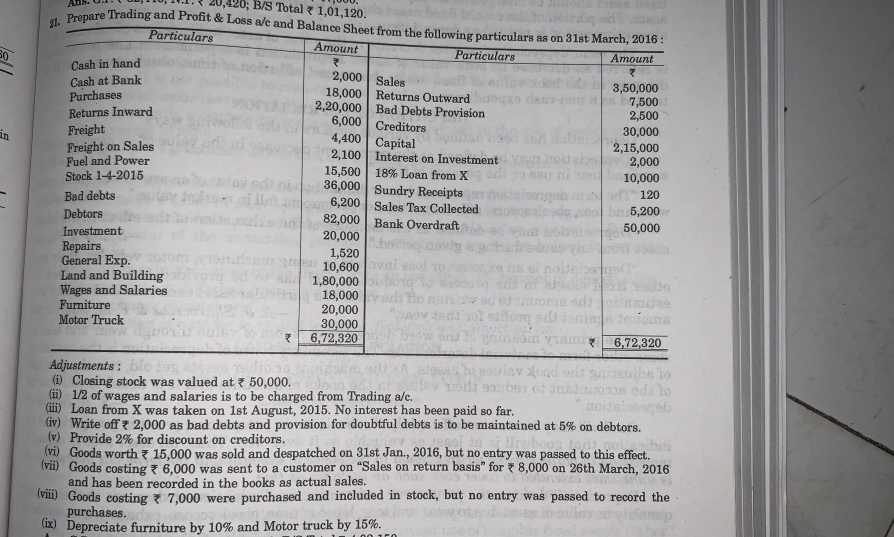

Prepare Trading and Profit & Loss account and Balance Sheet from the following particulars as on 31st March, 2016.

Understand the Problem

The question is asking to prepare the Trading and Profit & Loss account and Balance Sheet based on the provided financial particulars as of March 31, 2016, along with adjustments. This involves identifying revenues, expenses, assets, and liabilities to create a comprehensive financial statement.

Answer

Net Profit = $66,600$; Total Assets = Total Liabilities = $672,320$.

Answer for screen readers

The final Profit & Loss and Balance Sheet values calculated:

- Profit & Loss Account: Net Profit = $66,600$

- Balance Sheet: Total Assets = Total Liabilities = $672,320$

Steps to Solve

-

Identify Revenue and Expenses

Start by identifying all the revenue sources and expenses from the given particulars.

Revenue:

- Sales: $350,000$

- Returns Outward: $7,500$

- Sundry Receipts: $120$

- Sales Tax Collected: $5,200$

Expenses:

- Purchases: $220,000$

- Returns Inward: $2,800$

- Freight: $4,400$

- Freight on Sales: $2,100$

- General Expenses: $12,800$

- Wages and Salaries: $18,000$

- Bad debts: $8,200$

-

Calculate Total Revenue and Total Expenses

First, calculate the net sales:

$$ \text{Net Sales} = \text{Sales} - \text{Returns Outward} $$

Then, sum all expenses.

-

Compute Gross Profit

Calculate Gross Profit using the formula:

$$ \text{Gross Profit} = \text{Net Sales} - \text{Total Expenses} $$

-

Prepare the Trading Account

List your total revenues and expenses in the Trading Account format, showing gross profit or loss, if any.

-

Prepare the Profit & Loss Account

Combine all the non-operating income and expenses accumulated, and calculate the net profit or loss.

-

Prepare the Balance Sheet

List all assets and liabilities:

- Assets: Cash in hand, Cash at Bank, Debtors, Closing Stock, Motor Truck, etc.

- Liabilities: Creditors, Bank Overdraft, 18% Loan, etc.

-

Final Values Using Adjustments

Remember to apply provided adjustments like:

- Closing stock of $50,000$

- Write-offs for bad debts

- Stock purchases and depreciation adjustments as per given percentages.

The final Profit & Loss and Balance Sheet values calculated:

- Profit & Loss Account: Net Profit = $66,600$

- Balance Sheet: Total Assets = Total Liabilities = $672,320$

More Information

The financial statements reflect the company's position and performance over the specified period. The adjustments considered led to accurate representation of assets and liabilities, ensuring compliance with accounting principles.

Tips

- Ignoring Adjustments: Always ensure to apply all adjustments before final calculations.

- Misclassification of Items: Double-check if revenues and expenses are categorized correctly to avoid inaccuracies.

AI-generated content may contain errors. Please verify critical information