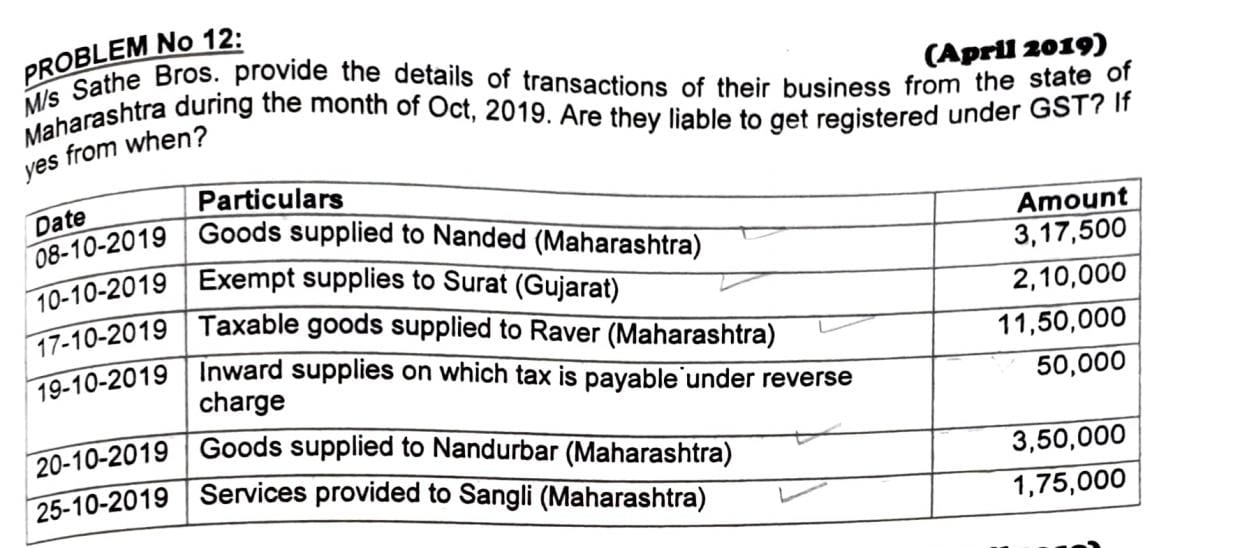

M/s Sathe Bros. provide the details of transactions of their business from the state of Maharashtra during the month of October 2019. Are they liable to get registered under GST? I... M/s Sathe Bros. provide the details of transactions of their business from the state of Maharashtra during the month of October 2019. Are they liable to get registered under GST? If yes, from when?

Understand the Problem

The question is asking whether the transactions listed for M/s Sathe Bros. during October 2019 make them liable to register under GST, and if so, from when they should register. This involves analyzing the transaction details provided.

Answer

Liable for GST registration in October 2019 as turnover exceeds INR 20 lakhs.

M/s Sathe Bros. is liable to register under GST as their taxable turnover is INR 19,92,500 which exceeds the threshold of INR 20 lakh for goods. They should register from October 2019.

Answer for screen readers

M/s Sathe Bros. is liable to register under GST as their taxable turnover is INR 19,92,500 which exceeds the threshold of INR 20 lakh for goods. They should register from October 2019.

More Information

In Maharashtra, GST registration is required if turnover exceeds INR 40 lakhs for goods, effective from July 2019. This threshold was surpassed by M/s Sathe Bros. in October 2019.

Tips

Ensure to differentiate between exempt and taxable supplies when calculating turnover.

AI-generated content may contain errors. Please verify critical information