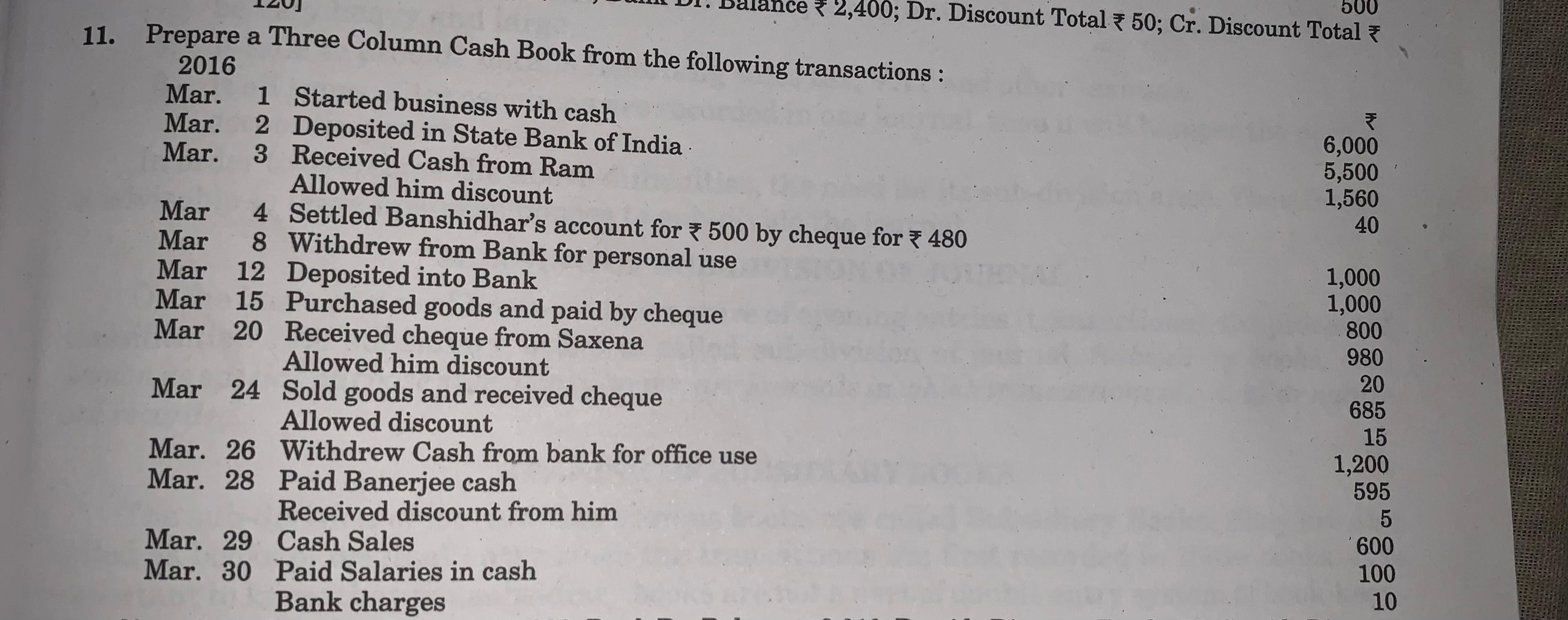

Prepare a Three Column Cash Book from the following transactions: March 1: Started business with cash. March 2: Deposited in State Bank of India. March 3: Received Cash from Ram, A... Prepare a Three Column Cash Book from the following transactions: March 1: Started business with cash. March 2: Deposited in State Bank of India. March 3: Received Cash from Ram, Allowed him discount. March 4: Settled Banshidhar's account for ₹500 by cheque for ₹480. March 8: Withdraw from Bank for personal use. March 12: Deposited into Bank. March 15: Purchased goods and paid by cheque. March 20: Received cheque from Saxena, Allowed him discount. March 24: Sold goods and received cheque, Allowed discount. March 26: Withdraw Cash from bank for office use. March 28: Paid Banerjee cash, Received discount from him. March 29: Cash Sales. March 30: Paid Salaries in cash, Bank charges.

Understand the Problem

The question is asking to prepare a Three Column Cash Book for the transactions listed for March 2016. This involves organizing cash transactions, bank transactions, and discounts into a structured format, typically used in accounting.

