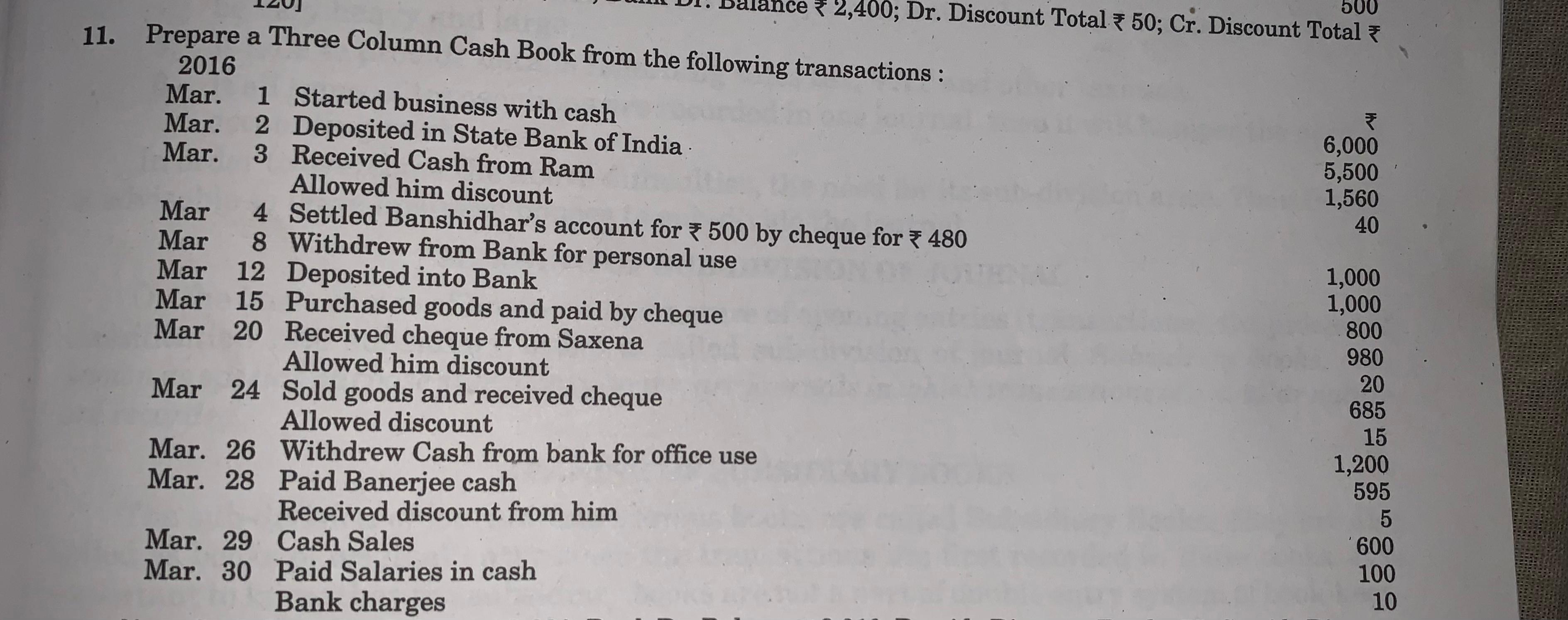

Prepare a Three Column Cash Book from the following transactions: 2016 Mar. 1 Started business with cash Mar. 2 Deposited in State Bank of India Mar. 3 Received Cash from Ram Al... Prepare a Three Column Cash Book from the following transactions: 2016 Mar. 1 Started business with cash Mar. 2 Deposited in State Bank of India Mar. 3 Received Cash from Ram Allowed him discount Mar. 4 Settled Banshidhar's account for ₹ 500 by cheque for ₹ 480 Mar. 8 Withdrew from Bank for personal use Mar. 12 Deposited into Bank Mar. 15 Purchased goods and paid by cheque Mar. 20 Received cheque from Saxena Allowed him discount Mar. 24 Sold goods and received cheque Allowed discount Mar. 26 Withdrawn Cash from bank for office use Mar. 28 Paid Banerjee cash Received discount from him Mar. 29 Cash Sales Mar. 30 Paid Salaries in cash Bank charges.

Understand the Problem

The question is asking to prepare a three-column cash book based on the given transactions, which involves recording cash, bank, and discount transactions for the month of March 2016.

Answer

The total cash, bank, and discounts should be totaled in the cash book for March 2016 transactions.

