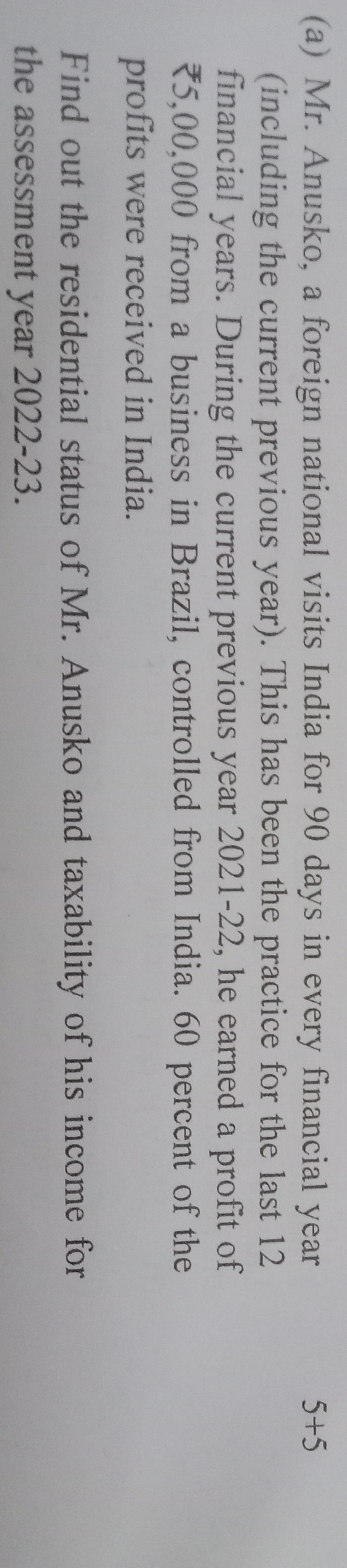

Find out the residential status of Mr. Anusko and taxability of his income for the assessment year 2022-23.

Understand the Problem

The question is asking about the residency status and taxability of Mr. Anusko's income based on his financial activities in India and abroad during the specified financial year.

Answer

Mr. Anusko is a non-resident. His taxable income in India is ₹3,00,000.

Answer for screen readers

Mr. Anusko is a non-resident for the assessment year 2022-23. His income of ₹3,00,000 received in India from his business profits is taxable in India.

Steps to Solve

- Determine Residency Status

To determine Mr. Anusko’s residency status, we need to consider the number of days he has been in India. He visits India for 90 days each financial year. Since he has been doing this for the last 12 years, he is not a resident of India under the applicable laws as he does not meet the required conditions to be considered a resident.

- Calculate Total Income Earned in India

Mr. Anusko earned a profit of ₹5,00,000 from his business in Brazil. Since 60% of these profits were received in India, we can calculate that amount:

[ \text{Income received in India} = 0.60 \times 5,00,000 = 3,00,000 ]

- Determine Taxability of Income

As a non-resident, Mr. Anusko is only liable to pay taxes on income that is received in India. Therefore, his income of ₹3,00,000 (received in India) will be taxable.

Mr. Anusko is a non-resident for the assessment year 2022-23. His income of ₹3,00,000 received in India from his business profits is taxable in India.

More Information

Mr. Anusko's residency status is determined based on the number of days spent in India. Since he visits only for 90 days each year for many years, he is classified as a non-resident. Non-residents are liable to tax only on income earned or received in India, which is why only ₹3,00,000 of his income is taxable.

Tips

- Miscalculating Residency: It's easy to misinterpret residency status based on the number of years spent in a country, rather than just days for the relevant financial year.

- Ignoring Different Types of Income: Non-residents may forget that taxes in India only apply to the income received in India, not on the total income earned worldwide.

AI-generated content may contain errors. Please verify critical information