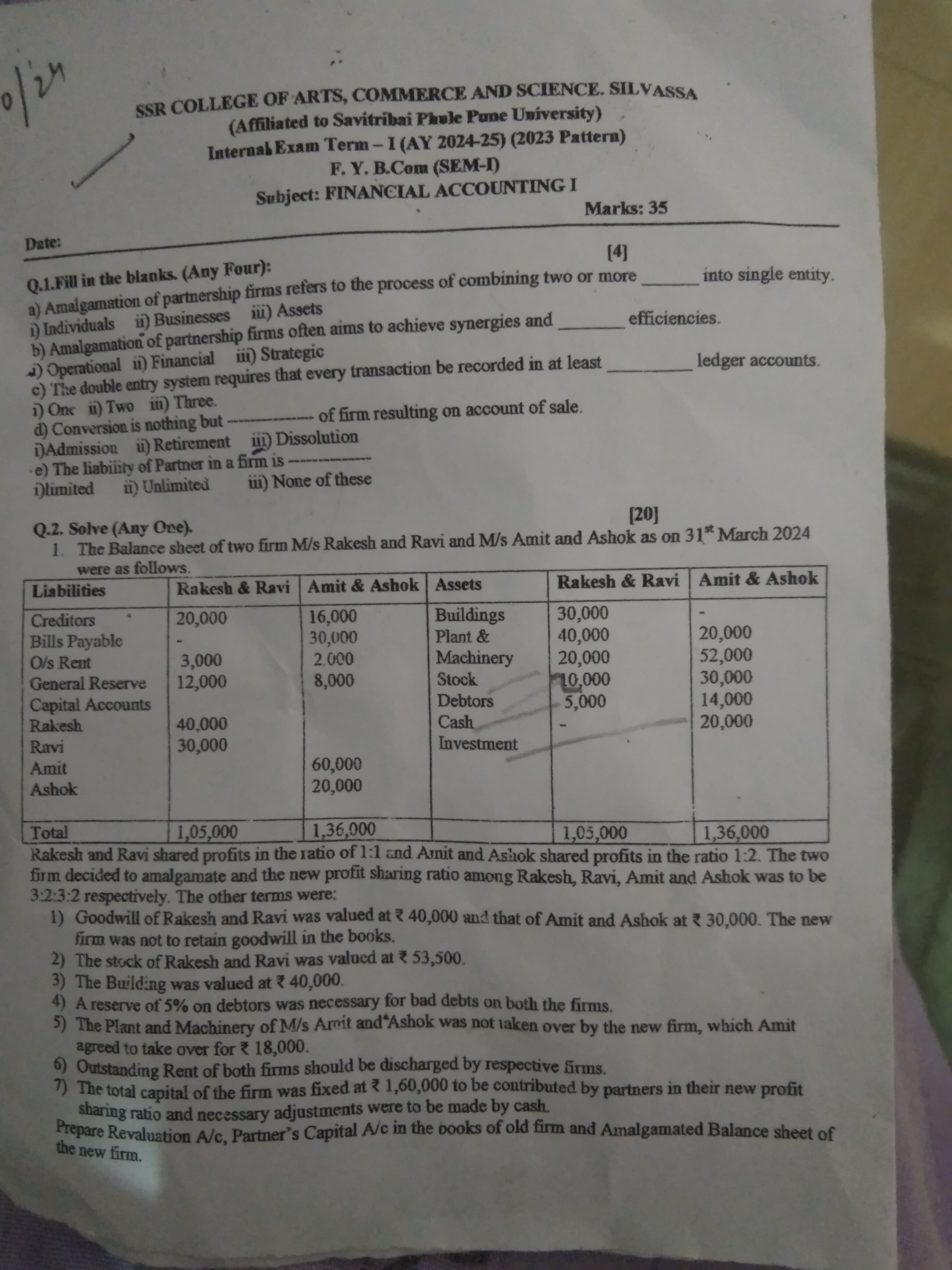

Rakesh and Ravi shared profits in the ratio of 1:1 and Amit and Ashok shared profits in the ratio 1:2. The two firms decided to amalgamate and the new profit-sharing ratio among Ra... Rakesh and Ravi shared profits in the ratio of 1:1 and Amit and Ashok shared profits in the ratio 1:2. The two firms decided to amalgamate and the new profit-sharing ratio among Rakesh, Ravi, Amit, and Ashok was to be 3:2:3:2 respectively. Prepare Revaluation A/c, Partner's Capital A/c in the books of old firm and Amalgamated Balance sheet of the new firm.

Understand the Problem

The question involves accounting concepts, specifically related to the amalgamation of firms and the preparation of financial statements. It requires cleaning up the financial data, adjusting for goodwill, and preparing the necessary accounts and balance sheets for the new firm resulting from the amalgamation.

Answer

Total assets after amalgamation: ₹264,000; total liabilities: ₹194,000.

Answer for screen readers

The Amalgamated Balance Sheet after adjustments shows total assets of ₹264,000 and total liabilities of ₹194,000.

Steps to Solve

-

Identify Liabilities and Assets

First, list the liabilities and assets of both firms. The balance sheet shows:-

Liabilities:

- Rakesh & Ravi:

- Creditors: ₹20,000

- Bills Payable: ₹3,000

- O/s Rent: ₹3,000

- General Reserve: ₹12,000

- Capital Accounts: ₹40,000

- Total: ₹78,000

- Amit & Ashok:

- Creditors: ₹16,000

- Bills Payable: ₹30,000

- O/s Rent: ₹2,000

- General Reserve: ₹8,000

- Capital Accounts: ₹60,000

- Total: ₹116,000

- Rakesh & Ravi:

-

Liabilities:

-

Calculate Total Assets

Next, calculate the total assets of both firms from the provided data.-

Assets:

- Rakesh & Ravi:

- Buildings: ₹30,000

- Machinery: ₹20,000

- Stock: ₹10,000

