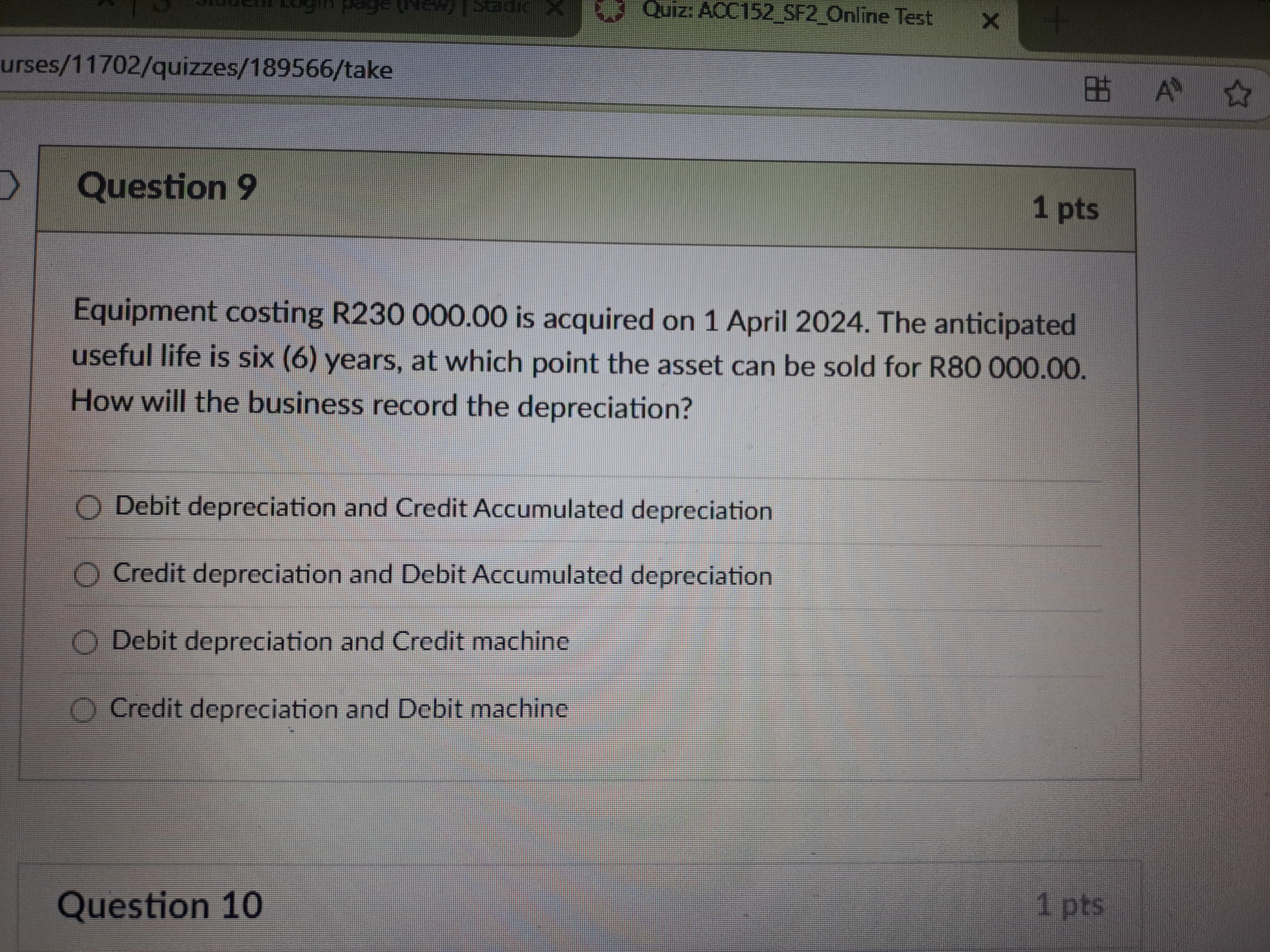

How will the business record the depreciation?

Understand the Problem

The question is asking how to record the depreciation for equipment acquired at a certain cost, useful life, and resale value. It requires knowledge of accounting principles, specifically how to record depreciation in financial statements.

Answer

Debit depreciation and Credit Accumulated depreciation.

The final answer is: Debit depreciation and Credit Accumulated depreciation.

Answer for screen readers

The final answer is: Debit depreciation and Credit Accumulated depreciation.

More Information

Depreciation is recorded as a part of financial statements, where depreciation expense is debited, reflecting a reduction in profit, and accumulated depreciation is credited, reflecting the reduction in asset value over time.

Tips

A common mistake is confusing the accounts to be debited and credited. Remember: expenses are debited and contra asset accounts like accumulated depreciation are credited.

Sources

- How to Record a Depreciation Journal Entry - The Motley Fool - fool.com

- What is the journal entry to record depreciation expense? - universalcpareview.com

AI-generated content may contain errors. Please verify critical information