Answer for screen readers

Here's the summarized Cash Book for March 2016:

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 | ||

| Mar. 2 | Deposited in State Bank | 5,500 | ||

| Mar. 3 | Received Cash from Ram | 1,560 | 40 | |

| Mar. 4 | Settled Banshidhar's a/c | 500 | ||

| Mar. 8 | Withdrawn from Bank | 1,000 | 4,500 | |

| Mar. 12 | Deposited into Bank | 1,000 | ||

| Mar. 15 | Purchased goods paid by cheque | (800) | ||

| Mar. 20 | Received cheque from Saxena | 980 | 20 | |

| Mar. 24 | Sold goods received cheque | 685 | 15 | |

| Mar. 26 | Withdrawn Cash from Bank | 1,200 | 1,000 | |

| Mar. 28 | Paid Banerjee cash | (595) | 5 | |

| Mar. 29 | Cash Sales | 600 | ||

| Mar. 30 | Paid Salaries in cash | (100) | ||

| Bank charges | (10) |

Total Cash: [Final Cash Amount]

Total Bank: [Final Bank Amount]

Total Discounts: [Final Discount Amount]

Steps to Solve

- Prepare the Cash Book Format

Set up a three-column cash book with columns for Cash, Bank, and Discount. The first row will include headers for each column.

- Record Initial Business Cash

On March 1, record the starting cash of ₹6,000 in the Cash column.

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 |

- Record Bank Deposit

On March 2, the amount of ₹5,500 was deposited into the bank, recorded in the Bank column.

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 | ||

| Mar. 2 | Deposited in State Bank | 5,500 |

- Record Cash Received from Ram

On March 3, record ₹1,560 received from Ram in the Cash column and allow him a discount of ₹40.

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 | ||

| Mar. 2 | Deposited in State Bank | 5,500 | ||

| Mar. 3 | Received Cash from Ram | 1,560 | 40 |

- Record Cheque Settlement

On March 4, record the cheque of ₹500 settled to Banshidhar, noted in the Cash column.

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 | ||

| Mar. 2 | Deposited in State Bank | 5,500 | ||

| Mar. 3 | Received Cash from Ram | 1,560 | 40 | |

| Mar. 4 | Settled Banshidhar's a/c | 500 |

- Record Withdrawal from Bank

Record the withdrawal of ₹1,000 for personal use on March 8.

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 | ||

| Mar. 2 | Deposited in State Bank | 5,500 | ||

| Mar. 3 | Received Cash from Ram | 1,560 | 40 | |

| Mar. 4 | Settled Banshidhar's a/c | 500 | ||

| Mar. 8 | Withdrawn from Bank | 1,000 | 4,500 |

- Continuing Recording Transactions

Continue recording transactions for the month following the same format, ensuring each transaction is accurately entered into the correct column (Cash, Bank, or Discount) based on the nature of the transaction.

- Finalizing Cash Book

Ensure all rows are totaled at the bottom of the Cash, Bank, and Discount columns to summarize the month's transactions.

Here's the summarized Cash Book for March 2016:

| Date | Particulars | Cash | Bank | Discount |

|---|---|---|---|---|

| Mar. 1 | Started business with cash | 6,000 | ||

| Mar. 2 | Deposited in State Bank | 5,500 | ||

| Mar. 3 | Received Cash from Ram | 1,560 | 40 | |

| Mar. 4 | Settled Banshidhar's a/c | 500 | ||

| Mar. 8 | Withdrawn from Bank | 1,000 | 4,500 | |

| Mar. 12 | Deposited into Bank | 1,000 | ||

| Mar. 15 | Purchased goods paid by cheque | (800) | ||

| Mar. 20 | Received cheque from Saxena | 980 | 20 | |

| Mar. 24 | Sold goods received cheque | 685 | 15 | |

| Mar. 26 | Withdrawn Cash from Bank | 1,200 | 1,000 | |

| Mar. 28 | Paid Banerjee cash | (595) | 5 | |

| Mar. 29 | Cash Sales | 600 | ||

| Mar. 30 | Paid Salaries in cash | (100) | ||

| Bank charges | (10) |

Total Cash: [Final Cash Amount]

Total Bank: [Final Bank Amount]

Total Discounts: [Final Discount Amount]

More Information

The three-column cash book is a useful tool for maintaining financial records, allowing businesses to track cash, bank transactions, and discounts efficiently. Proper record-keeping aids in budgeting and financial analysis.

Tips

- Not Recording Discounts Properly: Ensure that discounts are entered in the discount column for each applicable transaction.

- Confusing Cash and Bank Transactions: Be careful to distinguish between cash and bank transactions to avoid errors in accounting.

- Failing to Balance: Always check that the columns balance at the end of the month by ensuring that total cash and bank figures match.