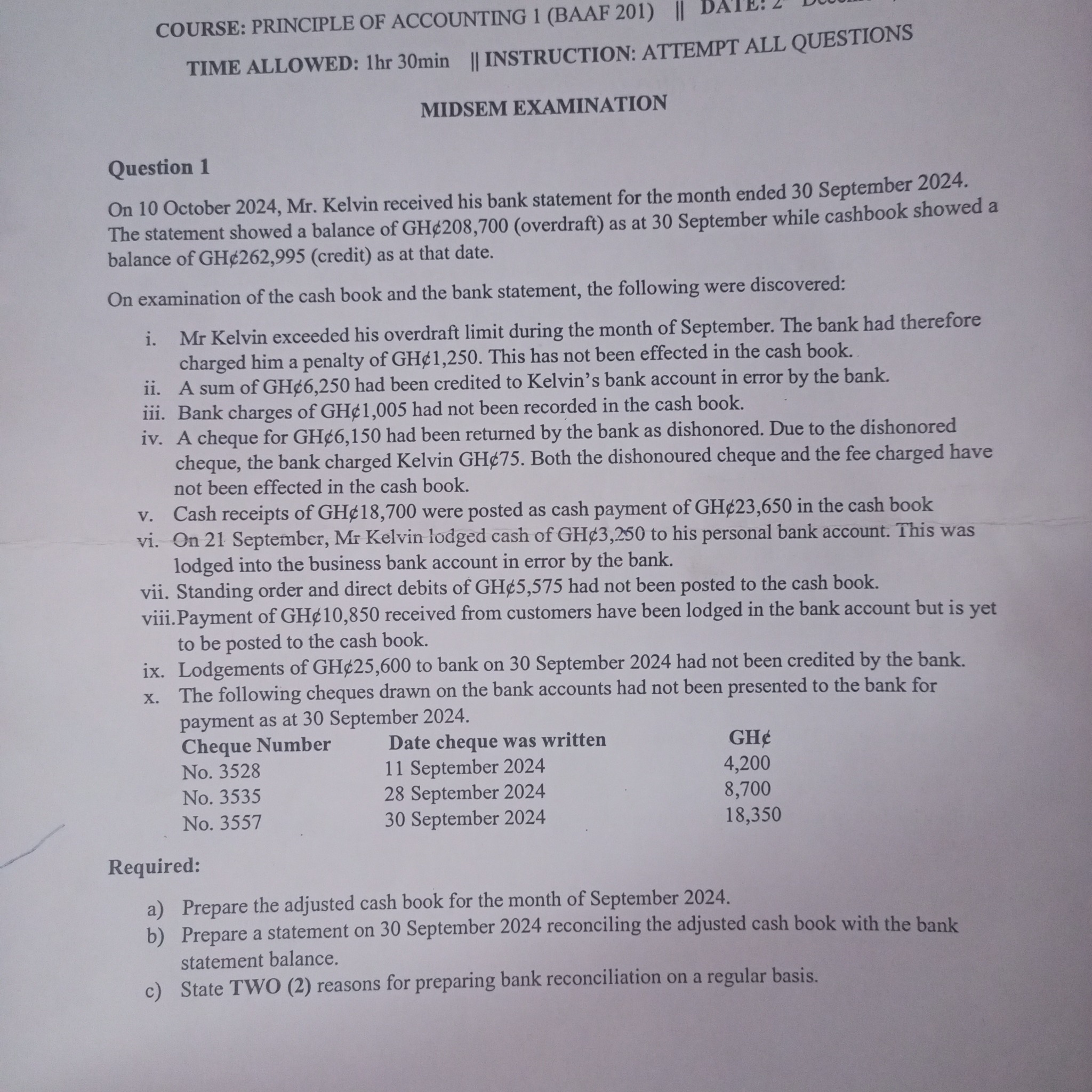

Prepare the adjusted cash book for the month of September 2024. Prepare a statement on 30 September 2024 reconciling the adjusted cash book with the bank statement balance. State T... Prepare the adjusted cash book for the month of September 2024. Prepare a statement on 30 September 2024 reconciling the adjusted cash book with the bank statement balance. State TWO reasons for preparing bank reconciliation on a regular basis.

Understand the Problem

The question is asking to prepare the adjusted cash book for September 2024, reconcile it with the bank statement, and state two reasons why regular bank reconciliations are necessary.

Answer

Ensure accurate records and detect errors or fraud.

The reasons for regular bank reconciliation are to ensure accurate financial records and to detect fraud or errors promptly.

Answer for screen readers

The reasons for regular bank reconciliation are to ensure accurate financial records and to detect fraud or errors promptly.

More Information

Regular bank reconciliations help maintain accurate financial records, identify discrepancies quickly, and prevent fraud by ensuring all transactions are accounted for in both the cash book and bank statements.

Tips

Omitting transactions or entering incorrect amounts can lead to discrepancies. Double-check entries for accuracy.

Sources

- Bank Reconciliation: Purpose, Example, Process - QuickBooks - quickbooks.intuit.com

AI-generated content may contain errors. Please verify critical information