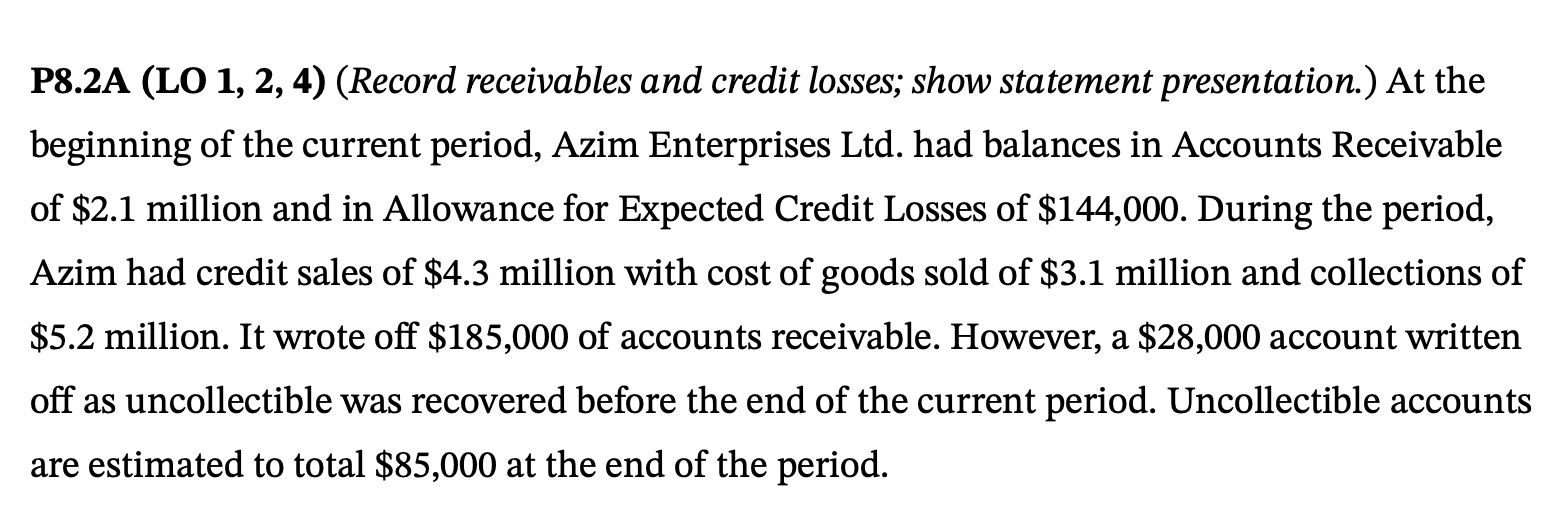

Record receivables and credit losses; show statement presentation. Prepare the entries to record sales and collections during the period.

Understand the Problem

The question is asking for the journal entries to record the credit sales and collections of Azim Enterprises Ltd. during a specific period, while also accounting for write-offs, recoveries, and the estimation of uncollectible accounts at the end of the period.

Answer

Record entries for credit sales, collections, write-offs, recoveries, and adjust for credit losses.

The journal entries are as follows:

- Initial balances: No entry needed.

- Credit sales: Debit Accounts Receivable $4,300,000; Credit Sales $4,300,000.

- Collections: Debit Cash $5,200,000; Credit Accounts Receivable $5,200,000.

- Write-off: Debit Allowance for Credit Losses $185,000; Credit Accounts Receivable $185,000.

- Recovery: Debit Accounts Receivable $28,000; Credit Allowance for Credit Losses $28,000; then Debit Cash $28,000; Credit Accounts Receivable $28,000.

- Adjust Allowance: Debit Bad Debt Expense $27,000; Credit Allowance for Credit Losses $27,000 (to reach the estimated total of $85,000).

Answer for screen readers

The journal entries are as follows:

- Initial balances: No entry needed.

- Credit sales: Debit Accounts Receivable $4,300,000; Credit Sales $4,300,000.

- Collections: Debit Cash $5,200,000; Credit Accounts Receivable $5,200,000.

- Write-off: Debit Allowance for Credit Losses $185,000; Credit Accounts Receivable $185,000.

- Recovery: Debit Accounts Receivable $28,000; Credit Allowance for Credit Losses $28,000; then Debit Cash $28,000; Credit Accounts Receivable $28,000.

- Adjust Allowance: Debit Bad Debt Expense $27,000; Credit Allowance for Credit Losses $27,000 (to reach the estimated total of $85,000).

More Information

This method uses the allowance method for credit losses, which aligns with GAAP principles. The recovery entry recognizes cash collections of previously uncollectible accounts.

Tips

Common mistakes include forgetting to adjust the allowance for expected credit losses and incorrect handling of recoveries.

Sources

- Accounting for Current Expected Credit Losses (“CECL”) - Boulay - boulaygroup.com

- Writing Off an Account Under the Allowance Method - accountingcoach.com

AI-generated content may contain errors. Please verify critical information