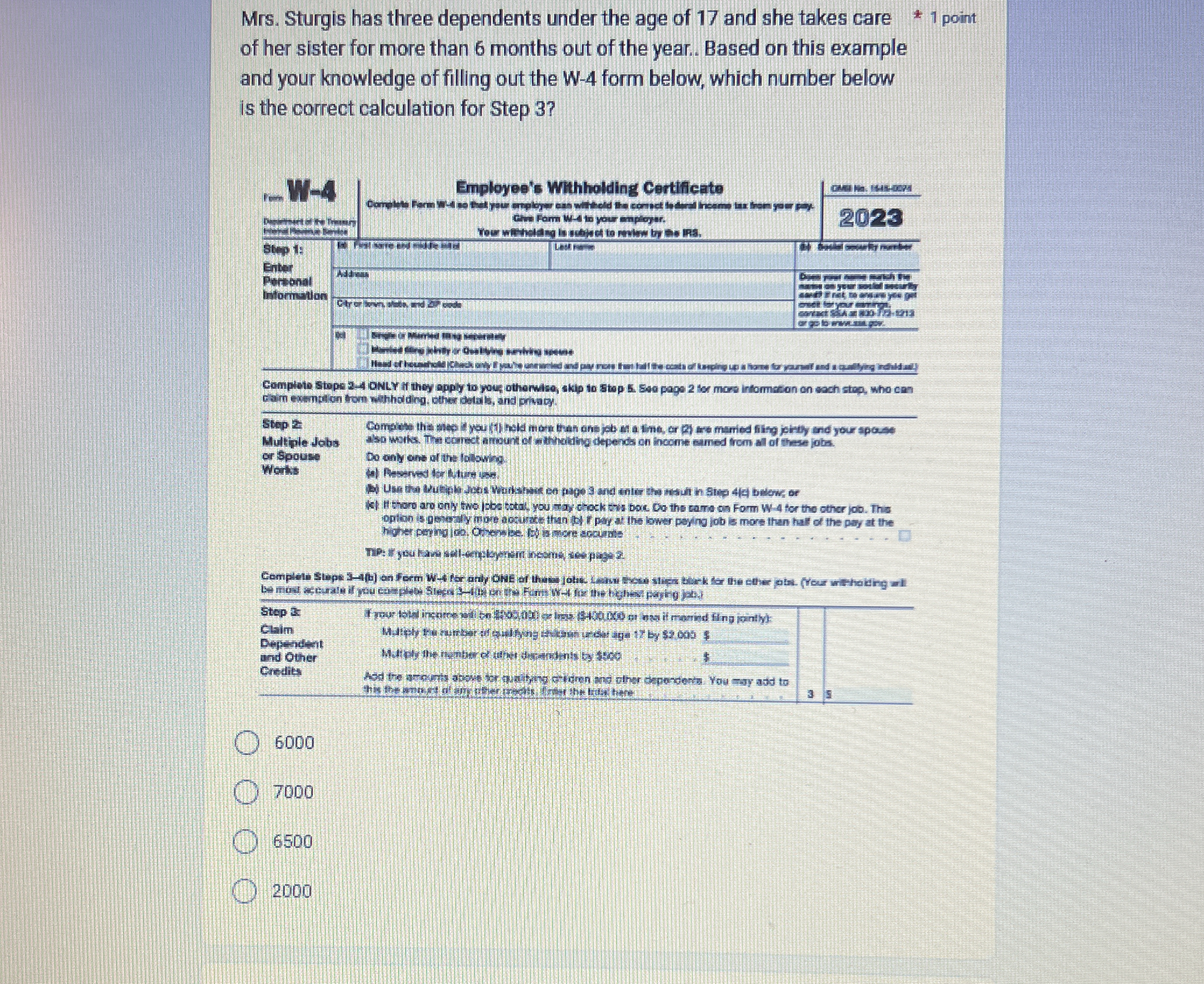

Mrs. Sturgis has three dependents under the age of 17 and she takes care of her sister for more than 6 months out of the year. Based on this example and your knowledge of filling o... Mrs. Sturgis has three dependents under the age of 17 and she takes care of her sister for more than 6 months out of the year. Based on this example and your knowledge of filling out the W-4 form, which number below is the correct calculation for Step 3?

Understand the Problem

The question is asking for the correct calculation for Step 3 of the W-4 form based on the provided scenario of Mrs. Sturgis and her dependents. It requires knowledge of how to fill out the W-4 form, specifically concerning the number of dependents and any applicable credits.

Answer

6000

The correct calculation for Step 3 is $6,000.

Answer for screen readers

The correct calculation for Step 3 is $6,000.

More Information

The W-4 form calculation for dependents under age 17 involves multiplying each child by $2,000. Mrs. Sturgis qualifies with three dependents.

Tips

A common mistake is including dependents over age 17 in the Step 3 calculation. Ensure to count only children under 17.

Sources

- Form W-4 - 2024 - IRS - irs.gov

AI-generated content may contain errors. Please verify critical information