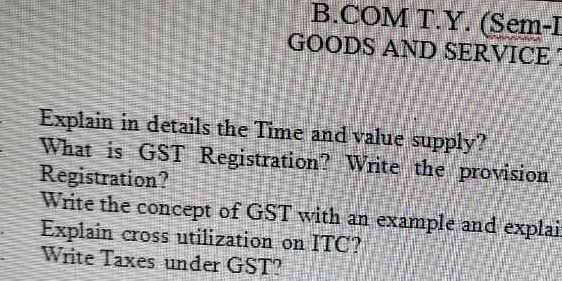

Explain in detail the Time and value supply. What is GST Registration? Write the provision of Registration? Write the concept of GST with an example and explain. Explain cross util... Explain in detail the Time and value supply. What is GST Registration? Write the provision of Registration? Write the concept of GST with an example and explain. Explain cross utilization on ITC. Write Taxes under GST.

Understand the Problem

The question is asking for detailed explanations regarding various concepts related to Goods and Services Tax (GST), including time and value supply, GST registration, the concept of GST, cross utilization of ITC, and types of taxes under GST.

Answer

Time and value supply define when and how GST is levied. GST registration is required for eligible businesses. GST is a uniform tax on goods and services. ITC allows offset across tax types. GST includes CGST, SGST, IGST, UTGST.

-

Time and Value of Supply: The 'time of supply' determines when the seller must charge GST and is often the earliest of the invoice date, payment date, or delivery date. The 'value of supply' is the transaction value, which is the price actually paid or payable.

-

GST Registration and Provisions: GST registration is mandatory for businesses exceeding a certain threshold turnover (e.g., Rs. 20 lakhs in India). Registration provisions require taxpayers to collect and remit GST, file returns, and claim input tax credits.

-

Concept of GST with Example: GST is a comprehensive, multi-stage, destination-based tax applied on every value addition. For example, if a manufacturer sells a product for Rs. 1000 with a GST rate of 18%, the tax is Rs. 180, which will be added to the selling price.

-

Cross Utilization of ITC: ITC allows business input taxes to be utilized across different types of GST (CGST, SGST, and IGST) to minimize tax liability. ITC of CGST can be utilized for paying CGST and IGST, and similarly for SGST.

-

Taxes under GST: GST consists mainly of Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST).

Answer for screen readers

-

Time and Value of Supply: The 'time of supply' determines when the seller must charge GST and is often the earliest of the invoice date, payment date, or delivery date. The 'value of supply' is the transaction value, which is the price actually paid or payable.

-

GST Registration and Provisions: GST registration is mandatory for businesses exceeding a certain threshold turnover (e.g., Rs. 20 lakhs in India). Registration provisions require taxpayers to collect and remit GST, file returns, and claim input tax credits.

-

Concept of GST with Example: GST is a comprehensive, multi-stage, destination-based tax applied on every value addition. For example, if a manufacturer sells a product for Rs. 1000 with a GST rate of 18%, the tax is Rs. 180, which will be added to the selling price.

-

Cross Utilization of ITC: ITC allows business input taxes to be utilized across different types of GST (CGST, SGST, and IGST) to minimize tax liability. ITC of CGST can be utilized for paying CGST and IGST, and similarly for SGST.

-

Taxes under GST: GST consists mainly of Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST).

More Information

GST standardizes the indirect tax system and facilitates a unified market across India. The input tax credits significantly reduce the cascading effect of taxes.

Tips

A common mistake is misunderstanding the eligibility thresholds and rules for GST registration, leading to compliance issues.

Sources

- Time, Place and Value of Supply in GST - ClearTax - cleartax.in

- Goods and Services Tax (GST): Definition, Types, and How It's ... - investopedia.com

- India Goods and Services Tax (GST) | Doing Business in India - india-briefing.com

AI-generated content may contain errors. Please verify critical information