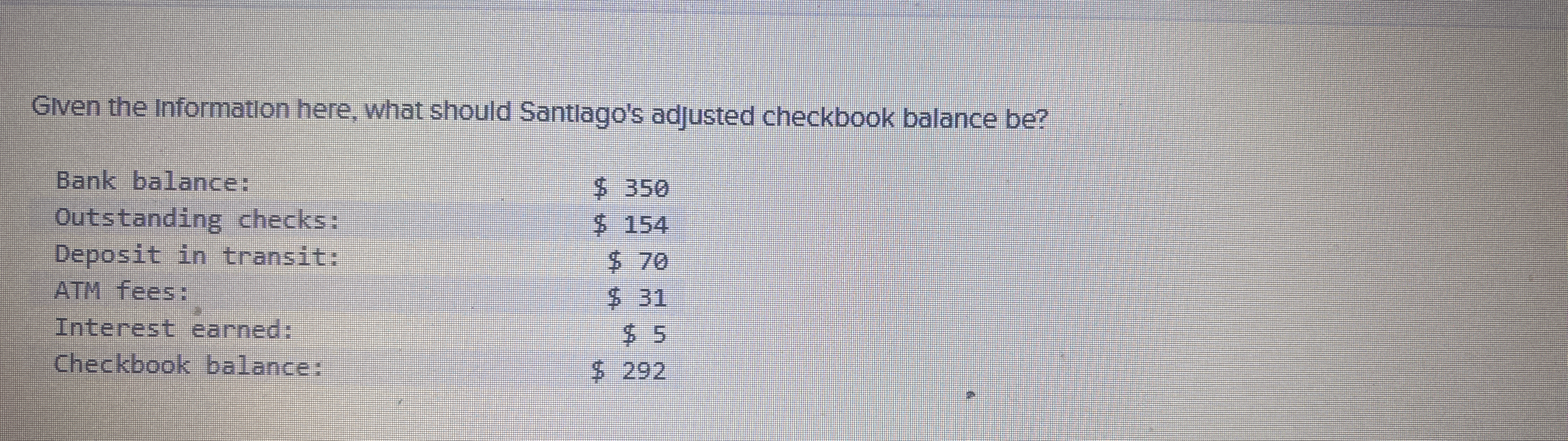

Given the information here, what should Santiago's adjusted checkbook balance be?

Understand the Problem

The question is asking for Santiago's adjusted checkbook balance based on the provided financial information, which includes the bank balance, outstanding checks, deposit in transit, ATM fees, interest earned, and the checkbook balance. To find the adjusted balance, we will use the provided figures to calculate the final amount.

Answer

$177

Answer for screen readers

Santiago's adjusted checkbook balance is $177.

Steps to Solve

- Determine the base checkbook balance

Start with the checkbook balance provided: $$ \text{Checkbook balance} = 292 $$

- Account for ATM fees

Subtract the ATM fees from the checkbook balance: $$ \text{Adjusted balance after fees} = 292 - 31 $$

- Add interest earned

Add the interest earned to the adjusted balance: $$ \text{Adjusted balance after interest} = \text{Adjusted balance after fees} + 5 $$

- Subtract outstanding checks

Subtract the outstanding checks from the balance: $$ \text{Final balance} = \text{Adjusted balance after interest} - 154 $$

- Account for deposits in transit

Finally, add the deposit in transit to the last balance calculated: $$ \text{Adjusted checkbook balance} = \text{Final balance} + 70 $$

Santiago's adjusted checkbook balance is $177.

More Information

The adjusted checkbook balance reflects all transactions and adjustments, such as fees and deposits, that affect the total amount Santiago has available. This process helps in maintaining accurate financial records.

Tips

- Failing to account for both the ATM fees and the outstanding checks in the correct order.

- Not adding the interest earned before subtracting the outstanding checks.

AI-generated content may contain errors. Please verify critical information