Explain prospects for India in developing offshore banking units in India. Explain principles of international finance. Explain meaning and components of BOP. Distinguish between A... Explain prospects for India in developing offshore banking units in India. Explain principles of international finance. Explain meaning and components of BOP. Distinguish between ADR and GDR. Explain in detail characteristics of Foreign Exchange Market. What is Risk Management in banking? Explain the concept of Credit created by banks.

Understand the Problem

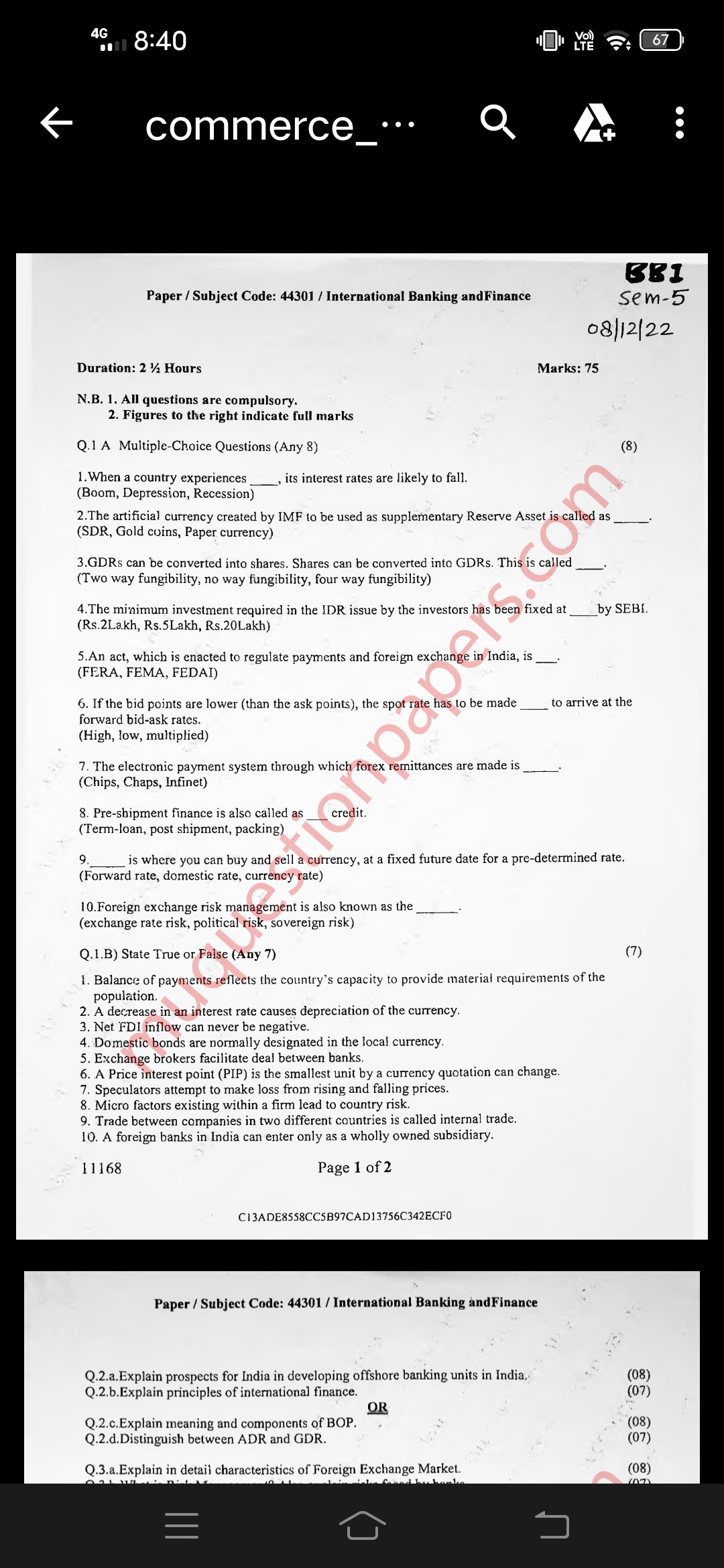

The question provides a set of multiple-choice and true/false questions related to International Banking and Finance, looking for explanations of concepts and characteristics within this field.

Answer

Offshore banking in India enhances foreign transactions. Key finance principles include exchange rates and BOP. BOP components: current, capital, financial accounts. ADR vs. GDR differ by trading location. Forex market is liquid and global. Risk management minimizes financial impact. Credit creation expands money supply.

-

Offshore Banking Units: In India, offshore banking units can enhance foreign currency transactions, boost the financial sector, and align with international banking standards, providing economic growth.

-

International Finance Principles: These include exchange rate mechanisms, balance of payments, and international monetary systems which ensure smooth trade and investment across borders.

-

Balance of Payments (BOP): BOP records all economic transactions between residents and the rest of the world, comprising the current account, capital account, and financial account.

-

ADR vs. GDR: ADRs are traded in the US markets, whereas GDRs are traded in multiple international markets. Both represent shares in foreign companies.

-

Foreign Exchange Market Characteristics: It operates 24 hours, provides major currency exchanges, and is highly liquid, facilitating global trade.

-

Risk Management in Banking: Involves identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, control, or eliminate their impact.

-

Credit Creation: Banks create credit by lending more than what is deposited, effectively expanding the economy’s money supply.

Answer for screen readers

-

Offshore Banking Units: In India, offshore banking units can enhance foreign currency transactions, boost the financial sector, and align with international banking standards, providing economic growth.

-

International Finance Principles: These include exchange rate mechanisms, balance of payments, and international monetary systems which ensure smooth trade and investment across borders.

-

Balance of Payments (BOP): BOP records all economic transactions between residents and the rest of the world, comprising the current account, capital account, and financial account.

-

ADR vs. GDR: ADRs are traded in the US markets, whereas GDRs are traded in multiple international markets. Both represent shares in foreign companies.

-

Foreign Exchange Market Characteristics: It operates 24 hours, provides major currency exchanges, and is highly liquid, facilitating global trade.

-

Risk Management in Banking: Involves identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, control, or eliminate their impact.

-

Credit Creation: Banks create credit by lending more than what is deposited, effectively expanding the economy’s money supply.

More Information

Risk management in banking is crucial for maintaining financial stability and preventing large-scale losses. Understanding ADRs and GDRs helps investors diversify across global markets.

Sources

- Difference between ADR and GDR - BYJU'S - byjus.com

- Global vs. American Depositary Receipts: What's the Difference? - investopedia.com

AI-generated content may contain errors. Please verify critical information