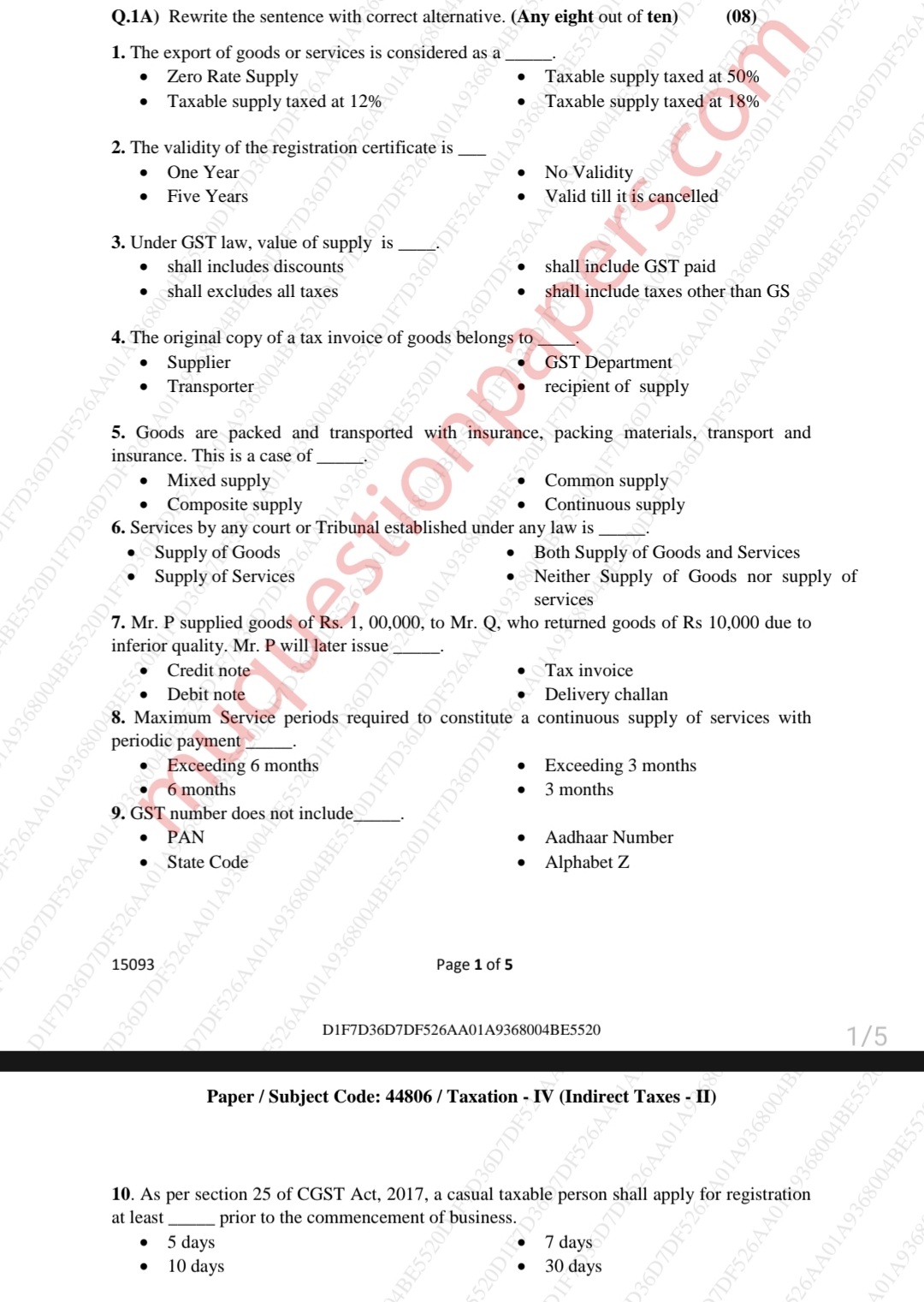

Rewrite the sentence with the correct alternative. (Any eight out of ten)

Understand the Problem

The question is asking to rewrite sentences by selecting the correct alternatives for each statement related to taxation and GST law. It requires understanding specific tax-related concepts to choose the right answers.

Answer

1. Taxable supply at 18% 2. Valid till cancelled 3. Include GST 4. Supplier 5. Composite supply 6. Both Goods/Services 7. Debit note 8. Exceed 3 months 9. Aadhaar 10. 30 days

- Taxable supply taxed at 18% 2. Valid till it is cancelled 3. Shall include GST paid 4. Supplier 5. Composite supply 6. Both Supply of Goods and Services 7. Debit note 8. Exceeding 3 months 9. Aadhaar Number 10. 30 days

Answer for screen readers

- Taxable supply taxed at 18% 2. Valid till it is cancelled 3. Shall include GST paid 4. Supplier 5. Composite supply 6. Both Supply of Goods and Services 7. Debit note 8. Exceeding 3 months 9. Aadhaar Number 10. 30 days

More Information

These options align with common taxation and GST-related practices.

Tips

Ensure each sentence is free from grammatical errors. Choose the most comprehensive and relevant alternative.

AI-generated content may contain errors. Please verify critical information