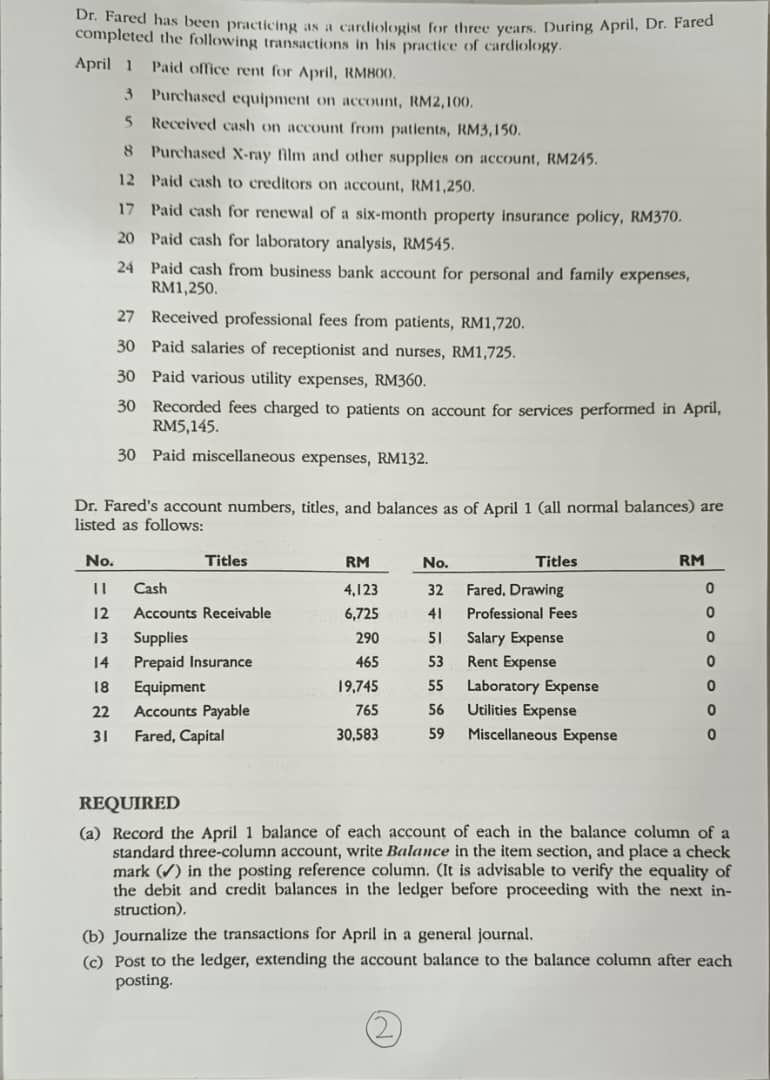

Record the April 1 balance of each account of each in the balance column of a standard three-column account, write Balance in the item section, and place a check mark in the postin... Record the April 1 balance of each account of each in the balance column of a standard three-column account, write Balance in the item section, and place a check mark in the posting reference column. Journalize the transactions for April in a general journal. Post to the ledger, extending the account balance to the balance column after each posting.

Understand the Problem

The question is asking to record and journalize the transactions of Dr. Fared for April, and post the balances in the ledger. This includes recording the initial balances, journalizing the transactions, and posting the results to a three-column account ledger.

Answer

The final balances after April transactions are: Cash: RM1,046, Accounts Receivable: RM11,870, Supplies: RM535, Prepaid Insurance: RM95, Equipment: RM21,845, Accounts Payable: RM2,110, Fared, Capital: RM30,583, Fared, Drawing: RM1,250, Professional Fees: RM5,145, Salary Expense: RM1,725, Rent Expense: RM800, Laboratory Expense: RM545, Utilities Expense: RM360, Miscellaneous Expense: RM132.

Answer for screen readers

The balances of the accounts after recording transactions in April are as follows:

- Cash: RM1,046

- Accounts Receivable: RM11,870

- Supplies: RM535

- Prepaid Insurance: RM95

- Equipment: RM21,845

- Accounts Payable: RM2,110

- Fared, Capital: RM30,583

- Fared, Drawing: RM1,250

- Professional Fees: RM5,145

- Salary Expense: RM1,725

- Rent Expense: RM800

- Laboratory Expense: RM545

- Utilities Expense: RM360

- Miscellaneous Expense: RM132

Steps to Solve

- Record the Initial Balances

Start by entering the initial balances of each account listed as of April 1 in the balance column of the three-column ledger.

- Cash: RM4,123

- Accounts Receivable: RM6,725

- Supplies: RM290

- Prepaid Insurance: RM465

- Equipment: RM19,745

- Accounts Payable: RM765

- Fared, Capital: RM30,583

- Fared, Drawing: RM0

- Professional Fees: RM0

- Salary Expense: RM0

- Rent Expense: RM0

- Laboratory Expense: RM0

- Utilities Expense: RM0

- Miscellaneous Expense: RM0

- Journalize the Transactions for April

Create a general journal to record the transactions made in April. For each transaction, identify the accounts affected and whether they are debited or credited.

- April 1: Rent Expense (Debit) RM800, Cash (Credit) RM800

- April 5: Equipment (Debit) RM2,100, Accounts Payable (Credit) RM2,100

- April 8: Supplies (Debit) RM245, Accounts Payable (Credit) RM245

- April 12: Accounts Payable (Debit) RM1,250, Cash (Credit) RM1,250

- April 17: Insurance Expense (Debit) RM370, Cash (Credit) RM370

- April 20: Laboratory Expense (Debit) RM545, Cash (Credit) RM545

- April 24: Fared, Drawing (Debit) RM1,250, Cash (Credit) RM1,250

- April 27: Cash (Debit) RM1,720, Professional Fees (Credit) RM1,720

- April 30: Salary Expense (Debit) RM1,725, Cash (Credit) RM1,725

- April 30: Utilities Expense (Debit) RM360, Cash (Credit) RM360

- April 30: Accounts Receivable (Debit) RM5,145, Professional Fees (Credit) RM5,145

- April 30: Miscellaneous Expense (Debit) RM132, Cash (Credit) RM132

- Post the Transactions to the Ledger

Post the individual amounts from the journal to the appropriate accounts in the ledger. Update the balance column after each posting.

- Finalize the Ledger Balances

After all transactions have been posted, collect the resulting balances for each account and report them in the balance column. Ensure the ledger reflects total debits equal total credits.

The balances of the accounts after recording transactions in April are as follows:

- Cash: RM1,046

- Accounts Receivable: RM11,870

- Supplies: RM535

- Prepaid Insurance: RM95

- Equipment: RM21,845

- Accounts Payable: RM2,110

- Fared, Capital: RM30,583

- Fared, Drawing: RM1,250

- Professional Fees: RM5,145

- Salary Expense: RM1,725

- Rent Expense: RM800

- Laboratory Expense: RM545

- Utilities Expense: RM360

- Miscellaneous Expense: RM132

More Information

The transaction journal and subsequent postings preserve the integrity of Dr. Fared's accounting records, allowing for accurate financial reporting for his medical practice. Proper recording and posting prevent discrepancies and provide a clear financial picture.

Tips

- Incorrect Debit/Credit Entries: Ensure to carefully analyze each transaction to avoid misclassification.

- Forgetting to Update Balances: After posting, it’s essential to update account balances accurately.

- Not Verifying Balances: Always check that total debits equal total credits before finalizing the ledger.

AI-generated content may contain errors. Please verify critical information