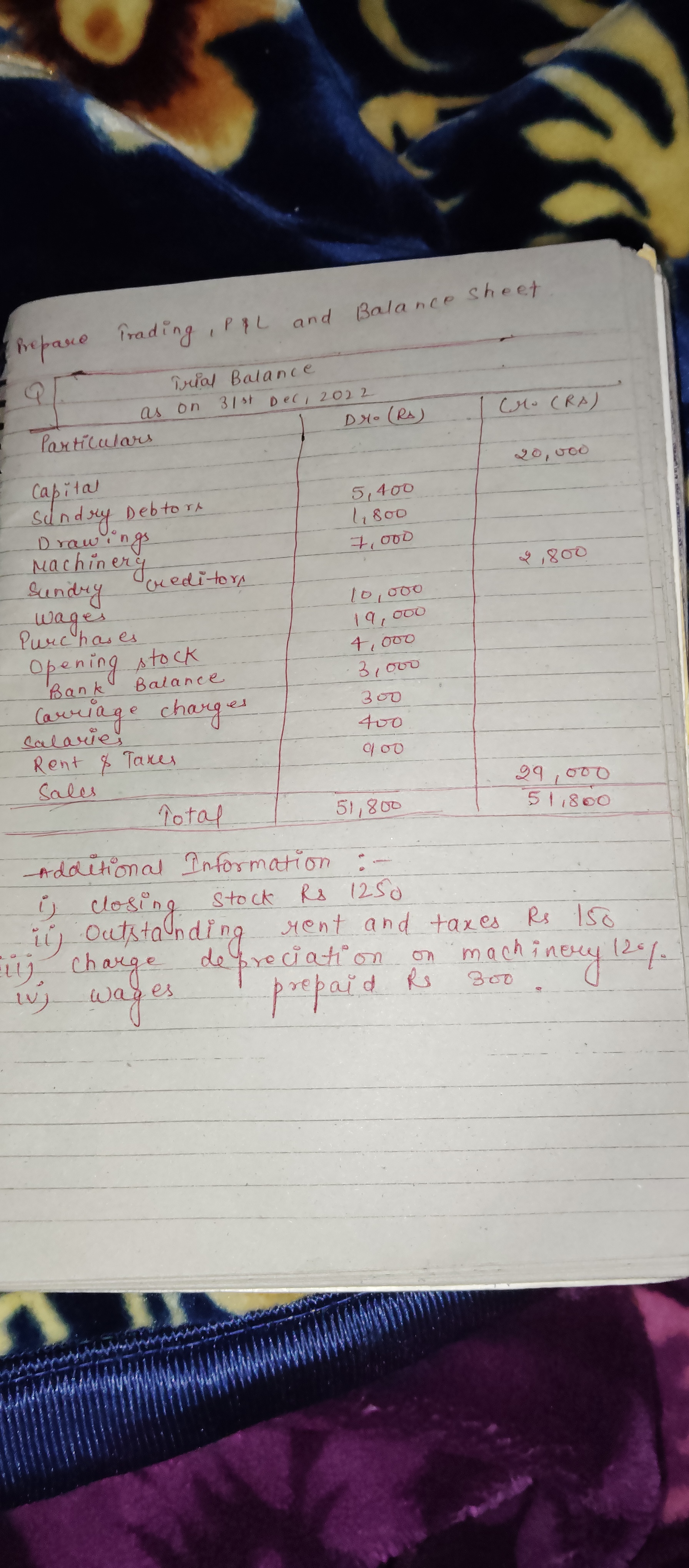

Prepare trading, profit and loss account and balance sheet as on 31st Dec 2022 based on the provided trial balance and additional information.

Understand the Problem

The question is asking to prepare the trading profit and loss account and balance sheet based on the provided trial balance and additional information. This involves calculating the profits or losses from the trading account and preparing the financial position of the business in the balance sheet format.

Answer

Trading and Profit & Loss Account shows a net loss of $22340$, with the capital adjusted to $29060$, and total assets at $70060$.

