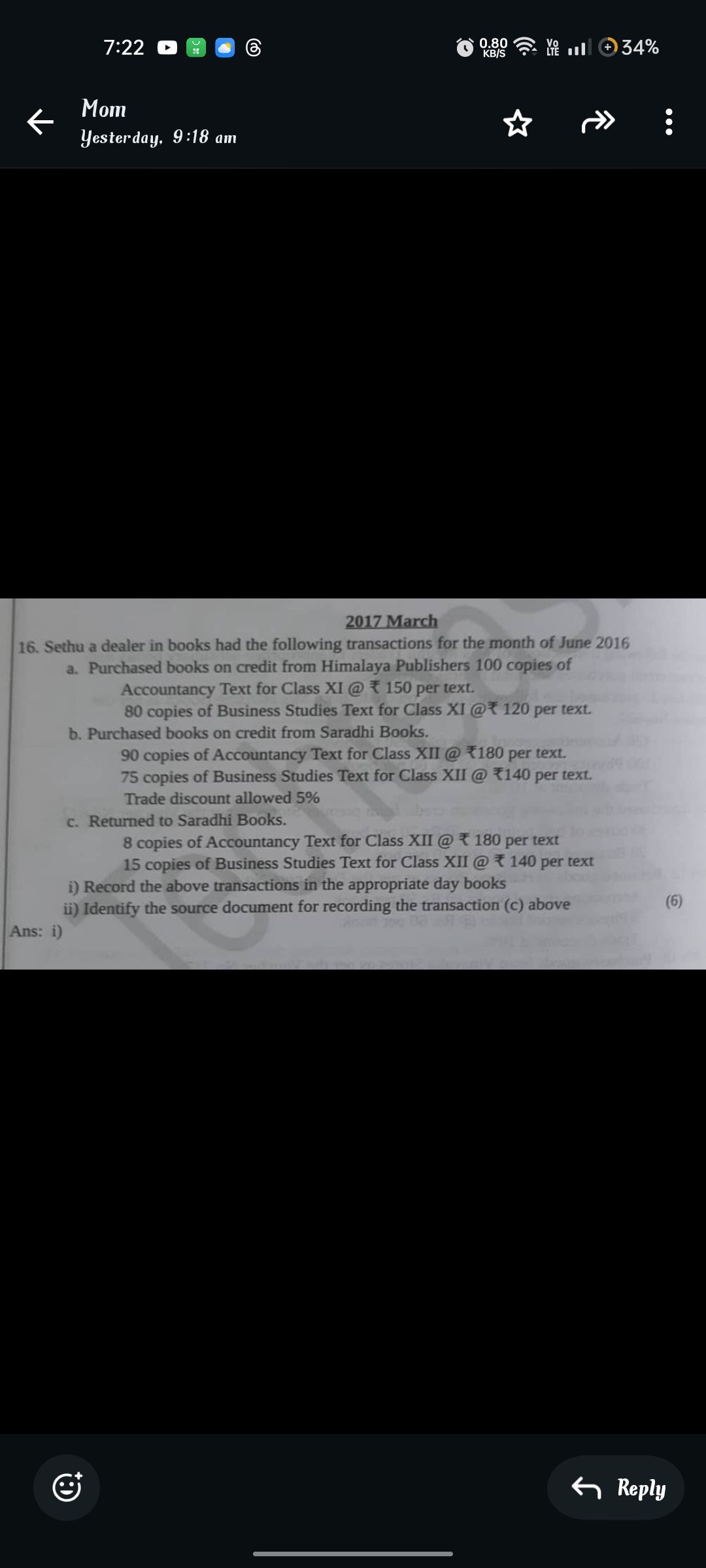

Sethu, a dealer in books, had the following transactions for June 2016: a) Purchased books on credit: 100 copies of Accountancy Text for Class XI at ₹150 per text, and 80 copies of... Sethu, a dealer in books, had the following transactions for June 2016: a) Purchased books on credit: 100 copies of Accountancy Text for Class XI at ₹150 per text, and 80 copies of Business Studies Text for Class XI at ₹120 per text. b) Purchased books on credit from Saradhi Books: 90 copies of Accountancy Text for Class XII at ₹180 per text, and 75 copies of Business Studies Text for Class XII at ₹140 per text, with a 5% trade discount. c) Returned 8 copies of Accountancy Text for Class XII at ₹180 per text, and 15 copies of Business Studies Text for Class XII at ₹140 per text. i) Record these transactions in the appropriate day books. ii) Identify the source document for recording the return transaction.

Understand the Problem

The question is asking for the recording of various book purchase transactions made by Sethu, including entries in the appropriate day books and identification of the source document for a return transaction.

Answer

Total purchases: ₹24,600; Purchases after discount: ₹25,365; Return amount: ₹3,540; Source document: Debit Note.

Answer for screen readers

- Total purchases from Himalaya Publishers: ₹24,600.

- Total purchases from Saradhi Books after discount: ₹25,365.

- Total return amount: ₹3,540.

- Source document for return transaction: Debit Note.

Steps to Solve

- Record Purchases from Himalaya Publishers

For the purchases from Himalaya Publishers:

- 100 copies of Accountancy Text for Class XI at ₹150 each:

- Total = $100 \times 150 = ₹15,000$

- 80 copies of Business Studies Text for Class XI at ₹120 each:

- Total = $80 \times 120 = ₹9,600$

The total from Himalaya Publishers is $₹15,000 + ₹9,600 = ₹24,600$.

- Record Purchases from Saradhi Books

For the purchases from Saradhi Books:

- 90 copies of Accountancy Text for Class XII at ₹180 each:

- Total = $90 \times 180 = ₹16,200$

- 75 copies of Business Studies Text for Class XII at ₹140 each:

- Total = $75 \times 140 = ₹10,500$

The total from Saradhi Books is $₹16,200 + ₹10,500 = ₹26,700$.

- Calculate Trade Discount

A trade discount of 5% is allowed on the total from Saradhi Books:

- Trade Discount = $5% , \text{of} , ₹26,700 = 0.05 \times 26,700 = ₹1,335$.

The net amount payable to Saradhi Books after the trade discount: $$ Total , after , discount = ₹26,700 - ₹1,335 = ₹25,365 $$

- Record Return Transaction to Saradhi Books

For the return transaction:

- 8 copies of Accountancy Text for Class XII at ₹180 each:

- Return Total = $8 \times 180 = ₹1,440$.

- 15 copies of Business Studies Text for Class XII at ₹140 each:

- Return Total = $15 \times 140 = ₹2,100$.

The total return amount is $₹1,440 + ₹2,100 = ₹3,540$.

- Identify Source Document for Return Transaction

The source document for recording the return transaction (c) is a Debit Note.

- Total purchases from Himalaya Publishers: ₹24,600.

- Total purchases from Saradhi Books after discount: ₹25,365.

- Total return amount: ₹3,540.

- Source document for return transaction: Debit Note.

More Information

This problem involves recording financial transactions in accounting, focusing on purchases and returns. A debit note serves as a formal record of goods returned to a supplier.

Tips

- Miscalculating the total amounts when recording each transaction.

- Forgetting to apply the trade discount correctly before finalizing the payable amount.

- Not recognizing the correct source document required for recording returns, which is a debit note.

AI-generated content may contain errors. Please verify critical information