- Debtors: ₹5,000

- Cash: ₹5,000

- Total: ₹70,000

- Amit & Ashok:

- Buildings: ₹40,000

- Plant & Machinery: ₹20,000

- Stock: ₹30,000

- Debtors: ₹14,000

- Investment: ₹20,000

- Total: ₹124,000

- Rakesh & Ravi:

-

Assets:

-

Determine Goodwill Adjustments

Include goodwill adjustments as stated in the question:- Goodwill of Rakesh & Ravi: ₹40,000

- Goodwill of Amit & Ashok: ₹30,000

- Total Goodwill: ₹70,000

-

Prepare the Amalgamated Balance Sheet

Combine the liabilities and assets, factoring in goodwill and any other adjustments:- Combine total assets and liabilities from both firms and include the goodwill values.

- For instance:

Total Assets = ₹70,000 + ₹124,000 + ₹70,000 = ₹264,000

Total Liabilities = ₹78,000 + ₹116,000 = ₹194,000

-

Prepare Revaluation Account and Partner's Capital Accounts

Calculate revaluation for both firms:- Include increases/decreases from asset valuations and adjust both partners’ capital accounts according to the agreed ratios (1:1 for Rakesh & Ravi, 1:2 for Amit & Ashok).

The Amalgamated Balance Sheet after adjustments shows total assets of ₹264,000 and total liabilities of ₹194,000.

More Information

This solution involves restructuring the financial statements of two firms into an amalgamated entity, crucial for accurately reflecting the combined financial position. The goodwill valuation is important as it recognizes the intangible assets resulting from the merger.

Tips

- Incorrectly combining liabilities and assets: Ensure that all items are included from both firms.

- Miscalculating goodwill: Carefully follow the ratios and adjustments mentioned.

- Forgetting to adjust for bad debts and reserve deductions: Always check for these common adjustments in amalgamations.

AI-generated content may contain errors. Please verify critical information