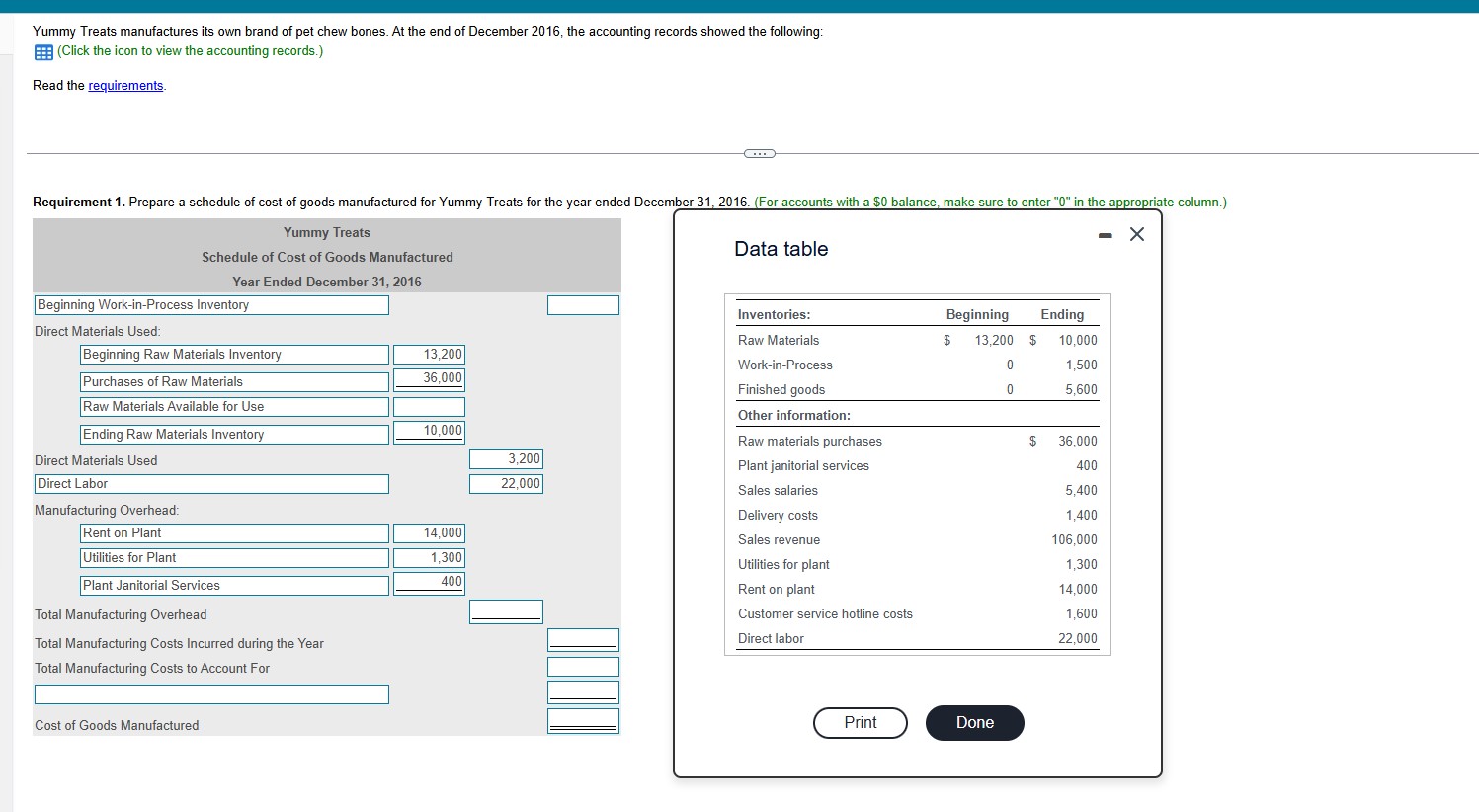

Prepare a schedule of cost of goods manufactured for Yummy Treats for the year ended December 31, 2016.

Understand the Problem

The question asks for the preparation of a schedule of cost of goods manufactured for Yummy Treats for the year ended December 31, 2016. This involves calculating various components such as beginning inventory, direct materials used, direct labor, and total manufacturing overhead based on the provided data.

Answer

The cost of goods manufactured is $75,400$.

Answer for screen readers

The cost of goods manufactured for Yummy Treats for the year ended December 31, 2016 is:

$$ 75,400 $$

Steps to Solve

- Calculate Raw Materials Used

To find the total raw materials used during the year, we use the formula:

[ \text{Direct Materials Used} = \text{Beginning Raw Materials} + \text{Purchases Raw Materials} - \text{Ending Raw Materials} ]

Substituting the values:

[ \text{Direct Materials Used} = 13,200 + 36,000 - 10,000 = 39,200 ]

- Total Direct Manufacturing Costs

Now we calculate the total direct manufacturing costs. This includes direct materials used, direct labor, and manufacturing overhead.

[ \text{Total Direct Manufacturing Costs} = \text{Direct Materials Used} + \text{Direct Labor} + \text{Total Manufacturing Overhead} ]

- Calculate Total Manufacturing Overhead

First, we find the total manufacturing overhead:

[ \text{Total Manufacturing Overhead} = \text{Rent on Plant} + \text{Utilities for Plant} + \text{Plant Janitorial Services} ]

Substituting in values:

[ \text{Total Manufacturing Overhead} = 14,000 + 1,300 + 400 = 15,700 ]

- Final Calculation of Total Manufacturing Costs

Now substitute values in the total direct manufacturing costs formula:

[ \text{Total Direct Manufacturing Costs} = 39,200 + 22,000 + 15,700 = 76,900 ]

- Calculate Cost of Goods Manufactured

Finally, to find the cost of goods manufactured, we need to add the beginning work-in-process inventory and subtract the ending work-in-process inventory:

[ \text{Cost of Goods Manufactured} = \text{Beginning Work-in-Process Inventory} + \text{Total Direct Manufacturing Costs} - \text{Ending Work-in-Process Inventory} ]

Assuming the beginning work-in-process is 0:

[ \text{Cost of Goods Manufactured} = 0 + 76,900 - 1,500 = 75,400 ]

The cost of goods manufactured for Yummy Treats for the year ended December 31, 2016 is:

$$ 75,400 $$

More Information

The cost of goods manufactured is a crucial metric in manufacturing accounting as it indicates the total cost incurred to produce goods during a specific period. This figure plays a vital role in evaluating both profitability and efficiency.

Tips

- Neglecting to include all costs: Make sure to include all components of manufacturing overhead.

- Errors in subtraction: Double-check that you accurately subtract ending inventories from totals.

AI-generated content may contain errors. Please verify critical information