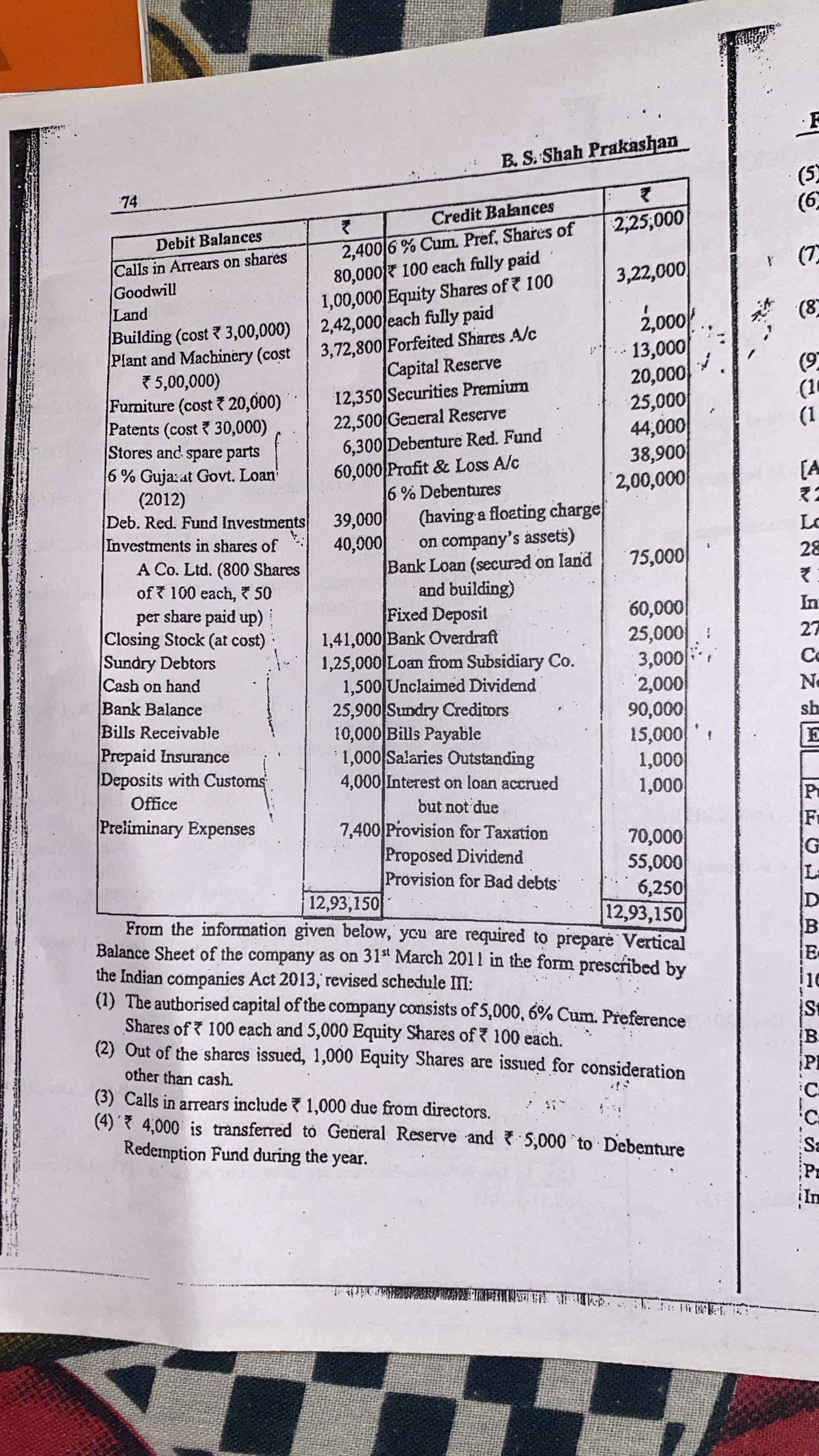

From the information given below, you are required to prepare a Vertical Balance Sheet of the company as on 31st March 2011 in the form prescribed by the Indian Companies Act 2013;... From the information given below, you are required to prepare a Vertical Balance Sheet of the company as on 31st March 2011 in the form prescribed by the Indian Companies Act 2013; revised schedule III.

