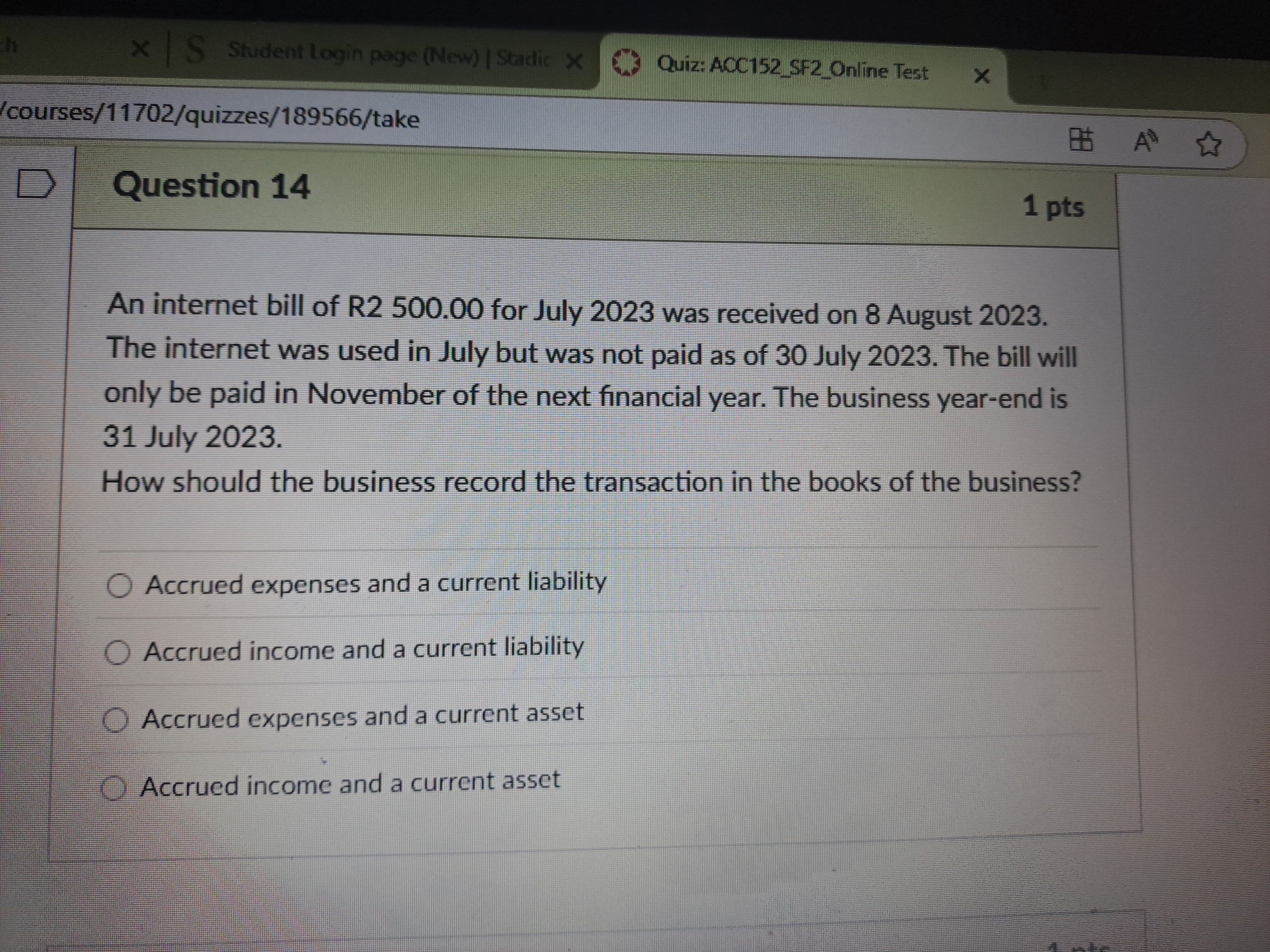

How should the business record the transaction in the books of the business?

Understand the Problem

The question is asking how the business should account for an internet bill that was incurred in July but not paid until August. It focuses on the concepts of accrued expenses and their classification within business accounting.

Answer

Accrued expenses and a current liability.

The business should record the transaction as accrued expenses and a current liability.

Answer for screen readers

The business should record the transaction as accrued expenses and a current liability.

More Information

Accrued expenses are costs that have been incurred but not yet paid. They must be recorded at the end of the accounting period to accurately represent the financial position.

Tips

A common mistake is to confuse accrued expenses with prepaid expenses. Remember, accrued expenses are unpaid liabilities incurred in the current period.

Sources

- Recording Business Transactions - Saylor Academy - learn.saylor.org

- Accounting Records: Definition, What They Include, and Types - investopedia.com

AI-generated content may contain errors. Please verify critical information