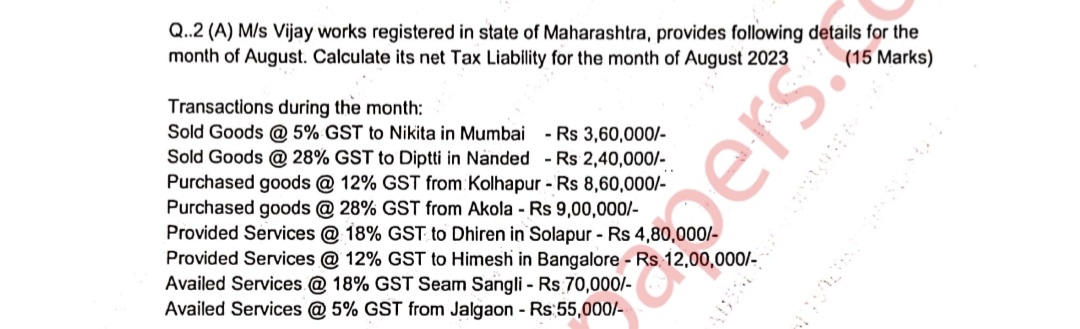

M/s Vijay works registered in the state of Maharashtra provides following details for the month of August. Calculate its net Tax Liability for the month of August 2023 based on the... M/s Vijay works registered in the state of Maharashtra provides following details for the month of August. Calculate its net Tax Liability for the month of August 2023 based on the transactions.

Understand the Problem

The question is asking to calculate the net tax liability for M/s Vijay for the month of August 2023, based on various transactions involving sales and purchases with different GST rates.

Answer

The net tax liability is $-54,950$.

Answer for screen readers

The net tax liability for M/s Vijay for August 2023 is $-54,950$, indicating a GST credit balance.

Steps to Solve

- Calculate Total Output GST Determine the GST collected from sales and services.

-

Sales at 5% GST: $$ 3,60,000 \times 0.05 = 18,000 $$

-

Sales at 28% GST: $$ 2,40,000 \times 0.28 = 67,200 $$

-

Services at 18% GST: $$ 4,80,000 \times 0.18 = 86,400 $$

-

Services at 12% GST: $$ 12,00,000 \times 0.12 = 1,44,000 $$

Total Output GST: $$ 18,000 + 67,200 + 86,400 + 1,44,000 = 3,15,600 $$

- Calculate Total Input GST Determine the GST paid on purchases and services availed.

-

Purchases at 12% GST: $$ 8,60,000 \times 0.12 = 1,03,200 $$

-

Purchases at 28% GST: $$ 9,00,000 \times 0.28 = 2,52,000 $$

-

Services at 18% GST: $$ 70,000 \times 0.18 = 12,600 $$

-

Services at 5% GST: $$ 55,000 \times 0.05 = 2,750 $$

Total Input GST: $$ 1,03,200 + 2,52,000 + 12,600 + 2,750 = 3,70,550 $$

- Calculate Net Tax Liability Find the net tax liability by subtracting total input GST from total output GST.

$$ \text{Net Tax Liability} = 3,15,600 - 3,70,550 $$

- Final Calculation Calculate the final figure:

$$ \text{Net Tax Liability} = -54,950 $$

Since the result is negative, it indicates that M/s Vijay has a credit balance of GST.

The net tax liability for M/s Vijay for August 2023 is $-54,950$, indicating a GST credit balance.

More Information

The negative net tax liability means that M/s Vijay paid more GST on purchases than collected on sales. This excess can often be carried forward to future periods to offset against GST liabilities.

Tips

- Forgetting to calculate the GST for all items sold or purchased.

- Not applying the correct GST rate for each transaction type.

- Confusing output GST (collected) with input GST (paid), leading to incorrect liability calculation.