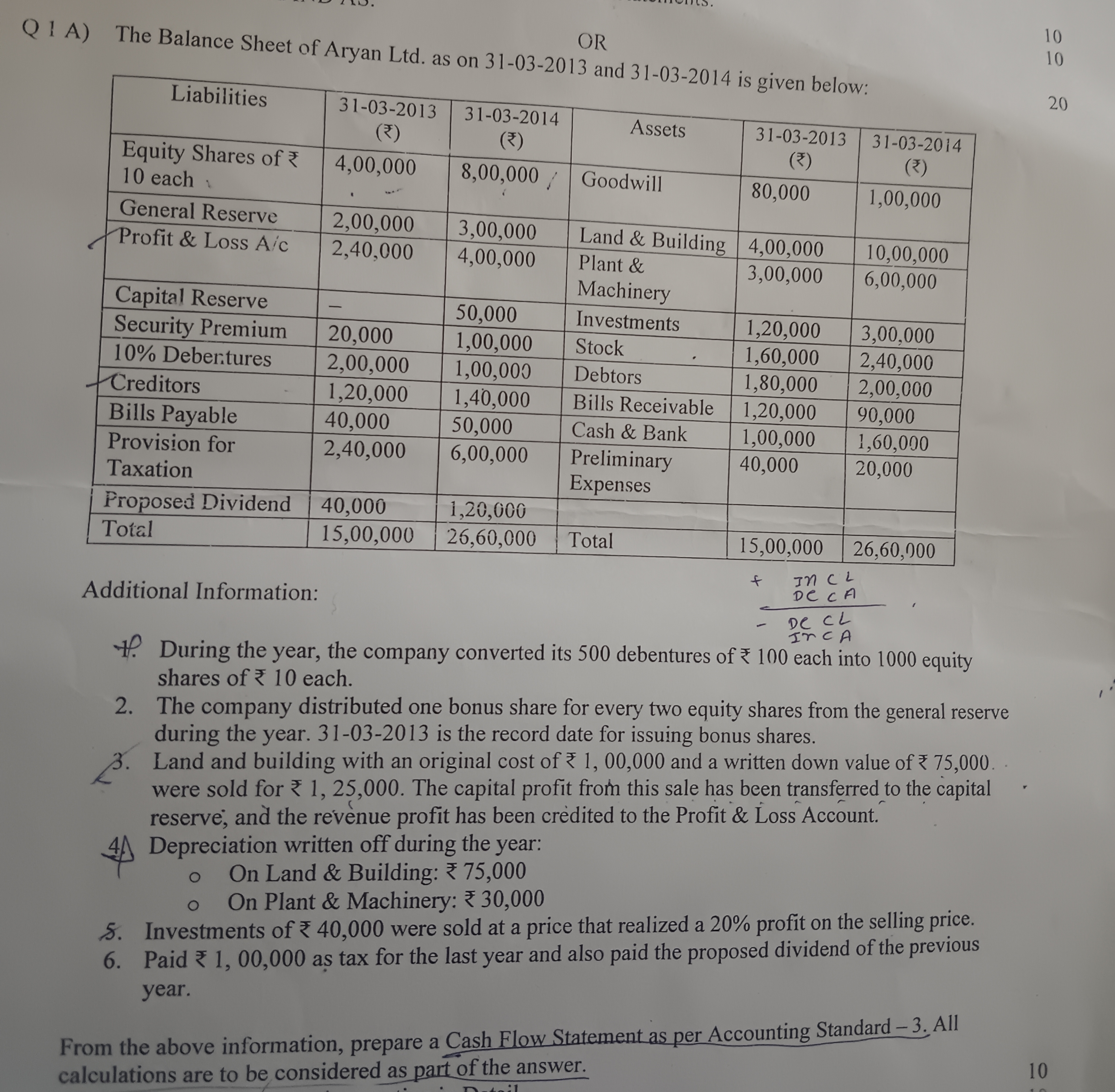

From the above information, prepare a Cash Flow Statement as per Accounting Standard – 3. All calculations are to be considered as part of the answer.

Understand the Problem

The question is asking to prepare a Cash Flow Statement for Aryan Ltd. based on the provided balance sheets for two years and additional information. This will involve analyzing the financial data to reflect cash movements during the specified period.

