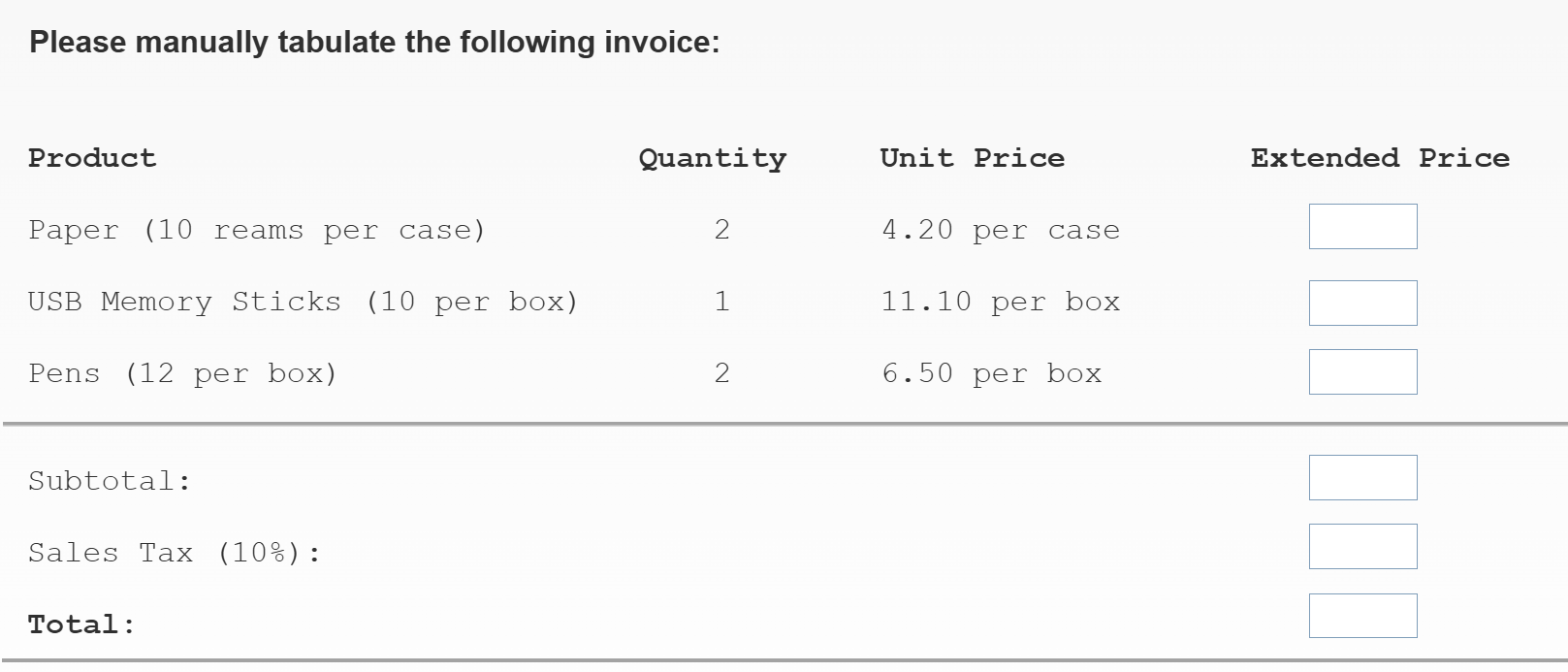

Please manually tabulate the following invoice: 1. Paper (10 reams per case): Quantity 2, Unit Price 4.20 per case. 2. USB Memory Sticks (10 per box): Quantity 1, Unit Price 11.10... Please manually tabulate the following invoice: 1. Paper (10 reams per case): Quantity 2, Unit Price 4.20 per case. 2. USB Memory Sticks (10 per box): Quantity 1, Unit Price 11.10 per box. 3. Pens (12 per box): Quantity 2, Unit Price 6.50 per box. Calculate the subtotal, sales tax (10%), and total.

Understand the Problem

The question is asking for a manual calculation of an invoice based on the provided products, their quantities, unit prices, and how to determine the subtotal, sales tax, and total amounts.

Answer

The total amount of the invoice is $35.75.

Answer for screen readers

-

Extended Price for Paper: $8.40

-

Extended Price for USB Memory Sticks: $11.10

-

Extended Price for Pens: $13.00

-

Subtotal: $32.50

-

Sales Tax (10%): $3.25

-

Total: $35.75

Steps to Solve

- Calculate Extended Price for Each Product

Multiply the quantity by the unit price for each product to find the extended price.

-

For Paper: $$ \text{Extended Price}_{\text{Paper}} = 2 \text{ (cases)} \times 4.20 \text{ (per case)} = 8.40 $$

-

For USB Memory Sticks: $$ \text{Extended Price}_{\text{USB}} = 1 \text{ (box)} \times 11.10 \text{ (per box)} = 11.10 $$

-

For Pens: $$ \text{Extended Price}_{\text{Pens}} = 2 \text{ (boxes)} \times 6.50 \text{ (per box)} = 13.00 $$

- Calculate Subtotal

Add all the extended prices to calculate the subtotal.

$$ \text{Subtotal} = 8.40 + 11.10 + 13.00 = 32.50 $$

- Calculate Sales Tax

Multiply the subtotal by the sales tax rate (10%).

$$ \text{Sales Tax} = 0.10 \times 32.50 = 3.25 $$

- Calculate Total Amount

Add the subtotal and the sales tax to find the total amount.

$$ \text{Total} = 32.50 + 3.25 = 35.75 $$

-

Extended Price for Paper: $8.40

-

Extended Price for USB Memory Sticks: $11.10

-

Extended Price for Pens: $13.00

-

Subtotal: $32.50

-

Sales Tax (10%): $3.25

-

Total: $35.75

More Information

The invoice showcases a breakdown of costs for different items purchased. This method gives clarity to the buyer on each product's cost, taxes applied, and the overall amount due. Understanding invoices is crucial for budgeting and financial management.

Tips

- Forgetting to multiply correctly for the extended price.

- Not adding up the extended prices correctly to compute the subtotal.

- Miscalculating the sales tax by using the wrong subtotal.

- Not properly adding the sales tax to the subtotal to find the total amount.

AI-generated content may contain errors. Please verify critical information