Calculate Laura's Share

Now, we compute Laura's actual share:

$$ \text{Laura's Share} = \frac{1}{6} \times 1,260,000 = 210,000 $$

- Determine Phillip's Share of Profit

Next, we calculate Phillip's share of the profit, which is 1/8 of the same total profit:

$$ \text{Phillip's Share} = \frac{1}{8} \times 1,260,000 $$

- Calculate Phillip's Share

Now, compute Phillip's actual share:

$$ \text{Phillip's Share} = \frac{1}{8} \times 1,260,000 = 157,500 $$

- Find the Difference Between Their Shares

Finally, we calculate how much more Laura's share is compared to Phillip's share:

$$ \text{Difference} = \text{Laura's Share} - \text{Phillip's Share} $$

- Calculate the Difference

Now, compute the difference:

$$ \text{Difference} = 210,000 - 157,500 = 52,500 $$

The difference between Laura's share and Phillip's share is ₱52,500.

More Information

Laura's share of the profit is greater than Phillip's because of the different fractions assigned to them. Understanding profit sharing can help in making financial decisions in partnerships.

Tips

- Miscalculating the shares by not correctly interpreting the fractions assigned to each partner.

- Forgetting to apply the fractions to the total profit when determining each partner’s share.

AI-generated content may contain errors. Please verify critical information