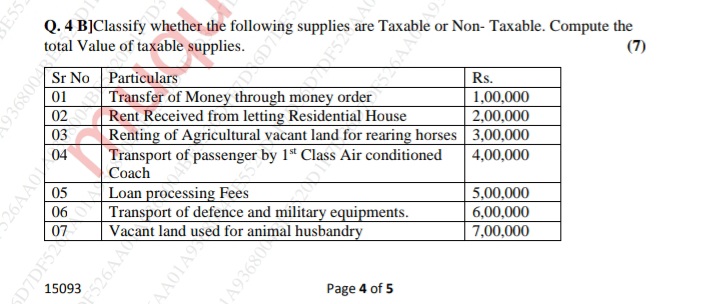

Classify whether the following supplies are Taxable or Non-Taxable. Compute the total value of taxable supplies.

Understand the Problem

The question is asking to classify various supplies as either Taxable or Non-Taxable and compute the total value of the taxable supplies based on the amounts provided.

Answer

The total value of taxable supplies is $9,000,000$.

Answer for screen readers

The total value of taxable supplies is $9,000,000$.

Steps to Solve

-

Identify Taxable and Non-Taxable Supplies

We will classify the supplies based on common tax regulations.- Transfer of Money through money order: Non-Taxable

- Rent Received from letting Residential House: Non-Taxable

- Renting of Agricultural vacant land for rearing horses: Non-Taxable

- Transport of passenger by 1st Class Air conditioned Coach: Taxable

- Loan processing Fees: Taxable

- Transport of defence and military equipments: Non-Taxable

- Vacant land used for animal husbandry: Non-Taxable

-

List the Taxable Supplies

Now, list out the amounts associated with the taxable supplies.- Transport of passenger by 1st Class Air conditioned Coach: $4,000,000$

- Loan processing Fees: $5,000,000$

-

Calculate Total Value of Taxable Supplies

Add the values of the identified taxable supplies.[ \text{Total Taxable Supplies} = 4,000,000 + 5,000,000 = 9,000,000 ]

The total value of taxable supplies is $9,000,000$.

More Information

In tax regulations, certain services or supplies are exempt from tax, such as agricultural rents and financial transfers. In this case, only specific transport and fees are taxable.

Tips

- Misclassifying supplies based on a lack of understanding of tax regulations. Always refer to local tax laws for proper classification.

AI-generated content may contain errors. Please verify critical information