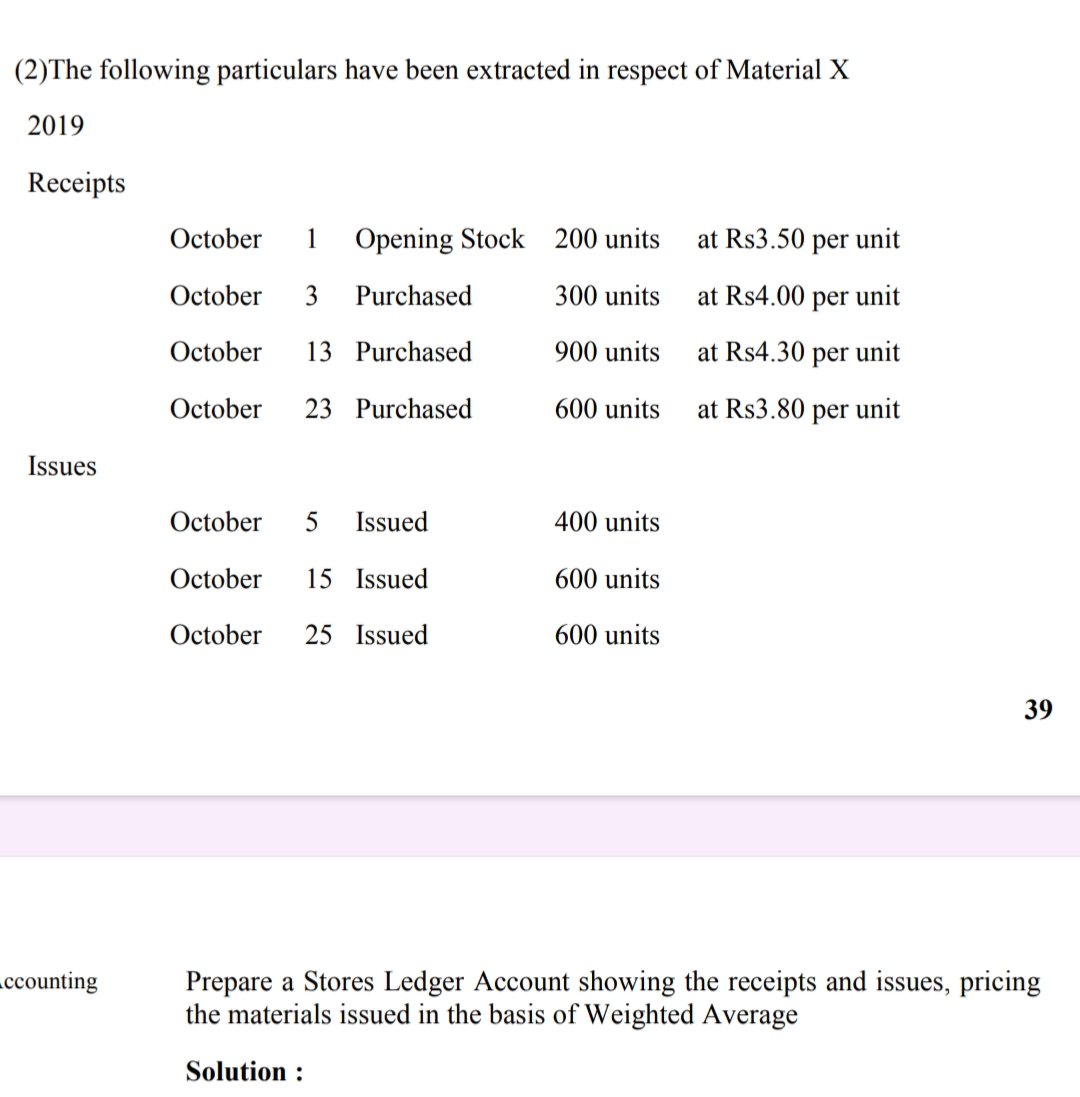

Prepare a Stores Ledger Account showing the receipts and issues, pricing the materials issued on the basis of Weighted Average.

Understand the Problem

The question is asking to prepare a Stores Ledger Account based on the provided receipts and issues of Material X, using the Weighted Average method for pricing.

Answer

Remaining Stock: 400 units at Rs. 4.025 per unit.

Answer for screen readers

The Stores Ledger Account shows:

Remaining Stock: 400 units at Weighted Average Cost Rs. 4.025.

Steps to Solve

-

Calculate Total Units and Value for Each Receipt

We begin by calculating the total units received and their respective total values:

-

Opening Stock:

- Units: 200

- Value: $200 \times 3.50 = 700$

-

Purchase on October 3:

- Units: 300

- Value: $300 \times 4.00 = 1200$

-

Purchase on October 13:

- Units: 900

- Value: $900 \times 4.30 = 3870$

-

Purchase on October 23:

- Units: 600

- Value: $600 \times 3.80 = 2280$

The total units received = $200 + 300 + 900 + 600 = 2000$ units

The total value received = $700 + 1200 + 3870 + 2280 = 8050$.

-

-

Calculate Weighted Average Cost per Unit

The weighted average cost per unit is calculated using the total value divided by the total units:

$$ \text{Weighted Average Cost} = \frac{\text{Total Value}}{\text{Total Units}} = \frac{8050}{2000} = 4.025 $$

-

Record Issues and Calculate Cost for Each Issue

We need to apply the weighted average cost to the issued units:

-

October 5: Issued 400 units

- Cost: $400 \times 4.025 = 1610$

-

October 15: Issued 600 units

- Cost: $600 \times 4.025 = 2415$

-

October 25: Issued 600 units

- Cost: $600 \times 4.025 = 2415$

-

-

Prepare the Stores Ledger Account

We will summarize the receipts and issues in the ledger format:

Stores Ledger Account Date | Description | Units | Price/unit | Total Value ---------------------------------------------------------- 01/10 | Opening Stock | 200 | 3.50 | 700 03/10 | Purchase | 300 | 4.00 | 1200 13/10 | Purchase | 900 | 4.30 | 3870 23/10 | Purchase | 600 | 3.80 | 2280 ---------------------------------------------------------- Total | | 2000 | | 8050 ---------------------------------------------------------- 05/10 | Issued | 400 | 4.025 | 1610 15/10 | Issued | 600 | 4.025 | 2415 25/10 | Issued | 600 | 4.025 | 2415 ---------------------------------------------------------- Total | | 1600 | | 5440 -

Calculate Remaining Stock and Value

Remaining units will be calculated as total received minus total issued:

$$ \text{Remaining Units} = 2000 - 1600 = 400 $$

The remaining value is calculated as:

$$ \text{Remaining Value} = \text{Remaining Units} \times \text{Weighted Average Cost} = 400 \times 4.025 = 1610 $$

The Stores Ledger Account shows:

Remaining Stock: 400 units at Weighted Average Cost Rs. 4.025.

More Information

The Weighted Average method spreads the cost of material over the total units available, providing a consistent pricing strategy.

Tips

- Forgetting to update the weighted average after each issue: Ensure to keep the weighted average constant when multiple issues occur without further receipts.

- Incorrect total calculation of stocks and values: Double-check arithmetic operations for accuracy.

AI-generated content may contain errors. Please verify critical information