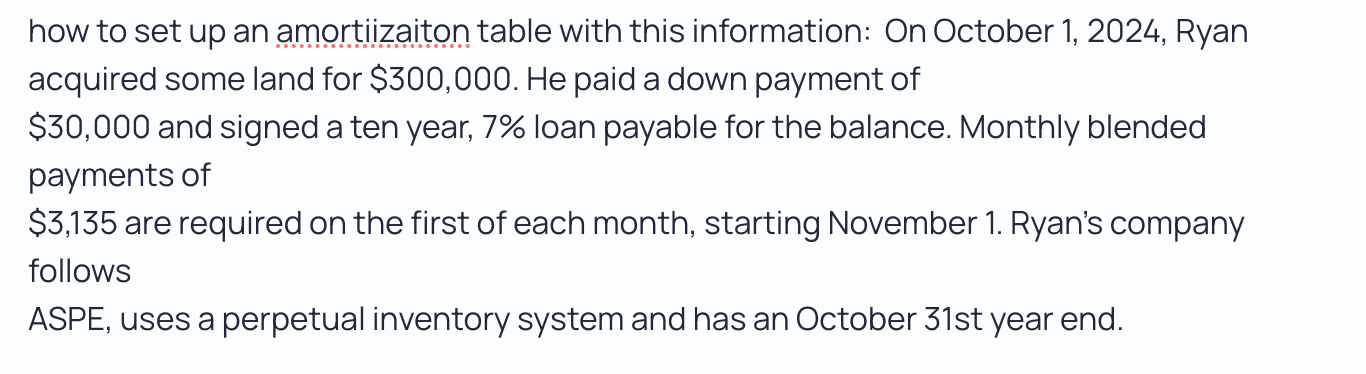

How to set up an amortization table with this information: On October 1, 2024, Ryan acquired some land for $300,000. He paid a down payment of $30,000 and signed a ten-year, 7% loa... How to set up an amortization table with this information: On October 1, 2024, Ryan acquired some land for $300,000. He paid a down payment of $30,000 and signed a ten-year, 7% loan payable for the balance. Monthly blended payments of $3,135 are required on the first of each month, starting November 1. Ryan’s company follows ASPE, uses a perpetual inventory system and has an October 31st year end.

Understand the Problem

The question is asking how to set up an amortization table, which involves calculating the principal and interest portions of monthly loan payments based on the loan terms provided. This includes determining the loan balance, interest accrual, and the payment schedule over a ten-year period.

Answer

The starting loan amount is $270,000 with monthly payments of approximately $3,135 for 10 years at a 7% interest rate.

Answer for screen readers

The setup for the amortization table involves the loan amount of $270,000, with monthly payments of approximately $3,135 over 10 years at an interest rate of 7%.

Steps to Solve

-

Determine the Loan Amount

Subtract the down payment from the purchase price of the land.

The loan amount is calculated as:

$$ \text{Loan Amount} = $300,000 - $30,000 = $270,000 $$ -

Calculate Monthly Interest Rate

Convert the annual interest rate to a monthly interest rate by dividing by 12.

The monthly interest rate is:

$$ \text{Monthly Interest Rate} = \frac{7%}{12} = \frac{0.07}{12} = 0.0058333 $$ -

Set Up the Amortization Formula

Utilize the loan payment formula to find the monthly payment:

$$ P = \frac{r \times PV}{1 - (1 + r)^{-n}} $$

where:

-

( P ) = monthly payment

-

( r ) = monthly interest rate

-

( PV ) = present value (loan amount)

-

( n ) = total number of payments (months)

In this case:

$$ P = \frac{0.0058333 \times 270,000}{1 - (1 + 0.0058333)^{-120}} $$

-

Calculate Monthly Payment (Blended Payment)

Using the values calculated:

$$ P = \frac{0.0058333 \times 270,000}{1 - (1 + 0.0058333)^{-120}} \approx $3,135 $$ -

Create the Amortization Table Format

Structure the amortization table to include columns for:

- Payment number

- Payment date

- Beginning balance

- Payment amount

- Interest paid

- Principal paid

- Ending balance

-

Calculate Each Row of the Amortization Table

For each payment:

-

Calculate interest for the period:

$$ \text{Interest} = \text{Beginning Balance} \times \text{Monthly Interest Rate} $$ -

Calculate principal paid:

$$ \text{Principal} = \text{Payment} - \text{Interest} $$ -

Update ending balance:

$$ \text{Ending Balance} = \text{Beginning Balance} - \text{Principal} $$ -

Continue for each of the 120 months.

The setup for the amortization table involves the loan amount of $270,000, with monthly payments of approximately $3,135 over 10 years at an interest rate of 7%.

More Information

Creating an amortization table helps in understanding how much of each payment goes towards interest versus principal and how the balance decreases over time.

Tips

- Forgetting to convert the annual interest rate to a monthly rate.

- Miscalculating the number of payments if the loan duration is not in months.

- Not updating the beginning balance correctly after each payment.

AI-generated content may contain errors. Please verify critical information