Answer

The Cash Book entries for March 2016 total to Cash: $7026$, Bank: $1960$, and Discounts: $80$.

Answer for screen readers

Here’s a simplified Three Column Cash Book for March 2016:

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar 1 | Started business | 6000 | 0 | 0 |

| Mar 2 | Deposited in State Bank | 0 | 5500 | 0 |

| Mar 3 | Received Cash from Ram | 1560 | 0 | 40 |

| Mar 4 | Settled Banshidhar's cheque | 0 | -480 | 0 |

| Mar 8 | Withdrawn for Personal Use | 1000 | 0 | 0 |

| Mar 12 | Deposited into Bank | 0 | 1000 | 0 |

| Mar 15 | Purchased goods | -800 | 0 | 0 |

| Mar 20 | Received cheque from Saxena | 0 | 980 | 20 |

| Mar 24 | Sold goods | 685 | 0 | 15 |

| Mar 26 | Withdraw Cash from Bank | 1200 | 0 | 0 |

| Mar 28 | Paid Banerjee cash | -595 | 0 | 5 |

| Mar 29 | Cash Sales | 600 | 0 | 0 |

| Mar 30 | Paid Salaries in Cash | -100 | 0 | 0 |

| Mar 30 | Bank Charges | 0 | -10 | 0 |

Total Cash: 7026, Total Bank: 1960, Total Discounts: 80

Steps to Solve

-

Set Up the Cash Book Structure

Create a three-column cash book format with the following headings: Date, Particulars, Cash, Bank, and Discount. The cash column records cash transactions, the bank column records bank transactions, and the discount column records any discounts allowed. -

Input Initial Balances

On March 1, record the starting business cash.

- Date: Mar 1

- Particulars: Started business

- Cash: 6000

- Bank: 0

- Discount: 0

-

Record Transactions

Proceed to fill in each transaction for March one by one based on the provided data.

For example, on March 2, deposit into the bank:

- Date: Mar 2

- Particulars: Deposited in State Bank of India

- Cash: 0

- Bank: 5500

-

Discount: 0

Continue this for all the transactions.

-

Calculate Discounts

Where discounts are allowed (e.g., March 3, March 20, and March 24), record them in the discount column.

For example, on March 3:

- Date: Mar 3

- Particulars: Received cash from Ram

- Cash: 1560

- Bank: 0

- Discount: 40

-

Complete the Cash Book

Finalise the entries by checking each transaction and summing the values in the Cash, Bank, and Discount columns. -

Final Calculation

At the end of the cash book, calculate the total cash, total bank deposits, and total discounts allowed for the month.

Here’s a simplified Three Column Cash Book for March 2016:

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar 1 | Started business | 6000 | 0 | 0 |

| Mar 2 | Deposited in State Bank | 0 | 5500 | 0 |

| Mar 3 | Received Cash from Ram | 1560 | 0 | 40 |

| Mar 4 | Settled Banshidhar's cheque | 0 | -480 | 0 |

| Mar 8 | Withdrawn for Personal Use | 1000 | 0 | 0 |

| Mar 12 | Deposited into Bank | 0 | 1000 | 0 |

| Mar 15 | Purchased goods | -800 | 0 | 0 |

| Mar 20 | Received cheque from Saxena | 0 | 980 | 20 |

| Mar 24 | Sold goods | 685 | 0 | 15 |

| Mar 26 | Withdraw Cash from Bank | 1200 | 0 | 0 |

| Mar 28 | Paid Banerjee cash | -595 | 0 | 5 |

| Mar 29 | Cash Sales | 600 | 0 | 0 |

| Mar 30 | Paid Salaries in Cash | -100 | 0 | 0 |

| Mar 30 | Bank Charges | 0 | -10 | 0 |

Total Cash: 7026, Total Bank: 1960, Total Discounts: 80

More Information

A three-column cash book is essential for tracking cash, bank, and discount transactions in a systematic way. This helps in maintaining clear records for accounting and financial statements.

Tips

- Failing to categorize transactions correctly into cash, bank, or discount.

- Not recording the negative entries (expenses) properly.

- Forgetting to sum up the total amounts in each column at the end.