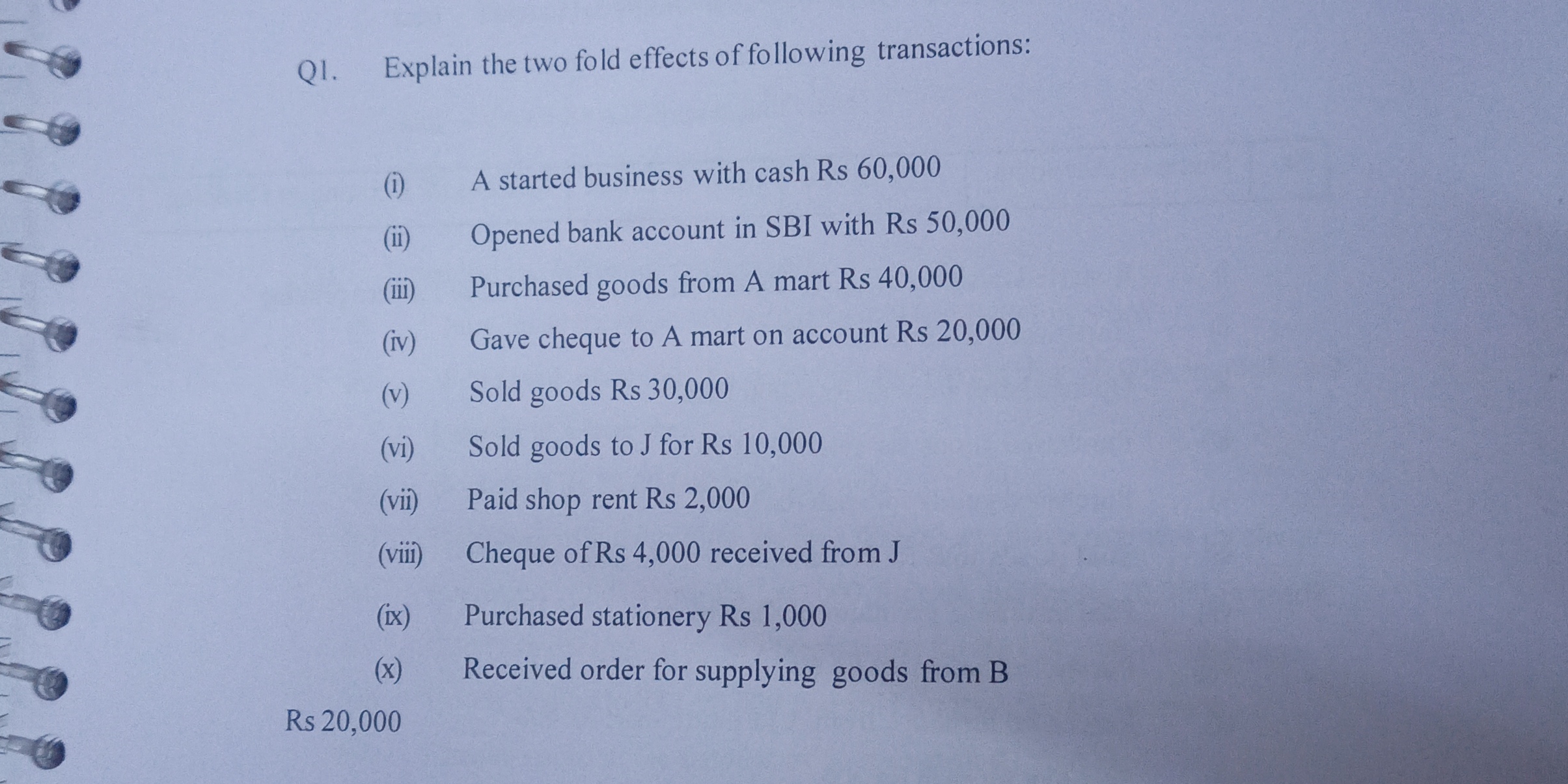

Explain the two fold effects of following transactions: (i) A started business with cash Rs 60,000 (ii) Opened bank account in SBI with Rs 50,000 (iii) Purchased goods from A mart... Explain the two fold effects of following transactions: (i) A started business with cash Rs 60,000 (ii) Opened bank account in SBI with Rs 50,000 (iii) Purchased goods from A mart Rs 40,000 (iv) Gave cheque to A mart on account Rs 20,000 (v) Sold goods Rs 30,000 (vi) Sold goods to J for Rs 10,000 (vii) Paid shop rent Rs 2,000 (viii) Cheque of Rs 4,000 received from J (ix) Purchased stationery Rs 1,000 (x) Received order for supplying goods from B.

Understand the Problem

The question is asking for an explanation of the two-fold effects of various business transactions listed. This requires an understanding of accounting principles, specifically how these transactions affect both the debit and credit sides of the accounts.

Answer

Each transaction affects two accounts in the accounting equation.

The two-fold effects of the transactions include changes in assets, liabilities, expenses, and capital. Each transaction affects at least two accounts in the accounting equation.

Answer for screen readers

The two-fold effects of the transactions include changes in assets, liabilities, expenses, and capital. Each transaction affects at least two accounts in the accounting equation.

More Information

These transactions illustrate the dual aspect concept, where each financial transaction involves two equal and opposite effects on the accounting equation.

Tips

Common mistakes include overlooking which accounts are affected and failing to classify them correctly.

AI-generated content may contain errors. Please verify critical information