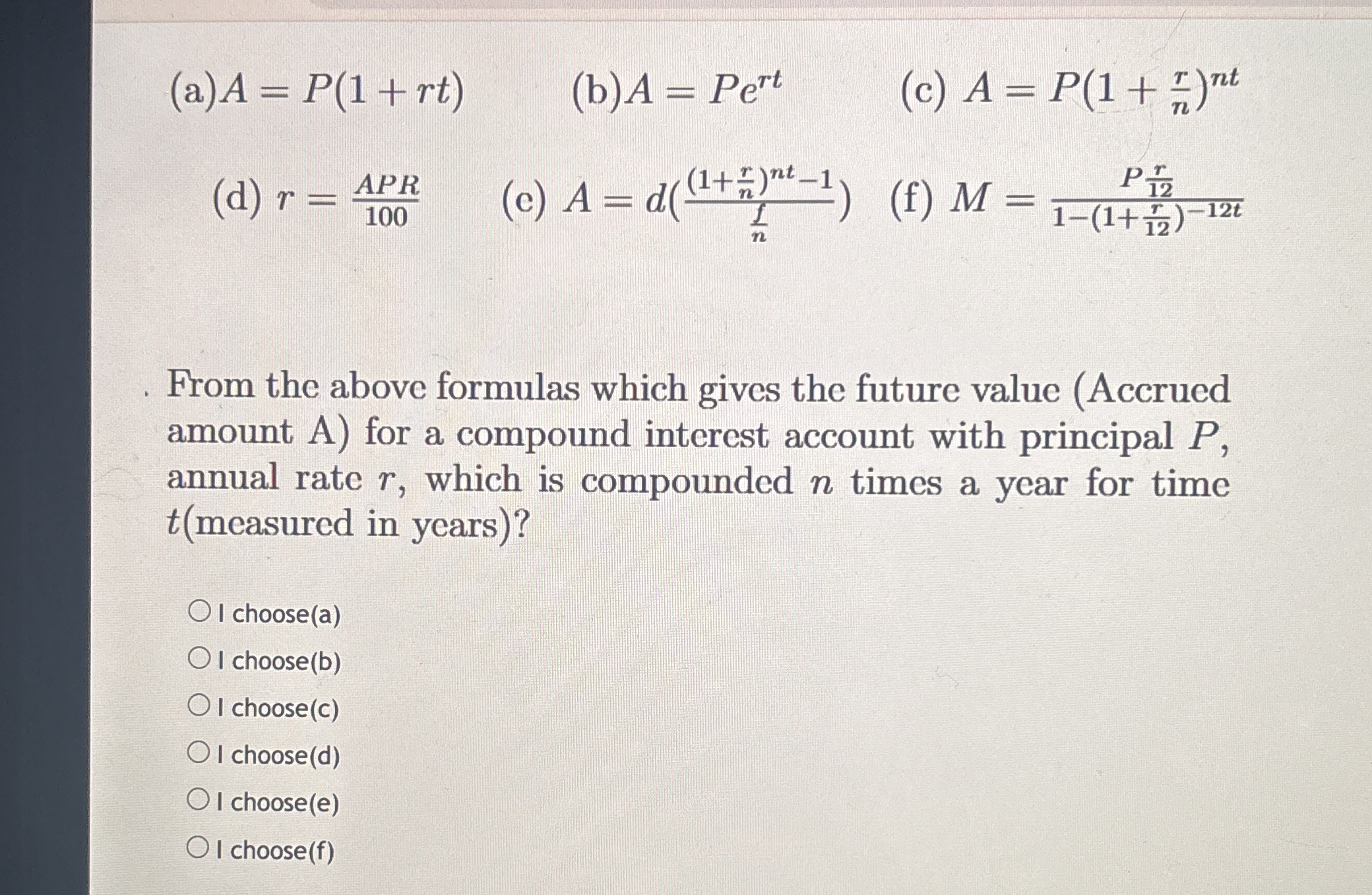

From the above formulas which gives the future value (Accrued amount A) for a compound interest account with principal P, annual rate r, which is compounded n times a year for time... From the above formulas which gives the future value (Accrued amount A) for a compound interest account with principal P, annual rate r, which is compounded n times a year for time t (measured in years)?

Understand the Problem

The question is asking to identify which formula from the list correctly calculates the future value of a compound interest account given the principal, annual interest rate, compounding frequency, and time period in years.

Answer

I choose (c) $A = P \left(1 + \frac{r}{n}\right)^{nt}$

Answer for screen readers

I choose (c)

Steps to Solve

- Understanding Compound Interest Formula

The general formula for compound interest is given by: $$ A = P \left(1 + \frac{r}{n}\right)^{nt} $$ where:

- ( A ) is the future value of the investment/loan, including interest.

- ( P ) is the principal investment amount (the initial deposit or loan amount).

- ( r ) is the annual interest rate (decimal).

- ( n ) is the number of times that interest is compounded per year.

- ( t ) is the time in years.

- Identifying the Correct Formula

From the options provided:

- (a) ( A = P(1 + rt) ) - This is for simple interest, not compound interest.

- (b) ( A = Pe^{rt} ) - This is for continuous compounding.

- (c) ( A = P(1 + \frac{r}{n})^{nt} ) - This matches the compound interest formula.

- (d) ( r = \frac{APR}{100} ) - This is not a complete compound interest formula.

- (e) ( A = d \left(\frac{(1 + \frac{r}{n})^{nt} - 1}{\frac{r}{n}}\right) ) - This relates to calculating the future value of an annuity.

- (f) ( M = \frac{P \cdot \frac{r}{12}}{1 - (1 + \frac{r}{12})^{-12t}} ) - This relates to loan amortization.

- Finalizing the Answer

Since option (c) is the only formula that correctly represents the future value for a compound interest account, the correct choice is:

$$ A = P \left(1 + \frac{r}{n}\right)^{nt} $$

I choose (c)

More Information

The compound interest formula is commonly used in finance to determine the future value of investments or loans based on principal, interest rate, compounding frequency, and time. It shows how interest can accumulate over multiple periods, making it essential for savings and investment strategies.

Tips

- Confusing simple interest with compound interest. Remember that simple interest does not account for interest on interest.

- Misinterpreting the parameters such as ( n ), which represents compounding frequency, not simply the time period.

AI-generated content may contain errors. Please verify critical information