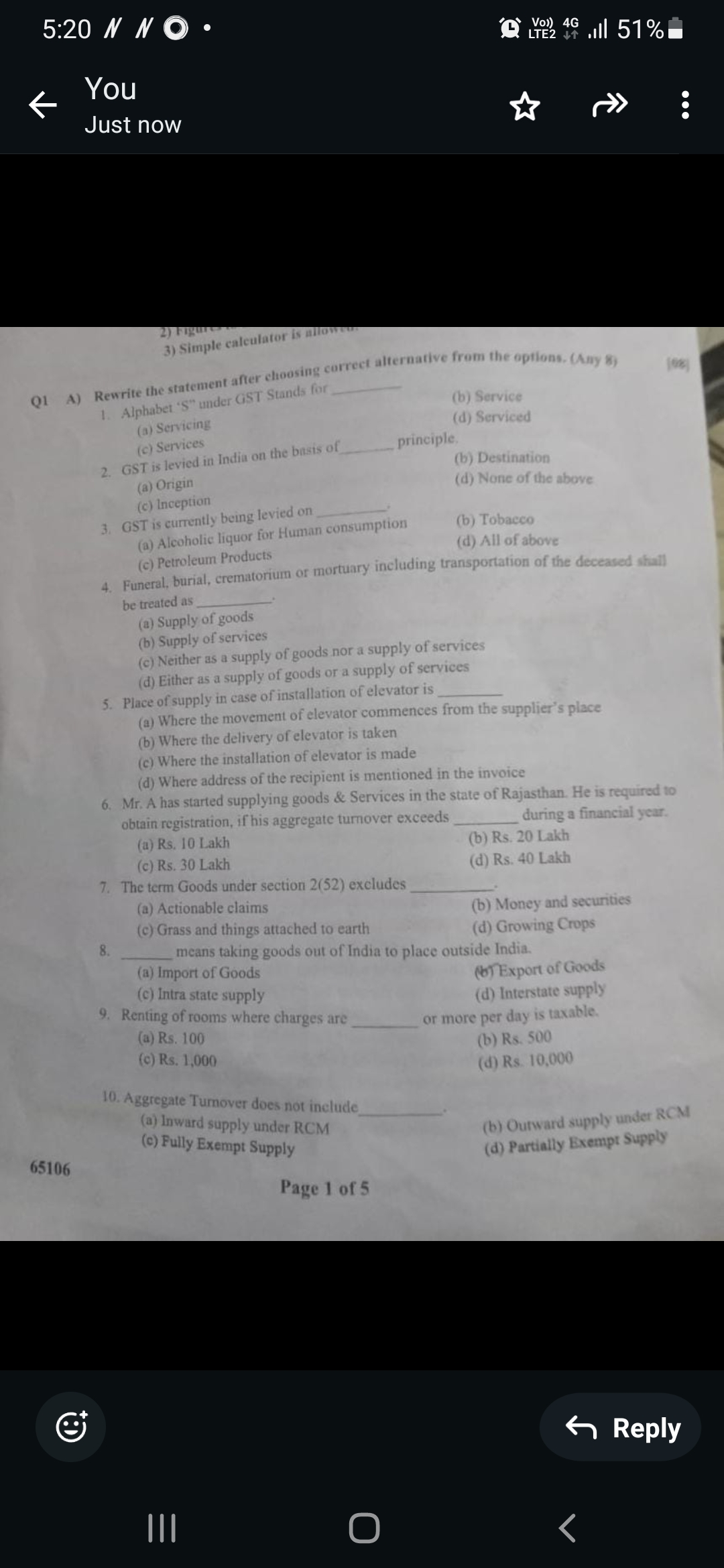

Rewrite the statement after choosing correct alternative from the options. (Any 8)

Understand the Problem

The question consists of multiple statements related to Goods and Services Tax (GST) in India, where the task is to choose the correct alternatives from the given options. It covers various aspects of GST, including definitions, principles, and regulations. The aim is to assess knowledge about GST regulations and their applications.

Answer

1. Service 2. Destination 3. All of the above 4. Neither a supply of goods nor a supply of services 5. Installation 6. Rs. 20 Lakh 7. Money and securities 8. Export of Goods 9. Rs. 1,000 10. Fully Exempt Supply

- Alphabet "S" under GST Stands for Service. 2. GST is levied in India on the basis of Destination principle. 3. GST is currently being levied on All of the above. 4. Funeral, burial, crematorium or mortuary including transportation of the deceased shall be treated as Neither a supply of goods nor a supply of services. 5. Place of supply in case of elevator commences from Where the installation of elevator is made. 6. Mr. A is required to obtain registration if his aggregate turnover exceeds Rs. 20 Lakh. 7. The term Goods under section 2(52) excludes Money and securities. 8. Export of Goods means taking goods out of India to place outside India. 9. Renting of rooms where charges are Rs. 1,000 or more per day is taxable. 10. Aggregate Turnover does not include Fully Exempt Supply.

Answer for screen readers

- Alphabet "S" under GST Stands for Service. 2. GST is levied in India on the basis of Destination principle. 3. GST is currently being levied on All of the above. 4. Funeral, burial, crematorium or mortuary including transportation of the deceased shall be treated as Neither a supply of goods nor a supply of services. 5. Place of supply in case of elevator commences from Where the installation of elevator is made. 6. Mr. A is required to obtain registration if his aggregate turnover exceeds Rs. 20 Lakh. 7. The term Goods under section 2(52) excludes Money and securities. 8. Export of Goods means taking goods out of India to place outside India. 9. Renting of rooms where charges are Rs. 1,000 or more per day is taxable. 10. Aggregate Turnover does not include Fully Exempt Supply.

More Information

These answers reflect the options typically associated with GST regulations in India.

Tips

Ensure to pick the option that most accurately reflects GST provisions as they apply in India.

AI-generated content may contain errors. Please verify critical information