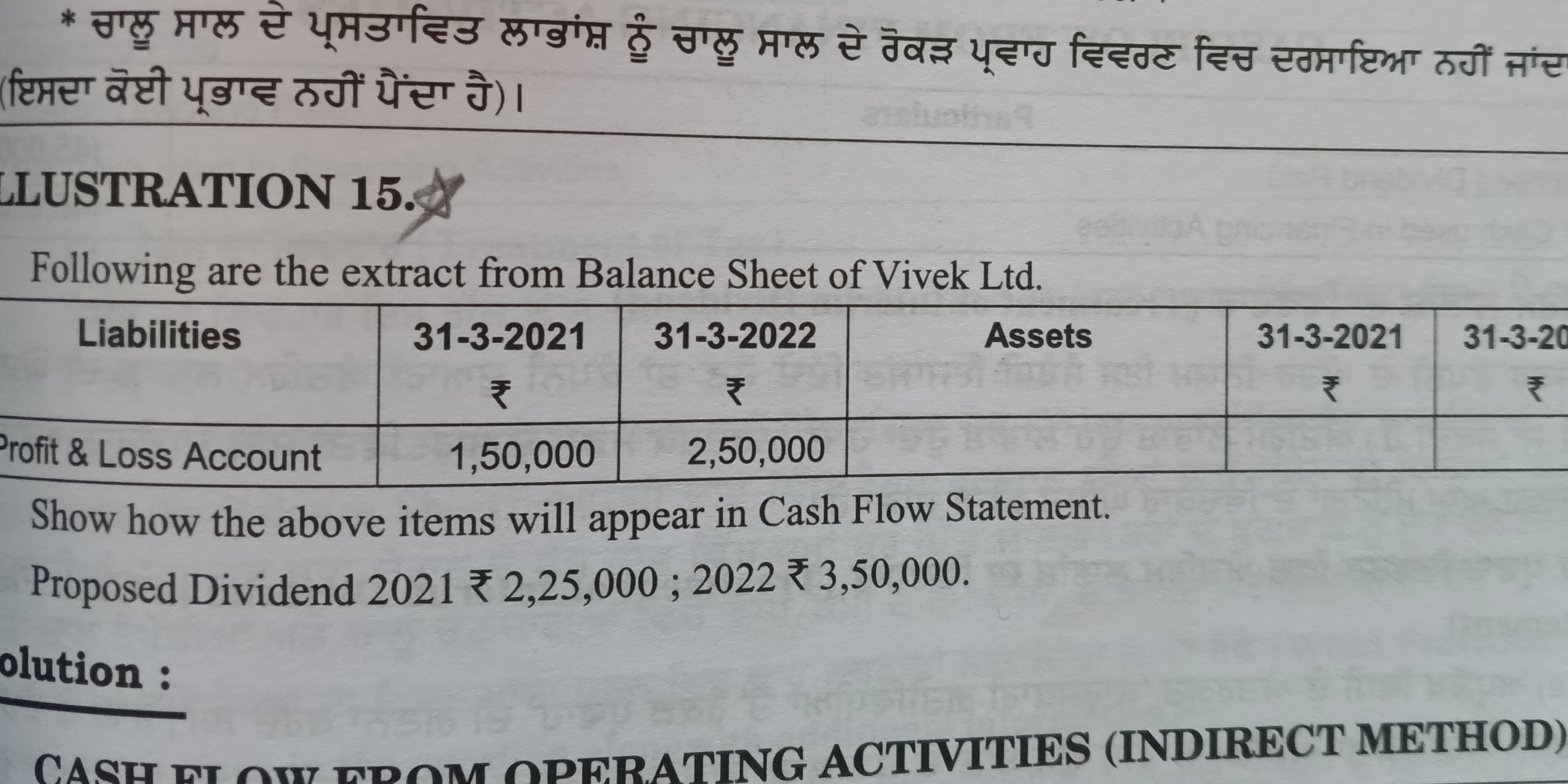

Show how the above items will appear in Cash Flow Statement. Proposed Dividend 2021 ₹2,25,000; 2022 ₹3,50,000.

Understand the Problem

The question is asking how certain items from a balance sheet will be reflected in a Cash Flow Statement, specifically for the financial years ending March 31, 2021, and March 31, 2022, with details on dividend payouts for those years.

Answer

Cash Flow from Operating Activities for 2021: ₹-1,25,000; for 2022: ₹-2,50,000.

Answer for screen readers

Cash Flow from Operating Activities for the years is as follows:

For 2021: ₹-1,25,000

For 2022: ₹-2,50,000

Steps to Solve

-

Identify the Key Information

Extract the relevant figures from the balance sheet for the years ending March 31, 2021, and 2022:- Profit & Loss Account as of March 31, 2021: ₹1,50,000

- Profit & Loss Account as of March 31, 2022: ₹2,50,000

- Proposed Dividend for 2021: ₹2,25,000

- Proposed Dividend for 2022: ₹3,50,000

-

Calculate Profit Changes

Determine the change in Profit & Loss Account:- Change = Profit & Loss (2022) - Profit & Loss (2021)

- Change = ₹2,50,000 - ₹1,50,000 = ₹1,00,000

-

Adjust for Proposed Dividends

Note that dividends affect cash flow. Consider the proposed dividends for both years:- For 2021, the dividend proposed is ₹2,25,000 (this will not affect the cash flow for the year it is proposed since it is paid later).

- For 2022, the proposed dividend of ₹3,50,000 affects the cash flow for the year 2022 when paid.

-

Construct Cash Flow Statement

Incorporate these elements into the Cash Flow Statement from Operating Activities:- Cash Flow from Operating Activities = Change in Profit & Loss + Proposed Dividends

- For 2021: Cash Flow from Operating Activities = ₹1,00,000 - ₹2,25,000 (as this is a future payout) = -₹1,25,000

- For 2022: Cash Flow from Operating Activities = ₹1,00,000 - ₹3,50,000 = -₹2,50,000

Cash Flow from Operating Activities for the years is as follows:

For 2021: ₹-1,25,000

For 2022: ₹-2,50,000

More Information

In cash flow statements, proposed dividends appear as a reduction in native profit for the following accounting periods. This can lead to negative cash flows if dividends exceed current profits.

Tips

- Forgetting the Timing of Dividends: Dividends proposed do not affect the cash flow in the year they are declared; they affect the cash flow when they are paid.

- Incorrect Profit Adjustment: Always account for how changes in profit affect cash flows correctly.

AI-generated content may contain errors. Please verify critical information