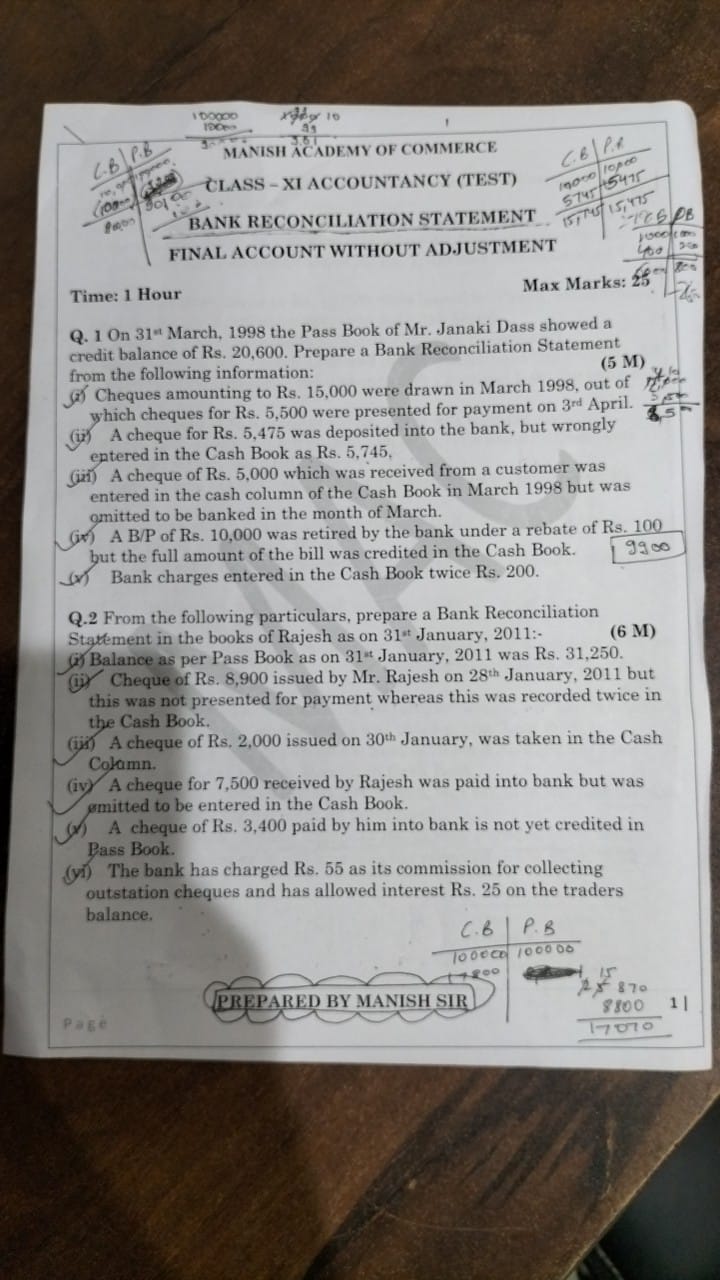

On 31st March, 1998 the Pass Book of Mr. Janaki Dass showed a credit balance of Rs. 20,600. Prepare a Bank Reconciliation Statement from the following information: Cheques amountin... On 31st March, 1998 the Pass Book of Mr. Janaki Dass showed a credit balance of Rs. 20,600. Prepare a Bank Reconciliation Statement from the following information: Cheques amounting to Rs. 15,000 were drawn in March 1998, out of which cheques for Rs. 5,500 were presented for payment on 3rd April. A cheque for Rs. 5,475 was deposited into the bank, but wrongly entered in the Cash Book as Rs. 5,745. A cheque of Rs. 5,000 received from a customer was entered in the cash column of the Cash Book in March 1998 but was omitted to be banked in the month of March. A B/P of Rs. 10,000 was retired by the bank under a rebate of Rs. 100 but the full amount of the bill was credited in the Cash Book. Bank charges entered in the Cash Book twice Rs. 200. From the following particulars, prepare a Bank Reconciliation Statement in the books of Rajesh as on 31st January, 2011: Balance as per Pass Book as on 31st January, 2011 was Rs. 31,250. A cheque of Rs. 8,900 issued by Mr. Rajesh on 28th January, 2011 but was not presented for payment whereas this was recorded twice in the Cash Book. A cheque of Rs. 2,000 issued on 30th January, was taken in the Cash Column. A cheque for 7,500 received by Rajesh was paid into bank but was omitted to be entered in the Cash Book. A cheque of Rs. 3,400 paid by him into bank is not yet credited in Pass Book. The bank has charged Rs. 55 as its commission for collecting outstation cheques and has allowed interest Rs. 25 on the traders balance.

Understand the Problem

The question is asking to prepare a Bank Reconciliation Statement based on the transactions listed for Mr. Janaki Dass and Mr. Rajesh for specified dates. The solution involves analyzing the discrepancies between the pass book and cash book balances, incorporating various transactions that affect the accounts.

Answer

The final adjusted balance is Rs. 16,370.

Answer for screen readers

The final adjusted balance for Mr. Janaki Dass as of 31st March 1998 is Rs. 16,370.

Steps to Solve

-

Identify Initial Balances

Start with the given bank balance for Mr. Janaki Dass on 31st March 1998, which is Rs. 20,600. -

Adjust for Cheques Drawn

Cheques amounting to Rs. 15,000 were drawn, but only Rs. 5,500 were presented for payment. Calculate the adjustment:- Rs. 15,000 (cheques drawn) - Rs. 5,500 (cheques presented)

- This leaves Rs. 9,500 unaccounted in the Cash Book.

-

Adjust for Cheque Deposited Incorrectly

A cheque for Rs. 5,475 was deposited but recorded incorrectly in the Cash Book as Rs. 5,745. The adjustment is:- Incorrectly recorded amount: Rs. 5,745

- Actual deposit: Rs. 5,475

- Adjusted difference: Rs. 5,745 - Rs. 5,475 = Rs. 270

-

Adjust for Customer Cheque

Include the cheque of Rs. 5,000 received from a customer that was not banked. This will increase the balance:- Add Rs. 5,000.

-

Adjust for B/P Adjustment

The Bill for Payment (B/P) of Rs. 10,000 was retired, but only Rs. 9,900 was credited. The adjustment:- Add Rs. 100 (as Rs. 10,000 was credited).

-

Adjust for Bank Charges

Subtract the bank charges entered twice at Rs. 200:- Deduct Rs. 200.

-

Calculate Final Bank Reconciliation Statement

Combine all adjustments to find the final balance:- Start with Rs. 20,600

- Subtract Rs. 9,500 for unpaid cheques.

- Add Rs. 5,000 from the customer cheque.

- Deduct Rs. 200 for bank charges.

- Adjust for the discrepancy from cheque deposit (add Rs. 270).

Perform the calculations step by step.

-

Summarize Adjustments

Summarize the final balance after applying all adjustments.

The final adjusted balance for Mr. Janaki Dass as of 31st March 1998 is Rs. 16,370.

More Information

The Bank Reconciliation Statement helps in identifying discrepancies between two financial records, ensuring that both account balances are consistent. Regular reconciliation can help prevent fraud and manage cash flow effectively.

Tips

- Failing to account for all transactions can lead to an inaccurate final balance.

- Misrecording amounts (such as mixing up debits and credits) may cause discrepancies.

- Not double-checking entries in both the pass book and cash book.

AI-generated content may contain errors. Please verify critical information