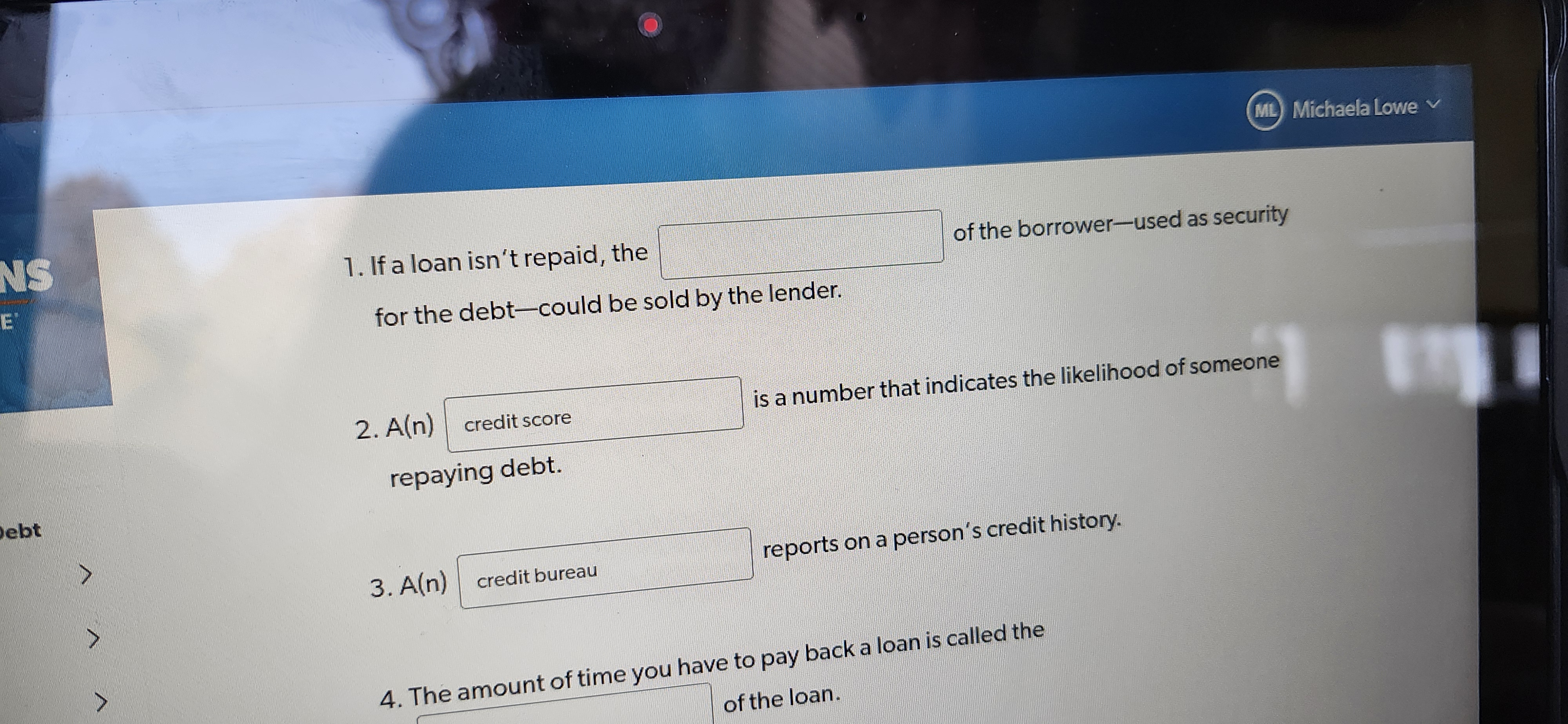

If a loan isn't repaid, the ___________ of the borrower—used as security for the debt—could be sold by the lender. A(n) ___________ is a number that indicates the likelihood of som... If a loan isn't repaid, the ___________ of the borrower—used as security for the debt—could be sold by the lender. A(n) ___________ is a number that indicates the likelihood of someone repaying debt. A(n) ___________ reports on a person's credit history. The amount of time you have to pay back a loan is called the ___________ of the loan.

Understand the Problem

The question contains fill-in-the-blank items related to loans and credit concepts. It requires understanding of financial terms such as collateral, credit score, and credit bureau.

Answer

1. collateral, 2. credit score, 3. credit bureau, 4. term.

The final answer is: 1. collateral, 2. credit score, 3. credit bureau, 4. term.

Answer for screen readers

The final answer is: 1. collateral, 2. credit score, 3. credit bureau, 4. term.

More Information

These terms are part of basic loan and credit understanding, essential for personal finance management.

Tips

It's important to not confuse 'credit score' with 'credit report' or 'credit history.'

Sources

- End of chapter 4 review .docx - Course Hero - coursehero.com

- Loan Terminology to Know | Community First Credit Union - communityfirstfl.org

AI-generated content may contain errors. Please verify critical information