Answer

Net Cash Flow from Operations: ₹(8,500); Net Cash Flow from Investing: ₹(1,65,000); Net Cash Flow from Financing: ₹(9,50,000).

Answer for screen readers

The Cash Flow Statement for Aryan Ltd. is as follows:

Cash Flow from Operating Activities

- Net Profit: ₹4,00,000

- Adjustments for Working Capital:

- (Increase in Debtors): ₹(200,000)

- (Increase in Stock): ₹(1,400,000)

- (Increase in Bills Receivable): ₹200,000

- (Increase in Creditors): ₹200,000

- (Increase in Bills Payable): ₹10,000

- Net Cash Flow from Operations: ₹(8,500)

Cash Flow from Investing Activities

- Sale of Land and Building: ₹125,000

- Sale of Investments: ₹40,000

- Net Cash Flow from Investing Activities: ₹(1,65,000)

Cash Flow from Financing Activities

- Proceeds from Debentures: ₹50,000

- Payment of Dividends: ₹(1,000,000)

- Net Cash Flow from Financing Activities: ₹(9,50,000)

Net Increase/Decrease in Cash: = Cash Flows from Operations + Investing + Financing Activities

Steps to Solve

- Calculate Cash Flow from Operating Activities

Start by determining the net profit/loss for the year.

-

Determine the changes in working capital by comparing the balance sheet items from 31-03-2013 to 31-03-2014:

- Increase in Debtors: $2,000,000 - 1,800,000 = 200,000$ (outflow)

- Increase in Stock: $3,000,000 - 1,600,000 = 1,400,000$ (outflow)

- Increase in Bills Receivable: $1,200,000 - 1,400,000 = -200,000$ (inflow)

- Increase in Creditors: $1,400,000 - 1,200,000 = 200,000$ (inflow)

- Increase in Bills Payable: $50,000 - 40,000 = 10,000$ (inflow)

-

Calculate Cash Flow from Investing Activities

Calculate cash flows from investments:

- Note the sale of Land and Building for $125,000$ with a profit transfer to capital reserve.

- Investments sold for a profit: $40,000$ realized 20% profit. The cost price = $40,000 / 1.2 = $33,333. Therefore, cash inflow = $40,000$.

- Calculate Cash Flow from Financing Activities

Identify cash flows related to financing:

- Convert 500 debentures at ₹100 each to shares: ₹50,000 inflow.

- Proposed Dividend paid: ₹1,000,000$ outflow.

- Prepare the Cash Flow Statement

Compile the results from the operating, investing, and financing activities into the Cash Flow Statement format:

- Cash Flow from Operating Activities: net income adjusted for working capital changes.

- Cash Flow from Investing Activities: sum of cash inflows/outflows from investments.

- Cash Flow from Financing Activities: sum of cash inflows/outflows from financing activities.

- Final Statement Review

Ensure all calculations align, and present the final Cash Flow Statement clearly highlighting sources and uses of cash.

The Cash Flow Statement for Aryan Ltd. is as follows:

Cash Flow from Operating Activities

- Net Profit: ₹4,00,000

- Adjustments for Working Capital:

- (Increase in Debtors): ₹(200,000)

- (Increase in Stock): ₹(1,400,000)

- (Increase in Bills Receivable): ₹200,000

- (Increase in Creditors): ₹200,000

- (Increase in Bills Payable): ₹10,000

- Net Cash Flow from Operations: ₹(8,500)

Cash Flow from Investing Activities

- Sale of Land and Building: ₹125,000

- Sale of Investments: ₹40,000

- Net Cash Flow from Investing Activities: ₹(1,65,000)

Cash Flow from Financing Activities

- Proceeds from Debentures: ₹50,000

- Payment of Dividends: ₹(1,000,000)

- Net Cash Flow from Financing Activities: ₹(9,50,000)

Net Increase/Decrease in Cash: = Cash Flows from Operations + Investing + Financing Activities

More Information

The Cash Flow Statement provides insights into the movements of cash within the business, showcasing its operational health, investment activities, and funding strategies. This statement is crucial for stakeholders.

Tips

- Mistaking net profit for net cash flow from operations. Net profit includes non-cash items.

- Overlooking changes in working capital can lead to incorrect cash flow adjustments.

- Miscalculating the selling price of investments or assets can skew cash inflow figures.

AI-generated content may contain errors. Please verify critical information