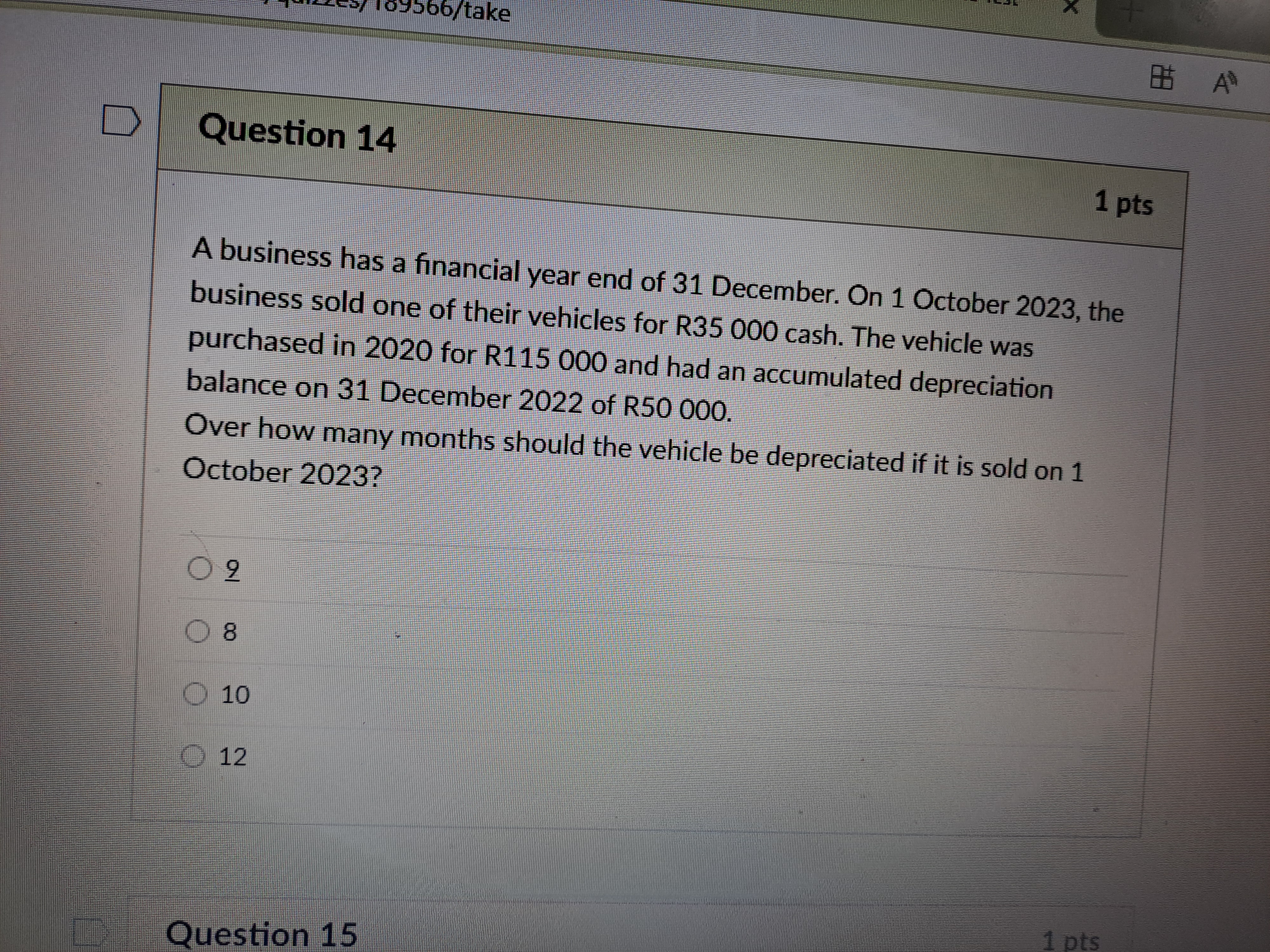

Over how many months should the vehicle be depreciated if it is sold on 1 October 2023?

Understand the Problem

The question is asking for the number of months over which the vehicle should be depreciated if sold on 1 October 2023, considering its purchase date and depreciation guidelines.

Answer

The vehicle should be depreciated over $12$ months.

Answer for screen readers

The vehicle should be depreciated over $12$ months.

Steps to Solve

-

Identify the date of vehicle sale

The vehicle is sold on 1 October 2023. -

Determine the financial year end

The business's financial year ends on 31 December each year. -

Calculate the time from last financial year end to sale date

From 31 December 2022 to 31 December 2023 is 12 months.

From 31 December 2022 to 1 October 2023 is:

- January to September = 9 months

-

Count the remaining months in the current financial year

The time frame from 1 October 2023 until the next financial year end (31 December 2023) is 3 months (October, November, December). -

Total depreciation period

Add the months from the last financial year end (9 months) to the months remaining in the current financial year (3 months):

$$ 9 + 3 = 12 \text{ months} $$

The vehicle should be depreciated over $12$ months.

More Information

The vehicle was considered for depreciation from the end of the last financial year (31 December 2022) to when it was sold on 1 October 2023, which includes the remainder of 2023.

Tips

- Confusing the financial year end with the sale date.

- Forgetting to count full months properly or not considering the months after the last financial year end.

AI-generated content may contain errors. Please verify critical information