In the case of printing of books and similar materials, how is the supply classified?

Understand the Problem

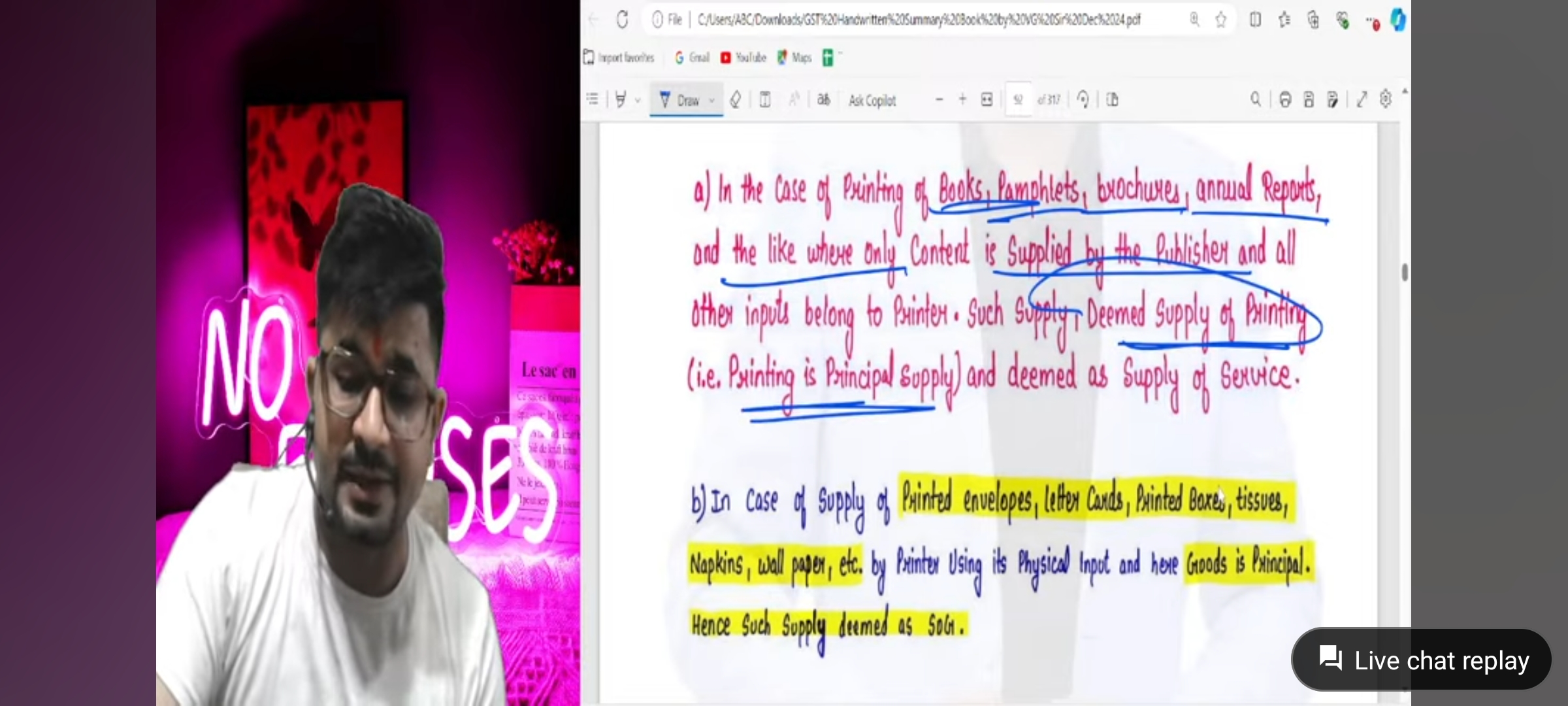

The question provides a context regarding the classification of printed materials and their supply. It discusses the distinction between principal supply (like printing) and supply of services in relation to printing items like books, pamphlets, and others. The aim seems to be understanding the tax implications or classifications in a legal or business context.

Answer

Supply of service

The supply for the printing of books and similar materials is classified as a 'supply of service' when only the content is provided by the publisher and all other inputs belong to the printer.

Answer for screen readers

The supply for the printing of books and similar materials is classified as a 'supply of service' when only the content is provided by the publisher and all other inputs belong to the printer.

More Information

In this scenario, the printing is considered the principal supply. The service aspect is emphasized because the publisher supplies only the content.

Tips

A common mistake is confusing this with the supply of goods, which applies when the materials used in the production are the principal supply.

AI-generated content may contain errors. Please verify critical information