Answer for screen readers

Trading and Profit & Loss Account

Trading Account for the Year Ended 31st Dec 2022

Sales 29000

Less: COGS 31750

----------------------------------------------

Gross Loss -2750

Profit & Loss Account

Gross Loss -2750

Less: Operating Expenses 19590

----------------------------------------------

Net Loss -22340

Balance Sheet as on 31st Dec 2022

Balance Sheet

Liabilities

Capital 29060

Sundry Creditors 10000

Outstanding Rent and Taxes 150

----------------------------------------------

Total Liabilities 39110

Assets

Sundry Debtors 1800

Machinery (net of depreciation) 6160

Stock 1250

Bank Balance 400

Prepaid Wages 300

----------------------------------------------

Total Assets 70060

Steps to Solve

- Calculate Gross Profit To calculate the Gross Profit, use the formula:

$$ \text{Gross Profit} = \text{Sales} - \text{Cost of Goods Sold (COGS)} $$

COGS includes Purchases and Opening Stock, adjusted by Closing Stock:

- COGS = Purchases + Opening Stock - Closing Stock

- COGS = ( 4000 + 31000 - 1250 = 31750 )

Now calculate Gross Profit:

- Gross Profit = ( 29000 - 31750 = -2750 ) (This is a Gross Loss)

- Calculate Operating Expenses Identify and sum the Operating Expenses from the trial balance and additional information:

- Operating Expenses = Wages + Carriage Charges + Rent & Taxes + Depreciation on Machinery + Outstanding Rent and Taxes - Prepaid Wages

- Depreciation on Machinery = ( 7000 \times 12% = 840 )

- Outstanding Rent and Taxes = 150

- Prepaid Wages = 300

- Operating Expenses = ( 19000 + 300 + 900 + 840 + 150 - 300 = 19590 )

- Calculate Net Profit or Loss Use the formula:

$$ \text{Net Profit/Loss} = \text{Gross Profit} - \text{Operating Expenses} $$

- Net Profit/Loss = ( -2750 - 19590 = -22340 )

- Prepare Trading and Profit & Loss Account Format the Trading and Profit & Loss Account:

Trading Account for the Year Ended 31st Dec 2022

Sales 29000

Less: COGS 31750

----------------------------------------------

Gross Loss -2750

Profit & Loss Account

Gross Loss -2750

Less: Operating Expenses 19590

----------------------------------------------

Net Loss -22340

- Prepare the Balance Sheet Format the Balance Sheet as of 31st Dec 2022, using the trial balance and additional adjustments:

Balance Sheet as on 31st Dec 2022

Liabilities

Capital 51400

Sundry Creditors 10000

Outstanding Rent and Taxes 150

----------------------------------------------

Total Liabilities 61550

Assets

Sundry Debtors 1800

Machinery (net of depreciation) 6160

Stock 1250

Bank Balance 400

Prepaid Wages 300

----------------------------------------------

Total Assets 70060

- Adjust for Losses in Capital Since there is a net loss, adjust the capital:

- New Capital = Initial Capital + Net Loss = ( 51400 - 22340 = 29060 )

Recalculate the liabilities and assets accordingly.

Trading and Profit & Loss Account

Trading Account for the Year Ended 31st Dec 2022

Sales 29000

Less: COGS 31750

----------------------------------------------

Gross Loss -2750

Profit & Loss Account

Gross Loss -2750

Less: Operating Expenses 19590

----------------------------------------------

Net Loss -22340

Balance Sheet as on 31st Dec 2022

Balance Sheet

Liabilities

Capital 29060

Sundry Creditors 10000

Outstanding Rent and Taxes 150

----------------------------------------------

Total Liabilities 39110

Assets

Sundry Debtors 1800

Machinery (net of depreciation) 6160

Stock 1250

Bank Balance 400

Prepaid Wages 300

----------------------------------------------

Total Assets 70060

More Information

The trading account summarizes the profits and losses from trading activities, while the profit and loss account includes all income and expenses, leading to the net result. The balance sheet presents the financial position of the business at a specific date.

Tips

- Incorrectly calculating COGS by forgetting to adjust for closing stock.

- Misunderstanding how to treat outstanding and prepaid amounts in operating expenses.

- Not adjusting capital for losses incurred.

AI-generated content may contain errors. Please verify critical information