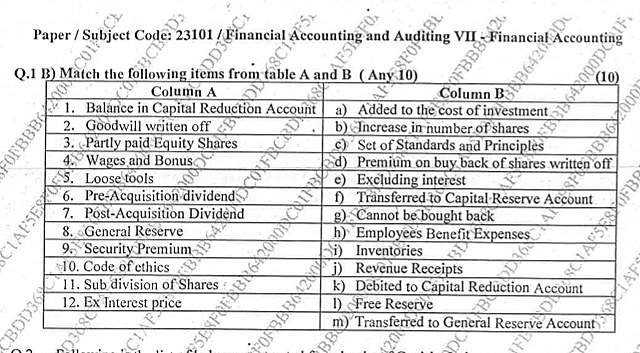

Match the following items from table A and B (Any 10)

Understand the Problem

The question requires matching items from two lists, Column A and Column B, which are related to financial accounting principles.

Answer

1: j, 2: d, 3: g, 4: h, 5: i, 6: a, 7: m, 8: k, 9: f, 10: c

Answer for screen readers

-

Balance in Capital Reduction Account - j. Debited to Capital Reduction Account

-

Goodwill written off - d. Premium on buy back of shares written off

-

Partly paid Equity Shares - g. Cannot be bought back

-

Wages and Bonus - h. Employees Benefit Expenses

-

Loose tools - i. Inventories

-

Pre-Acquisition dividend - a. Added to the cost of investment

-

Post-Acquisition Dividend - m. Transferred to General Reserve Account

-

General Reserve - k. Free Reserve

-

Security Premium - f. Transferred to Capital Reserve Account

-

Code of ethics - c. Set of Standards and Principles

Steps to Solve

- Identify Key Items in Column A

Review the first column and identify what each item represents in the context of financial accounting principles.

- Match Each Item to Column B

Go through each item in Column A and determine which definition or explanation in Column B corresponds to it.

- Provide Possible Matches

Here are proposed matches for the items from Column A to Column B:

-

- Balance in Capital Reduction Account → j. Debited to Capital Reduction Account

-

- Goodwill written off → d. Premium on buy back of shares written off

-

- Partly paid Equity Shares → g. Cannot be bought back

-

- Wages and Bonus → h. Employees Benefit Expenses

-

- Loose tools → i. Inventories

-

- Pre-Acquisition dividend → a. Added to the cost of investment

-

- Post-Acquisition Dividend → m. Transferred to General Reserve Account

-

- General Reserve → k. Free Reserve

-

- Security Premium → f. Transferred to Capital Reserve Account

-

- Code of ethics → c. Set of Standards and Principles

-

- Sub division of Shares → b. Increase in number of shares

-

- Ex Interest price → e. Excluding interest

- List Matches Clearly

Compile the identified matches in a clear format for easy reference.

-

Balance in Capital Reduction Account - j. Debited to Capital Reduction Account

-

Goodwill written off - d. Premium on buy back of shares written off

-

Partly paid Equity Shares - g. Cannot be bought back

-

Wages and Bonus - h. Employees Benefit Expenses

-

Loose tools - i. Inventories

-

Pre-Acquisition dividend - a. Added to the cost of investment

-

Post-Acquisition Dividend - m. Transferred to General Reserve Account

-

General Reserve - k. Free Reserve

-

Security Premium - f. Transferred to Capital Reserve Account

-

Code of ethics - c. Set of Standards and Principles

More Information

The matches made here reflect fundamental principles in financial accounting. Understanding these principles helps in grasping complex financial concepts and their implications in accounting practices.

Tips

- Confusing similar terms like "pre-acquisition dividend" and "post-acquisition dividend."

- Misunderstanding what constitutes an expense vs. a revenue receipt.

- Not recognizing how reserve accounts relate to capital reduction and general reserves.