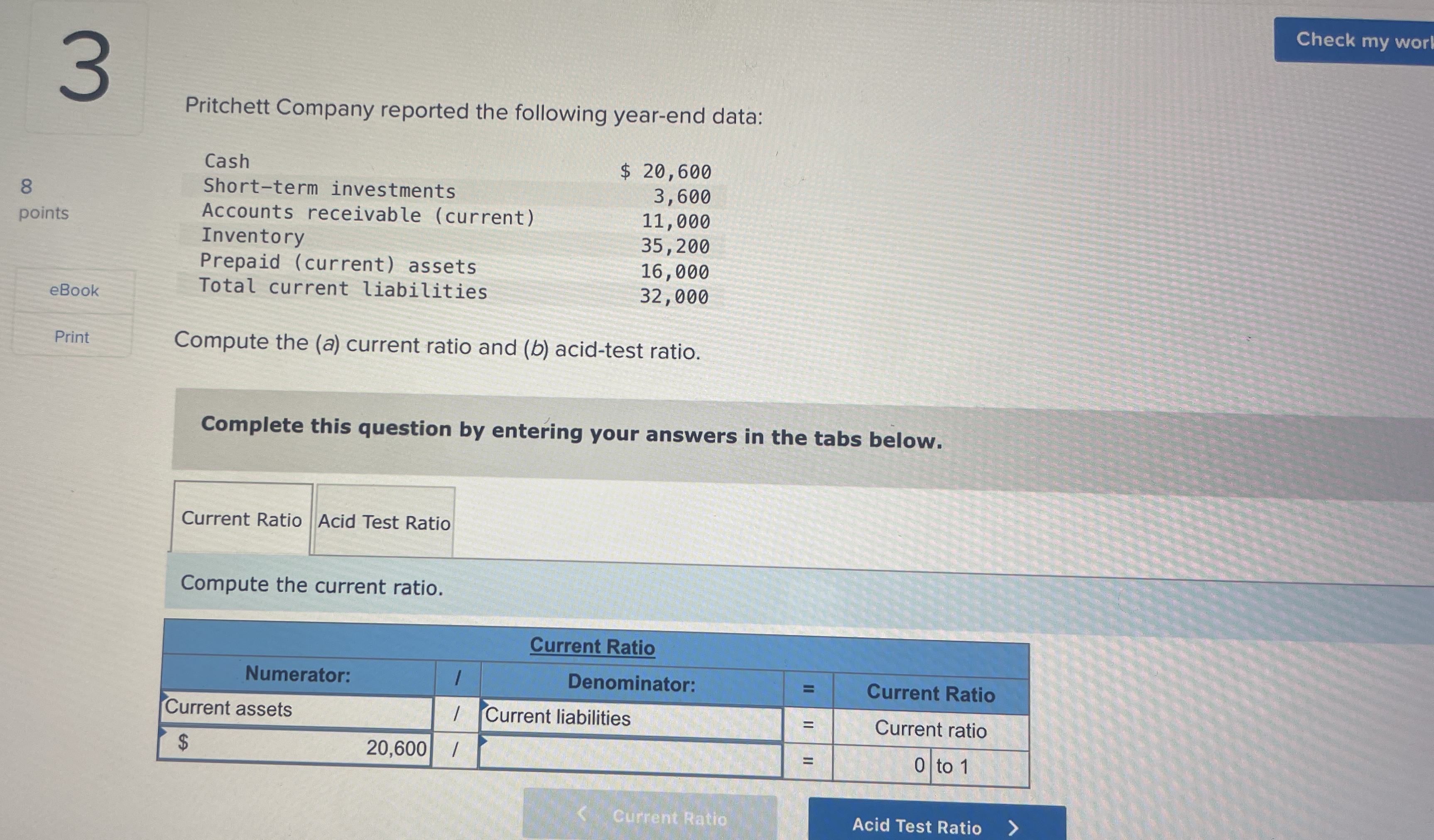

Compute the (a) current ratio and (b) acid-test ratio for Pritchett Company based on the year-end data provided.

Understand the Problem

The question is asking for the computation of two financial ratios: the current ratio and the acid-test ratio based on the provided year-end data from Pritchett Company. We will calculate the current assets and total current liabilities to find these ratios.

Answer

Current Ratio: $2.7$, Acid Test Ratio: $1.1$

Answer for screen readers

- Current Ratio: $2.7$

- Acid Test Ratio: $1.1$

Steps to Solve

-

Identify Current Assets

Current assets consist of cash, short-term investments, accounts receivable, inventory, and prepaid assets. We will sum these up:

$$ \text{Current Assets} = \text{Cash} + \text{Short-term Investments} + \text{Accounts Receivable} + \text{Inventory} + \text{Prepaid Assets} $$

Substituting the values:

$$ \text{Current Assets} = 20,600 + 3,600 + 11,000 + 35,200 + 16,000 $$ -

Sum Current Assets

Calculating the total of current assets:

$$ \text{Current Assets} = 20,600 + 3,600 + 11,000 + 35,200 + 16,000 = 86,400 $$ -

Identify Current Liabilities

We already have the total current liabilities from the data:

$$ \text{Total Current Liabilities} = 32,000 $$ -

Calculate the Current Ratio

The current ratio is calculated by dividing current assets by current liabilities:

$$ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} $$

Substituting the values:

$$ \text{Current Ratio} = \frac{86,400}{32,000} $$ -

Sum the Current Ratio

Calculating the current ratio:

$$ \text{Current Ratio} = 2.7 $$ -

Identify Liquid Assets for Acid Test Ratio

For the acid-test ratio, we consider only liquid assets: cash, short-term investments, and accounts receivable.

$$ \text{Liquid Assets} = \text{Cash} + \text{Short-term Investments} + \text{Accounts Receivable} $$

Substituting the values:

$$ \text{Liquid Assets} = 20,600 + 3,600 + 11,000 $$ -

Sum Liquid Assets

Calculating the total of liquid assets:

$$ \text{Liquid Assets} = 20,600 + 3,600 + 11,000 = 35,200 $$ -

Calculate the Acid Test Ratio

The acid-test ratio is calculated similarly to the current ratio but uses liquid assets:

$$ \text{Acid Test Ratio} = \frac{\text{Liquid Assets}}{\text{Current Liabilities}} $$

Substituting the values:

$$ \text{Acid Test Ratio} = \frac{35,200}{32,000} $$ -

Sum the Acid Test Ratio

Calculating the acid-test ratio:

$$ \text{Acid Test Ratio} = 1.1 $$

- Current Ratio: $2.7$

- Acid Test Ratio: $1.1$

More Information

The current ratio measures a company's ability to pay short-term obligations, while the acid-test ratio indicates the ability to pay off current liabilities without relying on inventory sales. A current ratio and acid-test ratio both above 1 imply good financial health.

Tips

- Neglecting to include all current assets: Ensure all components are considered for accurate ratios.

- Confusing current assets with liquid assets: Remember that the acid-test ratio only includes cash, short-term investments, and receivables.

AI-generated content may contain errors. Please verify critical information