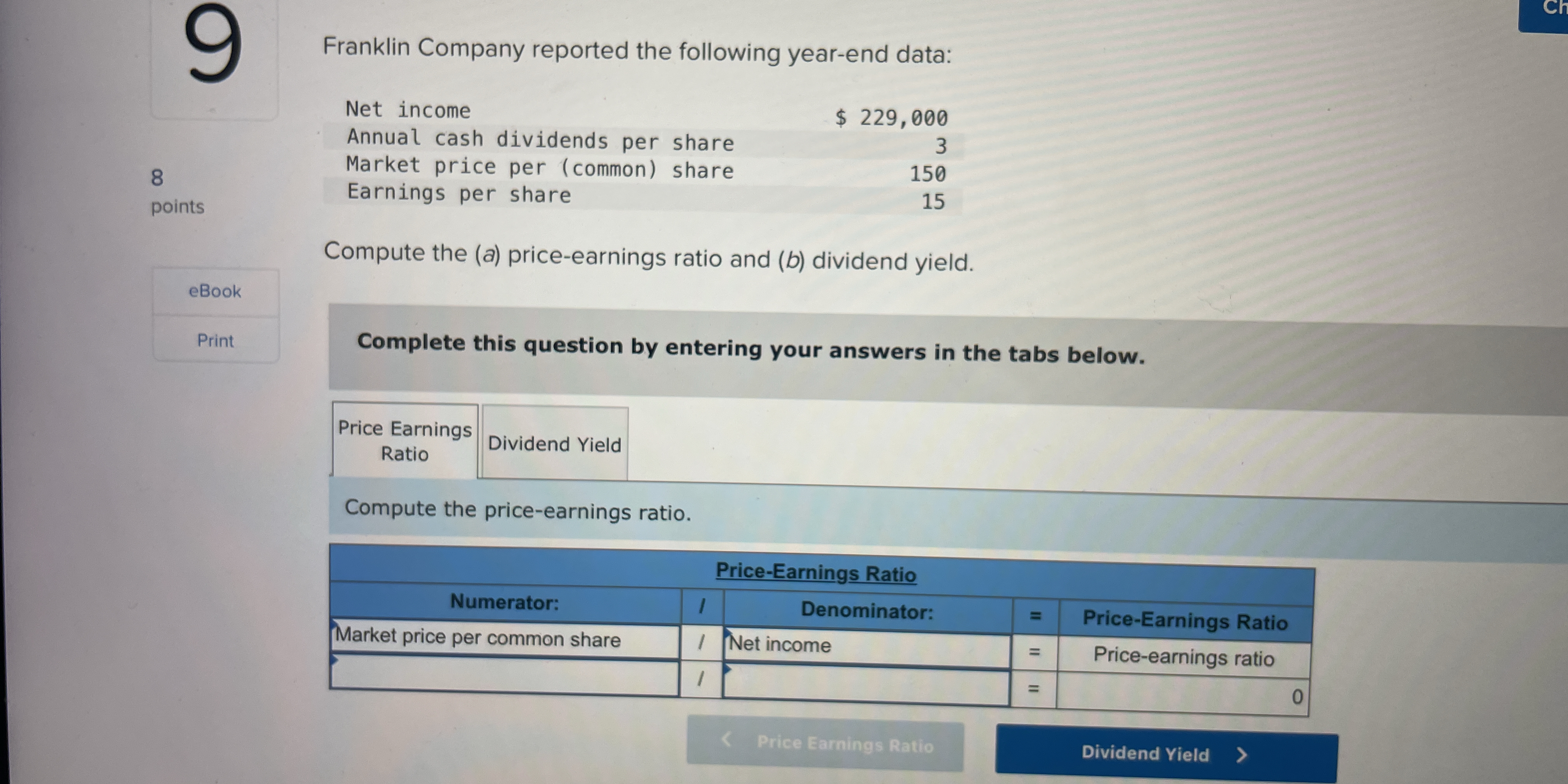

Compute the (a) price-earnings ratio and (b) dividend yield based on the provided data.

Understand the Problem

The question is asking to compute two financial metrics: the price-earnings ratio and the dividend yield based on the provided financial data of Franklin Company.

Answer

Price-Earnings Ratio: 10, Dividend Yield: 0.02 (or 2%)

Answer for screen readers

- Price-Earnings Ratio: 10

- Dividend Yield: 0.02 (or 2%)

Steps to Solve

- Calculate the Price-Earnings Ratio (P/E Ratio)

To find the Price-Earnings ratio, we need to use the formula:

$$ P/E , Ratio = \frac{\text{Market Price per Share}}{\text{Earnings per Share}} $$

From the problem, we have:

- Market price per share = $150

- Earnings per share = $15

Plugging in the values:

$$ P/E , Ratio = \frac{150}{15} $$

- Perform the Division for the P/E Ratio

Calculating the above division:

$$ P/E , Ratio = 10 $$

The Price-Earnings ratio is 10.

- Calculate the Dividend Yield

To find the Dividend Yield, we use the formula:

$$ Dividend , Yield = \frac{\text{Annual Cash Dividends per Share}}{\text{Market Price per Share}} $$

From the problem, we have:

- Annual cash dividends per share = $3

- Market price per share = $150

Plugging in the values:

$$ Dividend , Yield = \frac{3}{150} $$

- Perform the Division for Dividend Yield

Calculating the division for the Dividend Yield:

$$ Dividend , Yield = 0.02 $$

The Dividend Yield is 0.02, or 2%.

- Price-Earnings Ratio: 10

- Dividend Yield: 0.02 (or 2%)

More Information

The Price-Earnings ratio of 10 indicates that investors are willing to pay $10 for every $1 of earnings. A Dividend Yield of 2% means that investors receive 2% of the investment back as a dividend.

Tips

- Confusing earnings per share with net income. Always ensure you are using the right figure (earnings per share in this case).

- Not correctly performing the division, which could lead to inaccurate ratios. Double-check calculations to avoid errors.

AI-generated content may contain errors. Please verify critical information