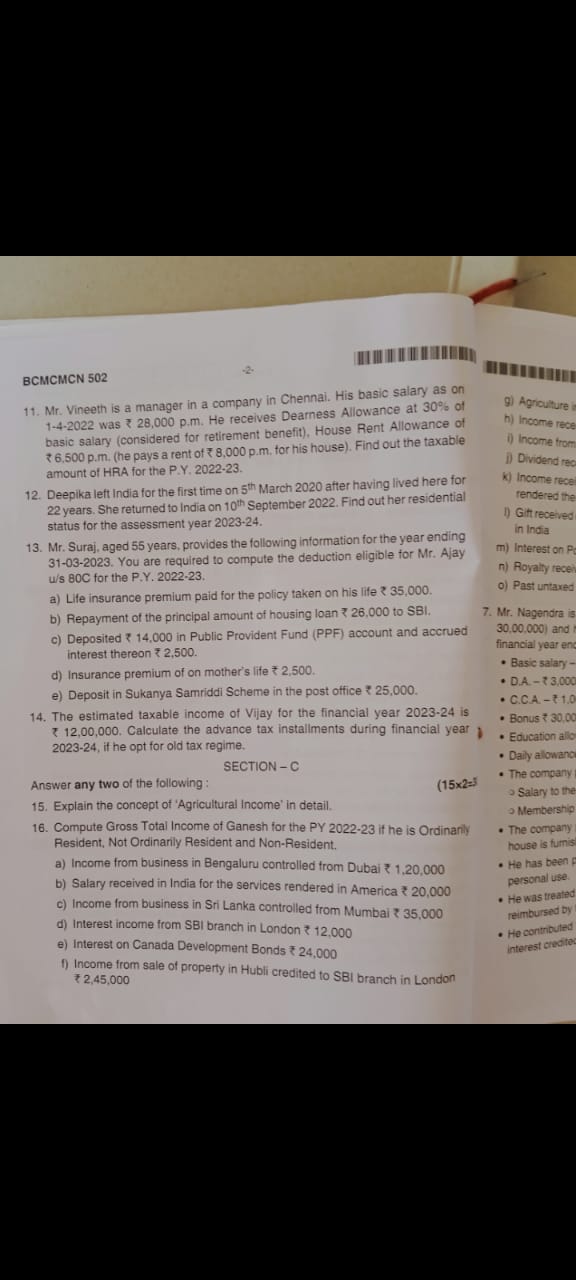

Mr. Vineeth is a manager in a company in Chennai. His basic salary as on 1-4-2022 was ₹ 28,000 p.m. He receives Dearness Allowance at 30% of basic salary, House Rent Allowance of ₹... Mr. Vineeth is a manager in a company in Chennai. His basic salary as on 1-4-2022 was ₹ 28,000 p.m. He receives Dearness Allowance at 30% of basic salary, House Rent Allowance of ₹ 6,500 p.m. (he pays a rent of ₹ 8,000 p.m. for his house). Find out the taxable amount of HRA for the P.Y. 2022-23. Deepika left India for the first time on 5th March 2020 after having lived here for 22 years. She returned to India on 10th September 2022. Find out her residential status for the assessment year 2023-24. Compute the deduction eligible for Mr. Ajay u/s 80C for the P.Y. 2022-23: a) Life insurance premium paid for the policy taken on his life ₹ 35,000, b) Repayment of the principal amount of housing loan ₹ 26,000 to SBI, c) Deposited ₹ 14,000 in Public Provident Fund (PPF) account and accrued interest thereon ₹ 2,500, d) Insurance premium on mother's life ₹ 2,500, e) Deposit in Sukanya Samriddhi Scheme in the post office ₹ 25,000.

Understand the Problem

The questions are related to income tax calculations and deductions for individuals based on their financial details for the specific assessment years. The problem includes identifying residential status and computing taxable amounts based on given scenarios.

Answer

Taxable HRA: ₹ 25,680; Deepika's status: Resident; Eligible 80C deduction: ₹ 102,500.

Answer for screen readers

- Taxable HRA for Mr. Vineeth: ₹ 25,680

- Deepika's residential status for AY 2023-24: Resident

- Eligible deduction for Mr. Ajay u/s 80C: ₹ 102,500

Steps to Solve

-

Calculate Basic Salary and DA Mr. Vineeth's basic salary is ₹ 28,000 per month. Total salary for the year (12 months) = ( 28,000 \times 12 = ₹ 336,000 )

The Dearness Allowance (DA) is 30% of the basic salary. $$ DA = 0.30 \times 28,000 = ₹ 8,400 \text{ per month} $$ Annual DA = ( 8,400 \times 12 = ₹ 100,800 )

-

Calculate Total Salary Total salary (basic + DA) for the year: $$ Total Salary = ₹ 336,000 + ₹ 100,800 = ₹ 436,800 $$

-

Determine HRA Details HRA received = ₹ 6,500 per month Annual HRA = ( 6,500 \times 12 = ₹ 78,000 )

-

Calculate Rent Paid Annual rent paid = ₹ 8,000 per month Annual rent = ( 8,000 \times 12 = ₹ 96,000 )

-

Calculate Eligible HRA Exemption The exemption for HRA is the least of the following:

- Actual HRA received: ₹ 78,000

- Rent paid in excess of 10% of salary:

- 10% of annual salary (Basic + DA) = 10% of ₹ 436,800 = ₹ 43,680

- Excess rent = ( 96,000 - 43,680 = ₹ 52,320 )

- 50% of salary if residing in Chennai:

- ( \frac{50}{100} \times 436,800 = ₹ 218,400 )

Exemption = minimum of ₹ 78,000, ₹ 52,320, and ₹ 218,400 is ₹ 52,320.

-

Calculate Taxable HRA Taxable HRA = Total HRA received - Exempt HRA $$ Taxable HRA = ₹ 78,000 - ₹ 52,320 = ₹ 25,680 $$

-

Determine Residential Status of Deepika

- Stayed in India for 22 years before leaving on 5th March 2020.

- Returned on 10th September 2022.

- To establish residential status in 2023-24 assessment year:

- Look at the last 10 years: She was present for more than 730 days in India in the last 7 years (need at least 730 days).

- In 2022-23, she was in India at least 60 days (from Sept 10 to March 31).

Thus, Deepika qualifies as a Resident in India for AY 2023-24.

-

Compute Eligible Deductions under Section 80C for Mr. Ajay Add the contributions:

- Life insurance: ₹ 35,000

- Housing loan repayment: ₹ 26,000

- PPF deposit: ₹ 14,000

- Mother's life insurance premium: ₹ 2,500

- Sukanya Samriddhi deposit: ₹ 25,000

Total Deduction: $$ Total Deduction = 35,000 + 26,000 + 14,000 + 2,500 + 25,000 = ₹ 102,500 $$

The maximum deduction allowed under Section 80C is ₹ 150,000, so Mr. Ajay can claim the full ₹ 102,500.

- Taxable HRA for Mr. Vineeth: ₹ 25,680

- Deepika's residential status for AY 2023-24: Resident

- Eligible deduction for Mr. Ajay u/s 80C: ₹ 102,500

More Information

- The calculation for HRA involves comparing the actual rent paid, the HRA received, and a percentage of the total salary.

- Residential status is determined by the duration of stay in India over specified periods.

- Under Section 80C, various investments qualify for tax deductions, capped at ₹ 150,000.

Tips

- A common mistake is miscalculating the HRA exemption by not considering all three components involved.

- Errors can occur when determining residential status based on incomplete information about the number of days in India.

AI-generated content may contain errors. Please verify critical information