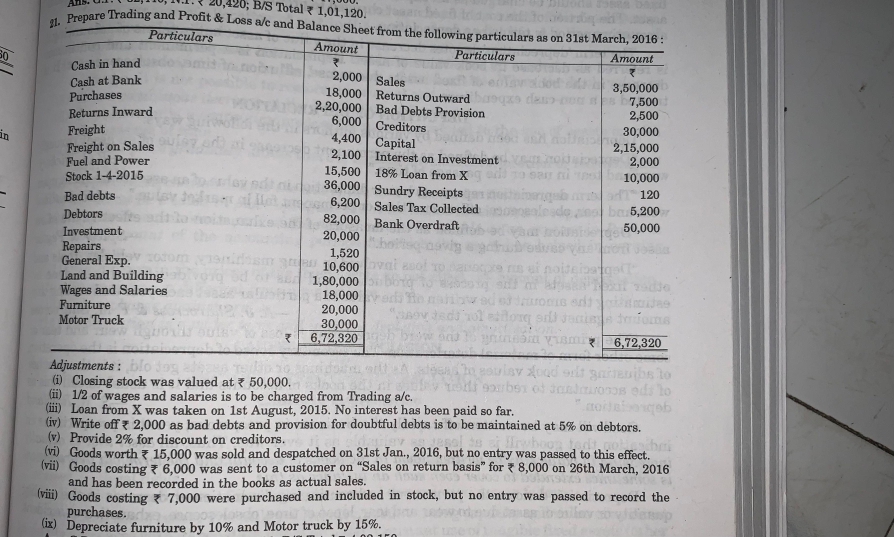

Prepare Trading and Profit & Loss account and Balance Sheet from the following particulars as on 31st March, 2016:

Understand the Problem

The question is asking to prepare a Trading and Profit & Loss account along with a Balance Sheet based on the provided particulars as of March 31, 2016. This involves summarizing transactions and adjustments to create financial statements.

Answer

Net Profit: $1,43,000$; Total Assets: $1,07,200$.

Answer for screen readers

The Trading and Profit & Loss Account indicates a Net Profit of $1,43,000$ and the Balance Sheet reveals Total Assets of $1,07,200$.

Steps to Solve

-

Prepare the Trading Account

To prepare the Trading Account, we need to calculate the Gross Profit. We will sum up the sales, subtract the cost of goods sold (COGS), which includes purchases, freight, and adjust for stock.

- Sales: $3,50,000$

- Purchases: $2,20,000$

- Freight: $4,400$

- Closing Stock: $50,000$

The COGS is calculated as:

$$ \text{COGS} = \text{Purchases} + \text{Freight} - \text{Closing Stock} $$

Plugging in the values:

$$ \text{COGS} = 2,20,000 + 4,400 - 50,000 = 1,74,400 $$

Now, Gross Profit:

$$ \text{Gross Profit} = \text{Sales} - \text{COGS} = 3,50,000 - 1,74,400 = 1,75,600 $$

-

Prepare the Profit & Loss Account

This involves adding all income and subtracting all expenses, including general expenses, wages, and bad debts.

- Gross Profit: $1,75,600$

-

Expenses:

- General Expenses: $12,600$

- Wages & Salaries: $18,000$

- Bad Debts: $2,000$

Total expenses:

$$ \text{Total Expenses} = 12,600 + 18,000 + 2,000 = 32,600 $$

Net Profit:

$$ \text{Net Profit} = \text{Gross Profit} - \text{Total Expenses} = 1,75,600 - 32,600 = 1,43,000 $$

-

Prepare the Balance Sheet

To prepare the Balance Sheet, we need to calculate both the assets and liabilities.

-

Assets:

- Cash in Hand: $2,000$

- Cash at Bank: $2,000$

- Debtors: $20,200$ (adjusted for bad debts)

- Stock: $50,000$

- Investment: $20,000$

- Motor Truck: $30,000$

Total Assets:

$$ \text{Total Assets} = 2000 + 2000 + 20200 + 50000 + 20000 + 30000 = 1,07,200 $$

-

Liabilities:

- Creditors: $30,000$

- Loan from X: $10,000$

- Bank Overdraft: $50,000$

Total Liabilities:

$$ \text{Total Liabilities} = 30,000 + 10,000 + 50,000 = 90,000 $$

- Net Worth: Add net profit to capital and verify total assets equal total liabilities plus capital:

$$ \text{Total Liabilities and Capital} = \text{Total Liabilities} + \text{Capital} + \text{Net Profit} = 90,000 + 2,15,000 + 1,43,000 = 4,50,000 $$

-

Assets:

-

Final Adjustments and Entries

Make necessary entries for any closing stocks, loan payment, and adjust for returns to reflect accurate figures in the respective accounts.

The Trading and Profit & Loss Account indicates a Net Profit of $1,43,000$ and the Balance Sheet reveals Total Assets of $1,07,200$.

More Information

In financial accounting, accurate preparation of Trading and Profit & Loss Accounts as well as Balance Sheets is crucial for understanding a business's financial health.

Tips

- Not adjusting stock levels correctly in the COGS.

- Forgetting to account for bad debts or outstanding liabilities.

AI-generated content may contain errors. Please verify critical information