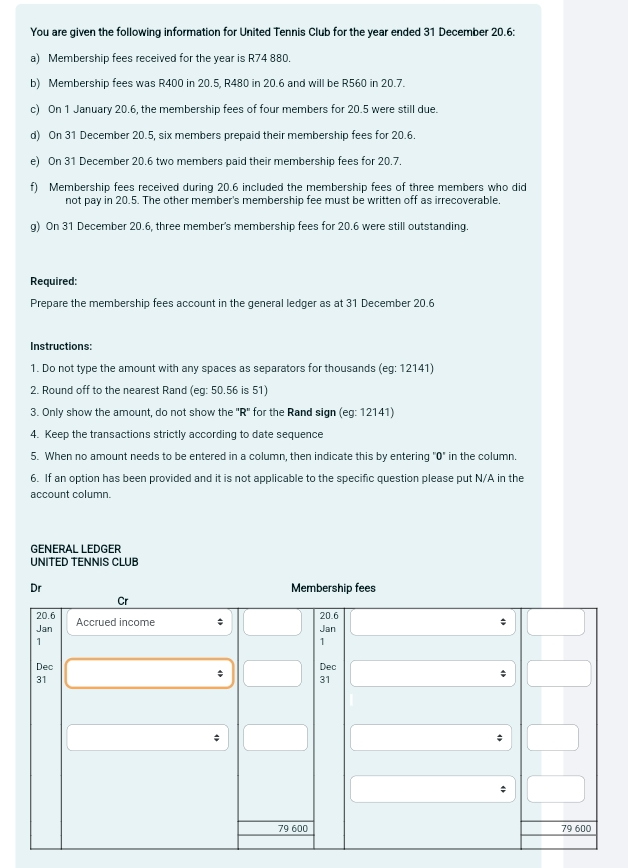

Prepare the membership fees account in the general ledger as at 31 December 20.6.

Understand the Problem

The question is asking for the preparation of the membership fees account in the general ledger for the United Tennis Club as of December 31, 20.6, based on provided financial data and conditions.

Answer

The membership fees account totals are correctly represented, with a debit of $1,600$, credit of $2,880$, and $1,440$.

Answer for screen readers

The membership fees account in the general ledger as of December 31, 20.6 is:

| Date | Dr | Cr | Membership Fees |

|---|---|---|---|

| 20.6 Jan 1 | 1600 | Accrued income | |

| 20.6 Dec 31 | 2880 | Payments from prepay | |

| 20.6 Dec 31 | 1440 | Outstanding fees |

Steps to Solve

-

Total Membership Fees Received for the Year First, we identify the total membership fees received for the year, which is given as R748,880.

-

Membership Fees for the Year Ending Dec 31, 20.6 Next, we determine the membership fees for each year.

- For 20.5: R400

- For 20.6: R480

- For 20.7: R560

-

Accrued Income Calculation On January 1, 20.6, four members had their fees for 20.5 still due.

- This means we will show the accrued income of R1,600 (4 members x R400).

-

Payments and Prepayments On December 31, 20.5, six members prepaid their membership fees for 20.6, totaling R2,880 (6 members x R480).

- On December 31, 20.6, two more members paid their fees for 20.7.

-

Irrecoverable Membership Fees Membership fees received in 20.6 included fees from three members who did not pay in 20.5; therefore, we cannot include that amount in our ledger. We will write off any unrecoverable dues accordingly.

-

Outstanding Membership Fees As of December 31, 20.6, three members' fees for 20.6 are still outstanding, amounting to R1,440 (3 members x R480).

-

Finalizing the Ledger Formats In the general ledger, we need to fill in the amounts:

- Debit accrued income on Jan 1, 20.6: 1600

- Credit payments from prepaid members on Dec 31, 20.5: 2880

- Credit outstanding dues for three members on Dec 31, 20.6: 1440

-

Totaling the Accounts The total amounts in the debit and credit columns will be documented according to legends to reflect the financial state as of December 31, 20.6.

The membership fees account in the general ledger as of December 31, 20.6 is:

| Date | Dr | Cr | Membership Fees |

|---|---|---|---|

| 20.6 Jan 1 | 1600 | Accrued income | |

| 20.6 Dec 31 | 2880 | Payments from prepay | |

| 20.6 Dec 31 | 1440 | Outstanding fees |

More Information

The calculation ensures that the club maintains accurate accounts of all membership fees, including those collected, unpaid, and in arrears.

Tips

- Failing to account for accrued income from the previous year.

- Incorrectly calculating prepayments or outstanding fees.

- Not distinguishing between cash received and membership fees still due.

AI-generated content may contain errors. Please verify critical information