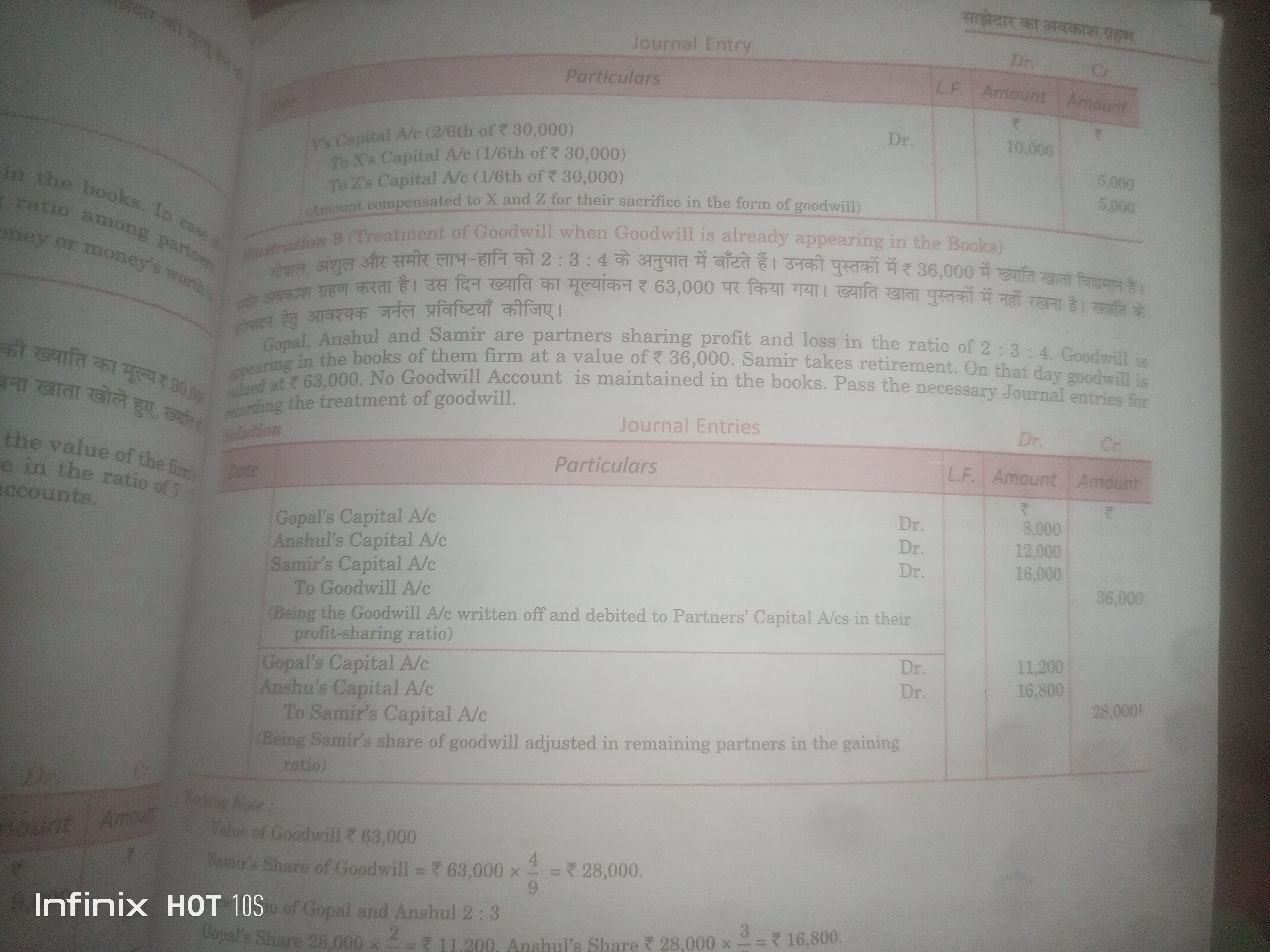

Gopal, Anshul, and Samir are partners sharing profit and loss in the ratio of 2:3:4. Goodwill is valued at ₹63,000. Samir takes retirement. Pass the necessary journal entries relat... Gopal, Anshul, and Samir are partners sharing profit and loss in the ratio of 2:3:4. Goodwill is valued at ₹63,000. Samir takes retirement. Pass the necessary journal entries relating to the treatment of goodwill.

