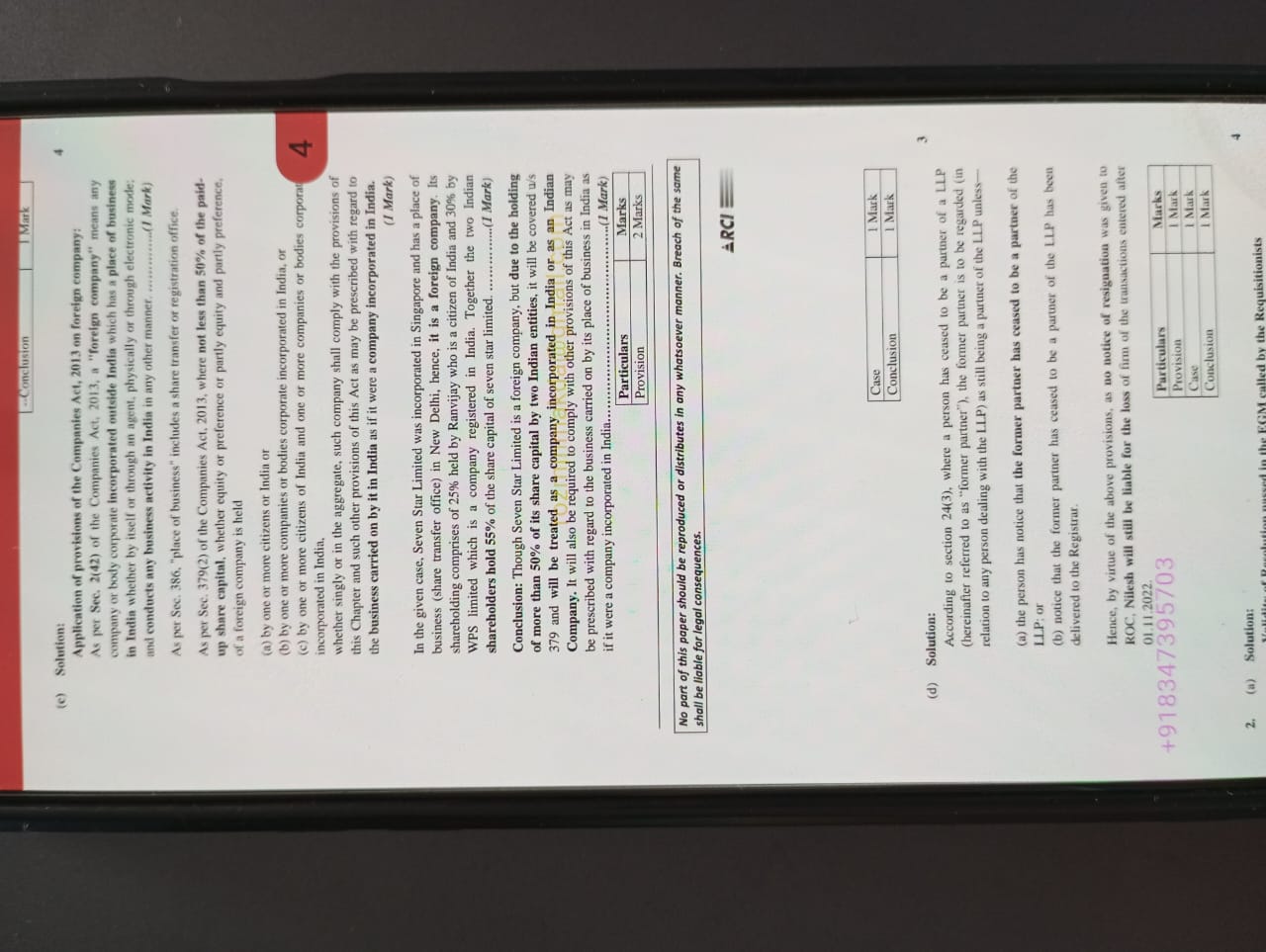

In the context of the Companies Act, 2013 in India, what provisions apply when a person ceases to be a partner of a LLP? What are the implications for registration?

Understand the Problem

The question appears to be asking about the application of certain provisions in the Companies Act relevant to a scenario involving a company incorporated in India. It discusses compliance issues and the implications of certain actions taken by company shareholders or partners in relation to registration and status within legal frameworks.

Answer

Registrar must be notified within 30 days of a partner's cessation. Former partners may notify too, affecting liability.

When a person ceases to be a partner of an LLP, the LLP is required to notify the Registrar within 30 days. The former partner can also file this notice. Failure to file may keep the former partner’s liability for obligations of the LLP until the notice is delivered to the Registrar.

Answer for screen readers

When a person ceases to be a partner of an LLP, the LLP is required to notify the Registrar within 30 days. The former partner can also file this notice. Failure to file may keep the former partner’s liability for obligations of the LLP until the notice is delivered to the Registrar.

More Information

This process ensures the LLP’s registration records remain up to date, and assists in limiting the former partner’s liability. The LLP Act provisions aim to clarify responsibilities and liabilities during transitions in partnership.

Tips

A common mistake is failing to promptly notify the Registrar, which can affect a former partner’s liability.

Sources

- Limited Liability Partnership Act, 2008 - MCA - mca.gov.in

AI-generated content may contain errors. Please verify critical information