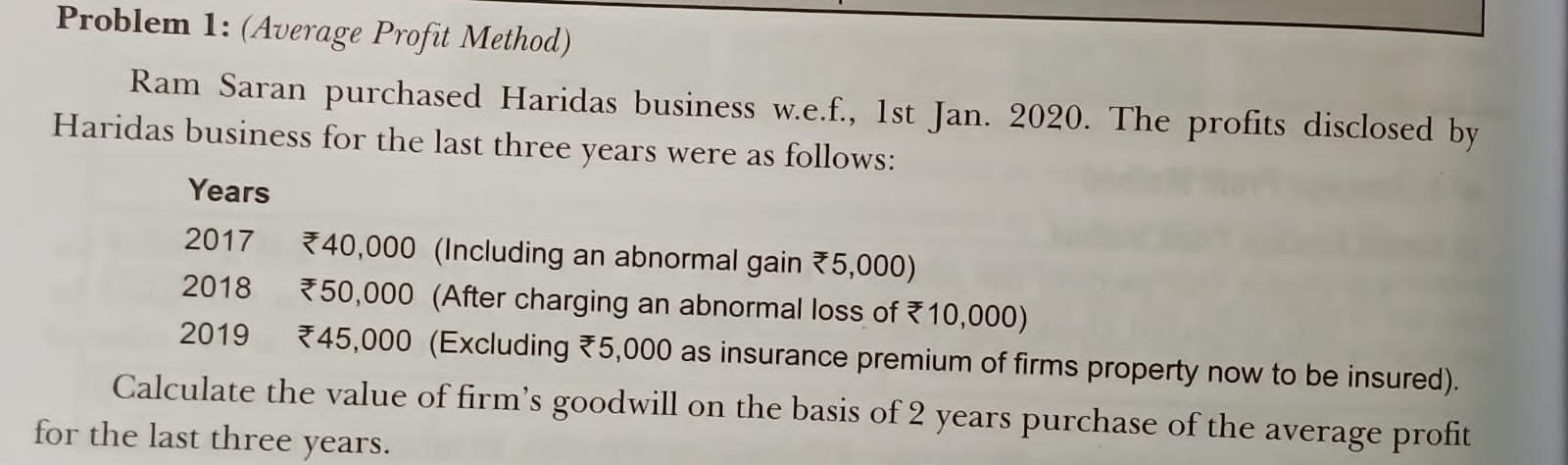

Calculate the value of firm's goodwill on the basis of 2 years purchase of the average profit for the last three years.

Understand the Problem

The question is asking for the calculation of the goodwill value of a business based on the average profit method, taking into account the profits of the last three years and certain adjustments due to abnormal gains and losses.

Answer

The goodwill of the firm is ₹96,666.66.

Answer for screen readers

The value of the firm's goodwill is ₹96,666.66.

Steps to Solve

-

Identify the profits for each year

We have the following profits for the last three years, adjusting for the abnormal gains and losses:

-

2017: ₹40,000 (abnormal gain of ₹5,000 included)

Adjusted profit: ₹40,000 - ₹5,000 = ₹35,000 -

2018: ₹50,000 (after an abnormal loss of ₹10,000 charged)

Adjusted profit: ₹50,000 + ₹10,000 = ₹60,000 -

2019: ₹45,000 (excluding ₹5,000 insurance premium)

Adjusted profit: ₹45,000 + ₹5,000 = ₹50,000

-

-

Calculate total adjusted profits

Now, we sum up the adjusted profits:

$$ \text{Total Adjusted Profits} = ₹35,000 + ₹60,000 + ₹50,000 $$

Calculating this gives us:

$$ \text{Total Adjusted Profits} = ₹145,000 $$

-

Find the average profit

The average profit over the last three years is calculated as:

$$ \text{Average Profit} = \frac{\text{Total Adjusted Profits}}{3} $$

So,

$$ \text{Average Profit} = \frac{₹145,000}{3} \approx ₹48,333.33 $$

-

Calculate goodwill

Lastly, we calculate the goodwill based on 2 years’ purchase of the average profit:

$$ \text{Goodwill} = \text{Average Profit} \times 2 $$

Thus,

$$ \text{Goodwill} = ₹48,333.33 \times 2 = ₹96,666.66 $$

The value of the firm's goodwill is ₹96,666.66.

More Information

Goodwill represents the intangible value of a business beyond its physical assets and liabilities. It is often calculated based on historical profits adjusted for any anomalies, providing a measure of the business's earning potential.

Tips

- Not Adjusting Profits Correctly: Failing to account for abnormal gains or losses can lead to inaccuracies. Always adjust the profit figures before calculating the average.

- Miscalculating Average Profit: Ensure correct division by the number of years considered to get an accurate average.

- Confusing Goodwill Calculation Method: Make sure you're clear about whether to multiply by the correct number of years for goodwill purchase.

AI-generated content may contain errors. Please verify critical information