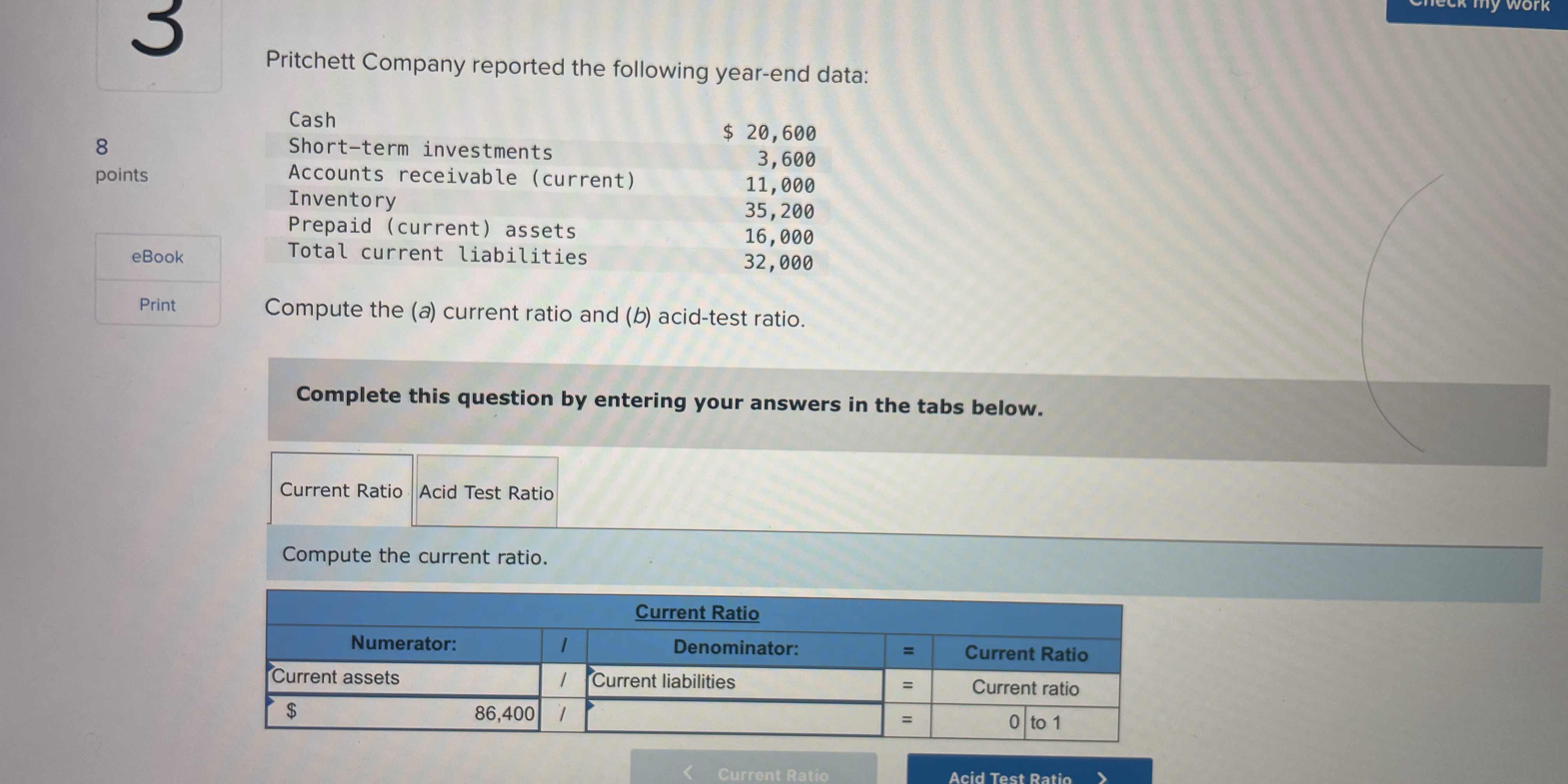

Compute the (a) current ratio and (b) acid-test ratio.

Understand the Problem

The question is asking for the computation of both the current ratio and the acid-test ratio based on the given year-end data for Pritchett Company. To solve it, we will calculate the current assets and current liabilities to derive the ratios.

Answer

Current Ratio: $2.725$, Acid-Test Ratio: $1.075$

Answer for screen readers

-

Current Ratio: $$ \text{Current Ratio} = 2.725 $$

-

Acid-Test Ratio: $$ \text{Acid-Test Ratio} = 1.075 $$

Steps to Solve

- Calculate Current Assets

First, sum up all current assets. The components are:

- Cash: $20,600

- Short-term investments: $3,600

- Accounts receivable (current): $11,000

- Inventory: $35,200

- Prepaid (current) assets: $16,800

The total current assets can be calculated as: $$ \text{Current Assets} = 20,600 + 3,600 + 11,000 + 35,200 + 16,800 = 87,200 $$

- Calculate Total Current Liabilities

Next, identify total current liabilities from the given data: $$ \text{Current Liabilities} = 32,000 $$

- Compute Current Ratio

The current ratio is calculated using the formula: $$ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} $$ Substituting in our values, we have: $$ \text{Current Ratio} = \frac{87,200}{32,000} $$

- Calculate Acid-Test Ratio

To compute the acid-test ratio, we only consider the most liquid assets:

- Cash: $20,600

- Short-term investments: $3,600

- Accounts receivable (current): $11,000

The acid-test ratio is computed using: $$ \text{Acid-Test Ratio} = \frac{\text{Cash} + \text{Short-term Investments} + \text{Accounts Receivable}}{\text{Current Liabilities}} $$ This becomes: $$ \text{Acid-Test Ratio} = \frac{20,600 + 3,600 + 11,000}{32,000} $$

-

Current Ratio: $$ \text{Current Ratio} = 2.725 $$

-

Acid-Test Ratio: $$ \text{Acid-Test Ratio} = 1.075 $$

More Information

The current ratio indicates that for every dollar of liability, Pritchett Company has approximately $2.73 in current assets. The acid-test ratio shows that it has $1.08 in liquid assets for every dollar of current liabilities, which suggests good short-term financial strength.

Tips

- Miscalculating the total current assets or current liabilities can lead to incorrect ratio calculations.

- Forgetting to exclude inventory when calculating the acid-test ratio is a common error.

AI-generated content may contain errors. Please verify critical information