Understand the Problem

The question requires the preparation of a vertical balance sheet for a company as of March 31, 2011, based on provided financial data and specific instructions related to shares and reserves.

Answer

Total assets and liabilities in the vertical balance sheet are ₹12,93,150.

Answer for screen readers

The vertical balance sheet totals on both sides as of March 31, 2011, are ₹12,93,150.

Steps to Solve

-

Organize the Debit Balances

List all the debit balances:

- Calls in Arrears on Shares: ₹2,400

- Goodwill: ₹80,000

- Land: ₹1,00,000

- Building: ₹2,42,800

- Plant and Machinery: ₹3,72,800

- Furniture: ₹12,350

- Patents: ₹22,500

- Stores and spare parts: ₹60,000

- Debenture Redemption Fund Investments: ₹39,000

- Investments in shares: ₹40,000

- Closing Stock: ₹1,41,000

- Sundry Debtors: ₹1,25,000

- Cash on hand: ₹1,500

- Bank Balance: ₹25,900

- Bills Receivable: ₹10,000

- Prepaid Insurance: ₹1,000

- Deposits with Customs: ₹4,000

- Preliminary Expenses: ₹7,400

Total Debit = ₹12,93,150

-

Organize the Credit Balances

List all the credit balances:

- 6% Cumulative Preference Shares: ₹2,25,000

- Equity Shares of ₹100 each: ₹3,22,000

- Forfeited Shares A/c: ₹2,000

- Capital Reserve: ₹13,000

- Securities Premium: ₹25,000

- General Reserve: ₹44,000

- Debenture Redemption Fund: ₹70,000

- Profit & Loss A/c: ₹38,900

- 6% Debentures: ₹2,00,000

- Bank Loan (secured): ₹75,000

- Fixed Deposit: ₹60,000

- Bank Overdraft: ₹25,000

- Loan from Subsidiary Co.: ₹2,000

- Unclaimed Dividend: ₹3,000

- Sundry Creditors: ₹90,000

- Bills Payable: ₹15,000

- Salaries Outstanding: ₹1,000

- Interest on Loan accrued: ₹1,000

- Provision for Taxation: ₹70,000

- Proposed Dividend: ₹55,000

- Provision for Bad Debts: ₹6,250

Total Credit = ₹12,93,150

-

Prepare the Vertical Balance Sheet

Arrange the data in proper balance sheet format, starting with the heading, followed by the liabilities on the right and assets on the left.

Based on the totals calculated:

ASSETS LIABILITIES ---------------------------------------- Goodwill ₹80,000 6% Cumulative Preference Shares ₹2,25,000 Land ₹1,00,000 Equity Shares of ₹100 each ₹3,22,000 Building ₹2,42,800 General Reserve ₹44,000 Plant and Machinery ₹3,72,800 Profit & Loss A/c ₹38,900 ... ... ... ... -

Apply Adjustments

Include the adjustments noted:

- ₹1,000 transferred to General Reserve

- ₹5,000 transferred to Debenture Redemption Fund

- One thousand equity shares issued for consideration other than cash.

-

Final Review

Sum up both sides to ensure the balance sheet is tallied at ₹12,93,150. Make corrections if there are any discrepancies.

The vertical balance sheet totals on both sides as of March 31, 2011, are ₹12,93,150.

More Information

This vertical balance sheet demonstrates the financial position of the company on a particular date, showcasing the assets owned and the liabilities owed. It's crucial for understanding the company’s solvency and financial health.

Tips

- Miscalculating totals on either side (debits vs. credits). Always double-check calculations.

- Forgetting to include adjustments made concerning reserves and shares.

- Not structuring the balance sheet correctly, leading to confusion in presentation.

AI-generated content may contain errors. Please verify critical information