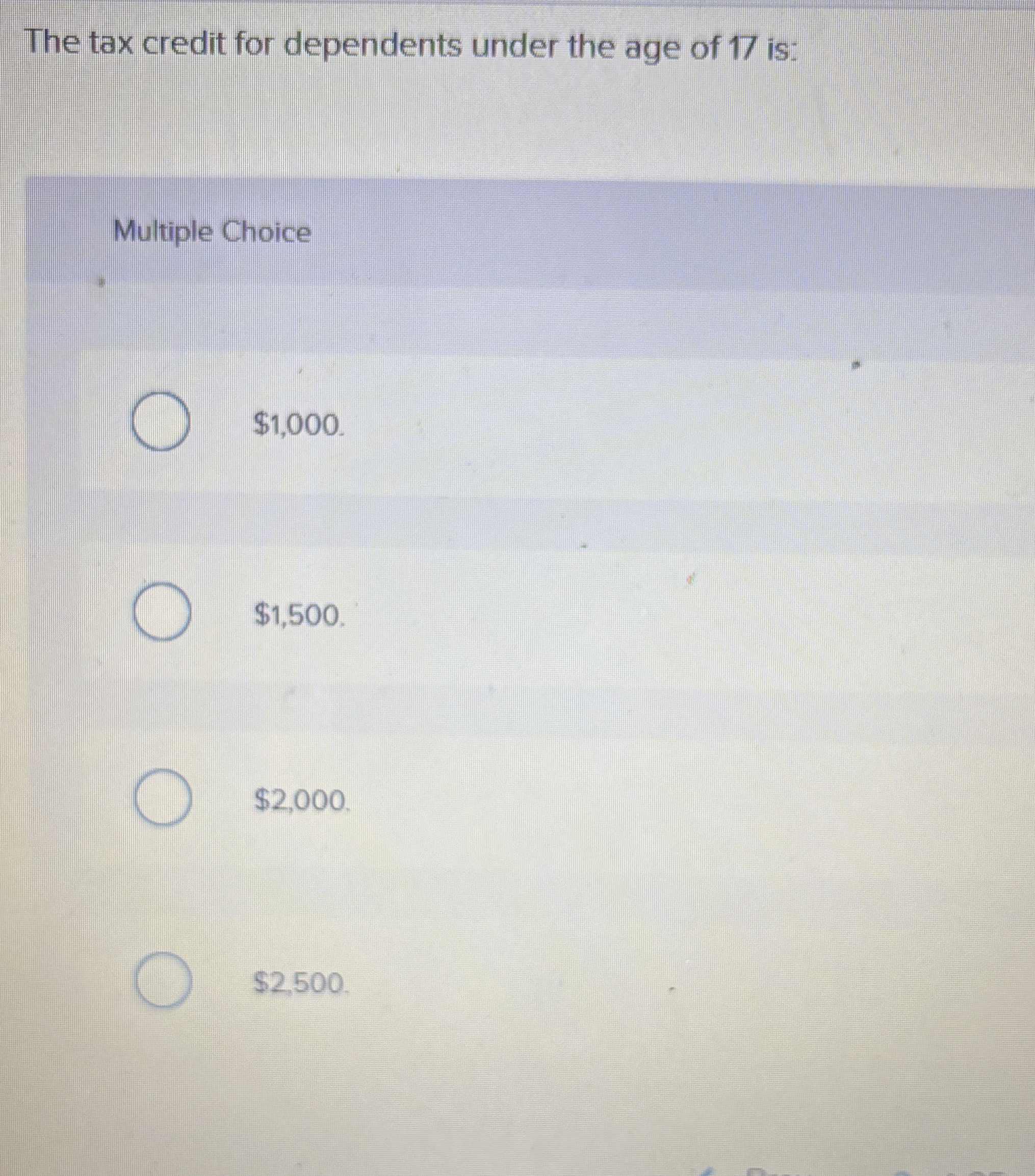

The tax credit for dependents under the age of 17 is:

Understand the Problem

The question is asking for the specific amount of the tax credit that can be claimed for dependents who are under the age of 17, providing multiple-choice options.

Answer

$2,000

The final answer is $2,000.

Answer for screen readers

The final answer is $2,000.

More Information

The Child Tax Credit is designed to help families with children under age 17. In recent changes, the amount was increased as part of temporary measures under certain acts like the American Rescue Plan.

Tips

Ensure to check the most recent tax guidelines, as changes can occur under new tax laws.

Sources

- Child Tax Credit and Credit for Other Dependents | IRS - irs.gov

- Child Tax Credit Overview - TurboTax - turbotax.intuit.com

AI-generated content may contain errors. Please verify critical information