Understand the Problem

The question involves a partnership accounting scenario where Gopal, Anshul, and Samir are partners with a specified profit-sharing ratio. Samir is retiring, and the task is to record the necessary journal entries related to goodwill, which is already included in the firm’s accounts. It asks for calculations of goodwill shared among the remaining partners based on the retirement.

Answer

The journal entries reflect the treatment of goodwill as: 1. Write-off of $36,000$ (total) among partners. 2. Adjustment of Samir's $28,000$ share among Gopal ($11,200$) and Anshul ($16,800$).

Answer for screen readers

The journal entries for the treatment of goodwill are as follows:

-

Write-off Goodwill Account:

- Debit Gopal's Capital Account: $8,000$

- Debit Anshul's Capital Account: $12,000$

- Debit Samir's Capital Account: $16,000$

- Credit Goodwill Account: $36,000$

-

Adjust remaining partners' goodwill:

- Debit Gopal's Capital Account: $11,200$

- Debit Anshul's Capital Account: $16,800$

- Credit Samir's Capital Account: $28,000$

Steps to Solve

-

Determine Goodwill Value The total value of goodwill for the firm is given as $63,000$.

-

Calculate Samir's Share of Goodwill Since Samir shares goodwill in the ratio 2:3:4, the calculation for Samir's share is: [ \text{Samir's Share} = \frac{4}{9} \times 63,000 = 28,000 ]

-

Goodwill Journal Entry for Write-off To write off goodwill from the books, the entry will be: [ \text{Gopal's Capital Account} \quad Dr. \quad 8,000 ] [ \text{Anshul's Capital Account} \quad Dr. \quad 12,000 ] [ \text{Samir's Capital Account} \quad Dr. \quad 16,000 ] [ \text{To Goodwill Account} \quad Cr. \quad 36,000 ] (Being the Goodwill Account written off and debited to Partners’ Capital Accounts in their profit-sharing ratio)

-

Adjust Remaining Partners' Capital Accounts After Samir retires, the goodwill remaining in the partnership should be distributed among Gopal and Anshul. The new shares will be calculated based on the remaining partners' profit-sharing ratio.

-

Calculate New Share of Goodwill for Gopal and Anshul The remaining goodwill after writing off Samir's share is: [ \text{Remaining Goodwill} = 63,000 - 28,000 = 35,000 ] The remaining partners' share is calculated as follows:

- Gopal's new share: [ \frac{2}{5} \times 28,000 = 11,200 ]

- Anshul's new share: [ \frac{3}{5} \times 28,000 = 16,800 ]

-

Final Journal Entry for Goodwill Adjustment The final journal entry will include: [ \text{Gopal's Capital Account} \quad Dr. \quad 11,200 ] [ \text{Anshul's Capital Account} \quad Dr. \quad 16,800 ] [ \text{To Samir's Capital Account} \quad Cr. \quad 28,000 ] (Being Samir’s share of goodwill adjusted in remaining partners in the gaining ratio)

The journal entries for the treatment of goodwill are as follows:

-

Write-off Goodwill Account:

- Debit Gopal's Capital Account: $8,000$

- Debit Anshul's Capital Account: $12,000$

- Debit Samir's Capital Account: $16,000$

- Credit Goodwill Account: $36,000$

-

Adjust remaining partners' goodwill:

- Debit Gopal's Capital Account: $11,200$

- Debit Anshul's Capital Account: $16,800$

- Credit Samir's Capital Account: $28,000$

More Information

Goodwill is an intangible asset that reflects the value of a firm's brand reputation, customer relations, and other non-physical assets. The calculations involve distributing this value among the remaining partners when one partner retires.

Tips

- Forgetting to calculate the share of goodwill accurately based on the profit-sharing ratio.

- Not making the distinction between writing off goodwill and adjusting for the retiring partner's share.

- Exceeding the total goodwill value in any journal entries, which can lead to balancing discrepancies.

AI-generated content may contain errors. Please verify critical information